-

"When the rating agencies developed and rolled out their ESG scores, they said their ESG scores would not impact an issuer's credit rating. We are holding them to their word," said Ben Watkins, director of the state Division of Bond Finance.

May 3 -

The Florida Legislature has passed a law that bans the issuance of municipal bonds, such as green bonds that use environmental, social or governance criteria. The bill now heads to Gov. Ron DeSantis for his signature.

April 20 -

"Florida may have the statutory authority to abrogate an agreement, but what does that say for things going forward?" asks Joseph Krist, publisher of Muni Credit News. "Why couldn't an anti-development administration do the same thing in reverse to somewhere like the Villages?"

April 19 -

Federal Reserve Bank of St. Louis President James Bullard said he favored continued interest-rate hikes to counter persistent inflation, while recession fears are overblown.

April 18 -

"Florida will not side with economic central planners; we will not adopt policies that threaten personal economic freedom and security," said Gov. Ron DeSantis.

March 21 -

So far 12 states have enacted ESG statutes with 67 pending statues in 28 states, according to the Morgan Lewis law firm. Florida's anti-ESG bill goes farthest.

March 15 -

Even more uncertainty has been introduced into the municipal bond market as the Federal Reserve may have to tweak its monetary policy plans as the situation unfolds.

March 13 -

The Federal Reserve said further interest-rate hikes would be required to restore price stability.

March 3 -

The fresh guidance seeks to end a debate over how to prioritize federal transportation funds that's dogged Biden administration officials for more than a year.

February 28 -

Gov. Ron DeSantis on Monday signed the bill to rename the Reedy Creek Improvement District and end Disney's self-governance. Separately, the Legislature will look at prohibiting the issuance of environmental, social and governance bonds and using associated ratings.

February 27 -

Federal Reserve Bank of St. Louis President James Bullard said the U.S. economy is proving more resilient than expected and repeated his call for the central bank to keep raising interest rates.

February 22 -

The Fed in a statement said Brainard submitted her resignation Tuesday, and that it will be effective on or around Feb. 20.

February 15 -

Federal Reserve Bank of New York President John Williams said forecasts officials submitted in December are still a good guide for where interest rates are headed this year and that policy may need to stay at restrictive levels for a few years to get inflation down.

February 8 -

"We think we are going to need to do further rate increases," Powell said Tuesday.

February 7 -

"The main point is that this is a change primarily in name only," said Ben Watkins, head of the state's Bond Division. "There will be no impact on debt whatsoever."

February 6 -

Many believe the Federal Reserve will slow down rate increases beginning in December.. Steve Friedman, senior macroeconomist at MacKay Shields, will join us the day after the meeting to discuss what was done and what he expects in the future.

-

"This week will likely have been the last active week of the year, but it turned out to be quite eventful," according to Barclays PLC.

December 16 -

The Fed chairman said he believes the Fed is getting close to a sufficiently restrictive level, but they're not quite there. While two good inflation reports are good, "there's still a long way to go to price stability."

December 14 -

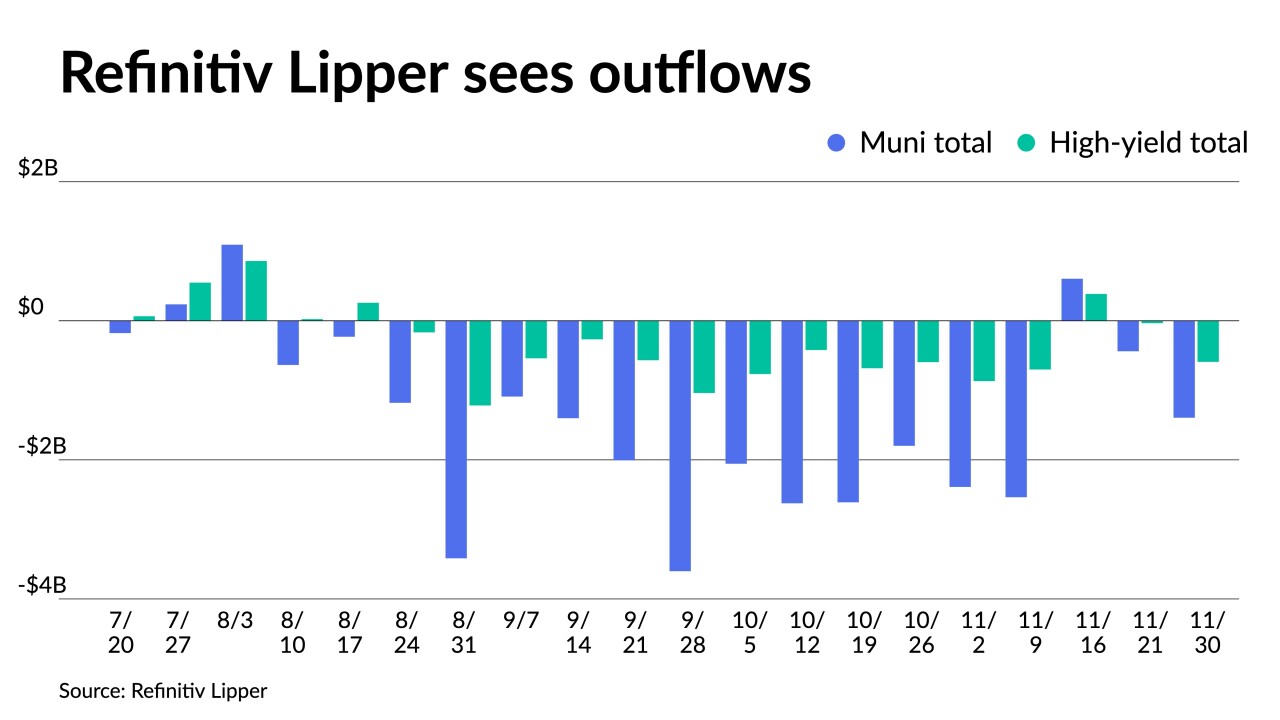

Munis saw the best performance in November in decades, with the asset class ending in the positive by 4.68%. The MSRB reported that trading volume reached another record in November, with 1.29 million municipal trades.

December 1 -

Powell said smaller interest rate increases are likely ahead — and could start as early as next month.

November 30