-

Healthcare issuance in 2023 was lower than usual, as many issuers were still using COVID-related federal aid. The largest issuances came from the Massachusetts Development Finance Agency.

June 3 -

Orrick, Herrington & Sutcliffe take the top spot with a 10.29% market share.

May 29 -

RBC Capital Markets took the top spot for total education issuance, underwriting more than $10 billion in 2023.

May 29 -

Two California issuers take first and third spots on the list. The Regents of the University of California top the list with $2.875 billion in six deals while Los Angeles Unified School District lands at third with $1.189 billion in two deals.

May 29 -

Overall education issuance, including higher ed, K-12 and student loan debt, in 2023 totaled $94.9619 billion, or 3.6% more than 2022's totals.

May 29 -

A state-by-state review of 2023 issuance in the Northeast.

February 26 -

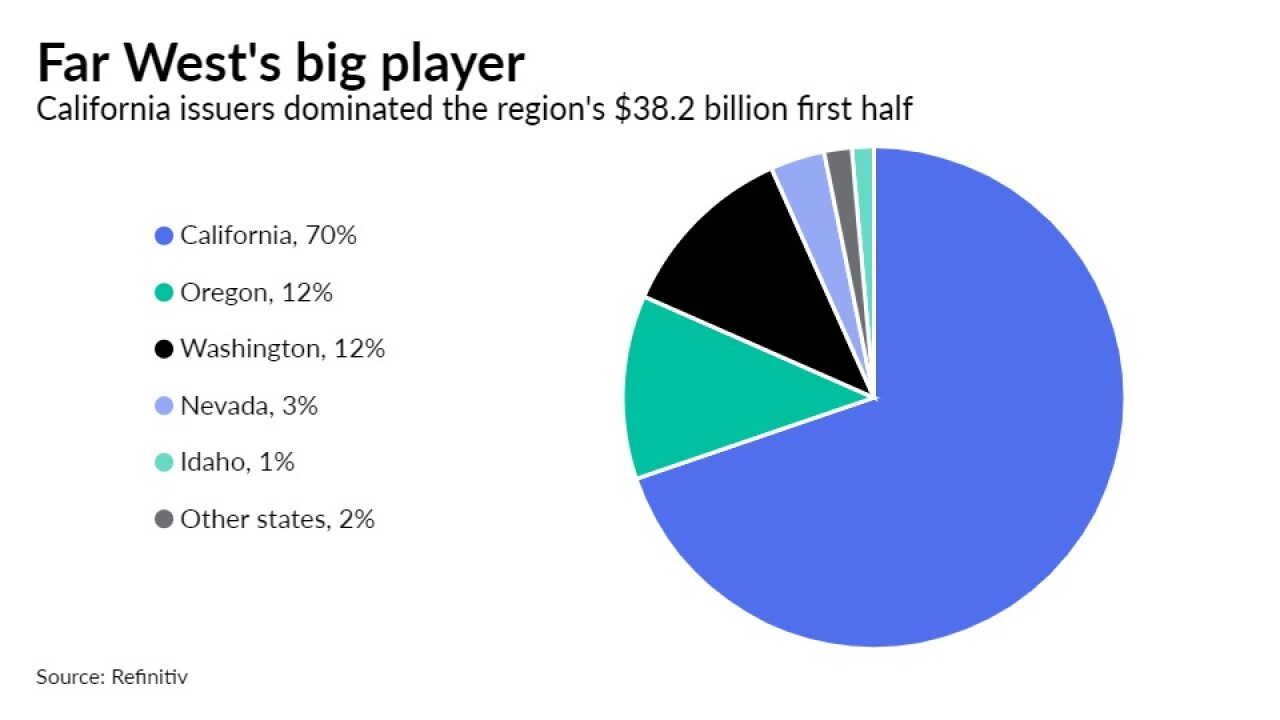

A state-by-state review of 2023 issuance in the Far West.

February 23 -

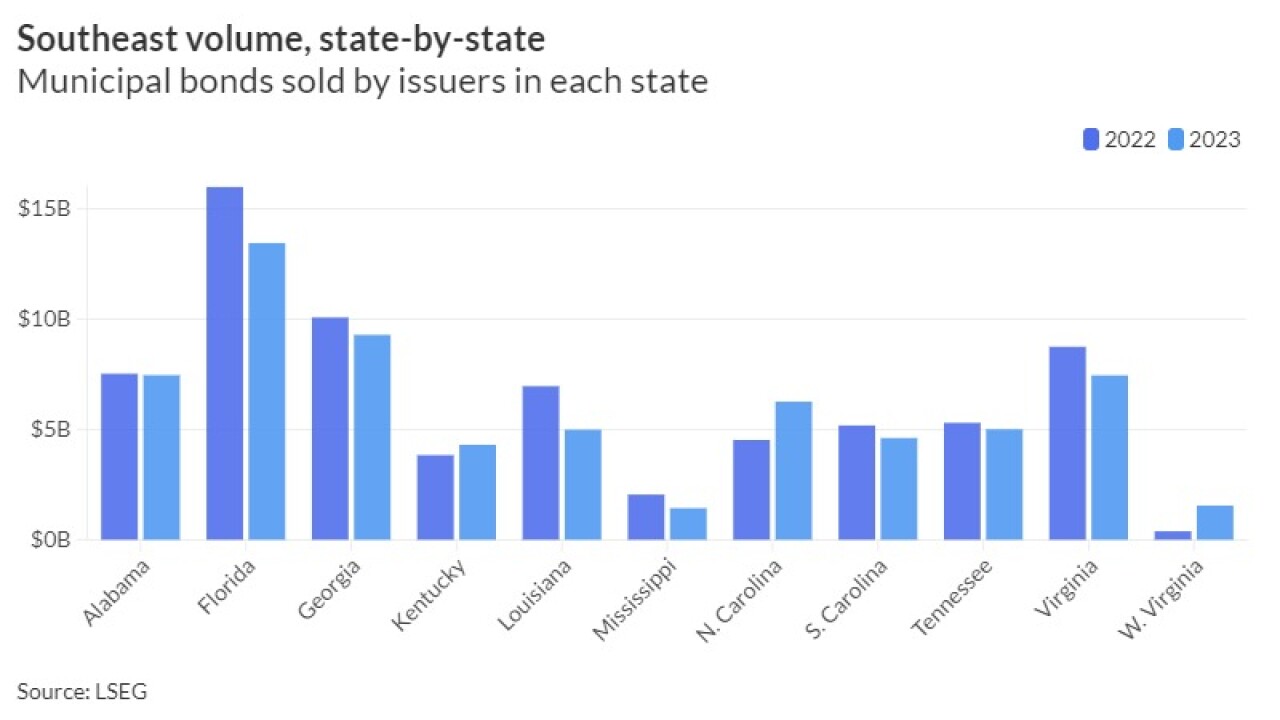

A state-by-state review of 2023 issuance in the Southeast.

February 22 -

Natural gas prepayment deals helped drive the utilities sector to top the Southeast in an overall down year for municipal bond sales across the region.

February 22 -

Larger deals, fewer issues: those were the overarching municipal bond sale trends, along with a surge in tax-exempt deals, across the Midwest in 2023.

February 21 -

A state-by-state review of 2023 issuance in the Midwest.

February 21 -

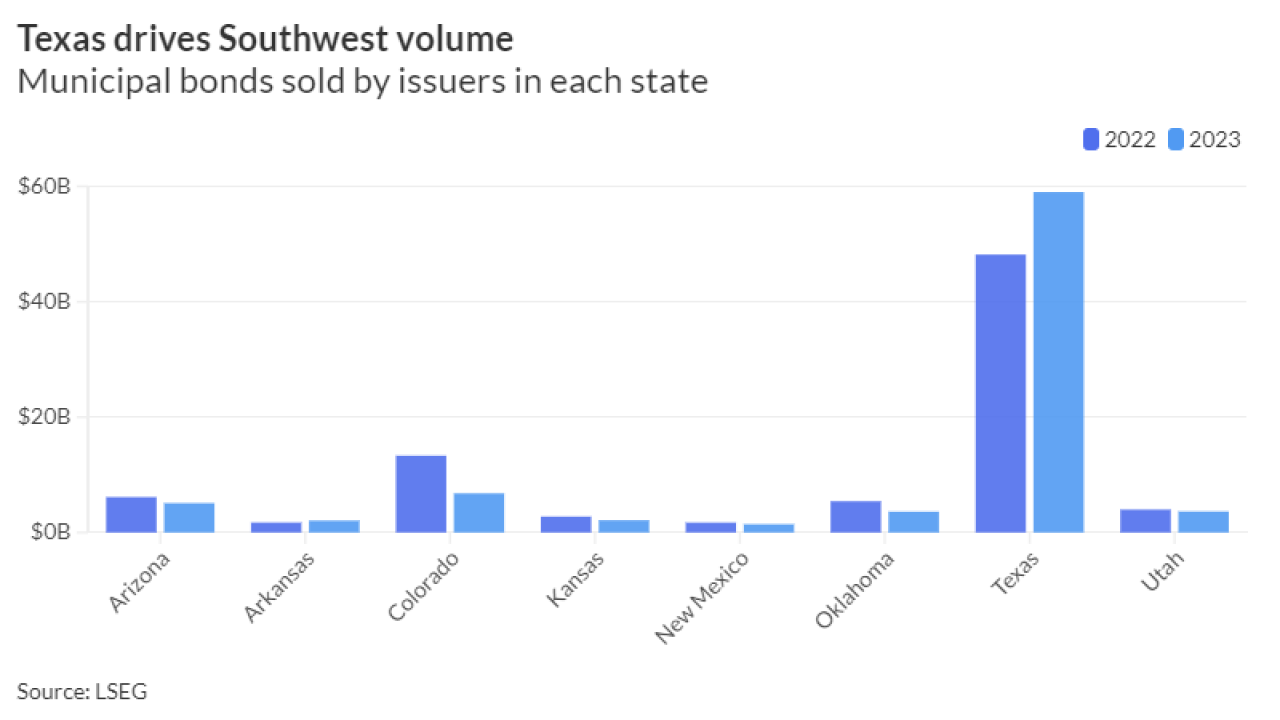

A state-by-state review of 2023 issuance in the Southwest.

February 20 -

Long-term municipal bond sales dropped for the second straight year, but a late year surge of issuance nearly brought volume level with the prior year and raised hopes for a rebound in 2024.

February 20 -

Issuance has fluctuated throughout the years since the financial crisis, following interest rate changes — rising when rates rise and falling when rates fall — but the totals have come in well below $15 billion every year since 2012, save for 2017 when $15.234 billion was sold.

February 20 -

Texas bond volume climbed 22.5% to lead the nation in a year when issuance in the eight-state Southwest region increased by only 0.6%.

February 20 -

A state-by-state review of first half 2023 issuance in the Far West.

August 25 -

Municipal bond issuance in the Far West was down 2.3% in a first half that saw volume drop 17.1% nationally.

August 24 -

A state-by-state review of first half 2023 issuance in the Southeast.

August 24 -

The region's issuers sold $30.3 billion of municipal bonds in the first half of 2023, 29.9% less than they did during the same period last year

August 23 -

A state-by-state review of first half 2023 issuance in the Midwest.

August 23