-

The pandemic, and now the spreading of the omicron variant, exposed nationwide disparities in Internet access with the transition to remote work and learning.

December 23 -

Sen. Schumer said the Senate would take up Build Back Better "very early in the new year."

December 20 -

One-shot federal aid and pending labor contracts require budgetary diligence, Scott Stringer says.

December 15 -

The agreement will move along the Penn Station Access commuter rail undertaking and East River tunnel fix-ups.

December 14 -

With the ink drying on the new Infrastructure Investment and Jobs Act, eyes now turn to the implementation of one of the largest infrastructure programs in American history.

December 3 -

Even short government shutdowns create uncertainty and risks for city leaders.

December 2 -

While the outgoing New York mayor's final plan showed some bright spots, enough remains to test Eric Adams when he takes office.

December 1 -

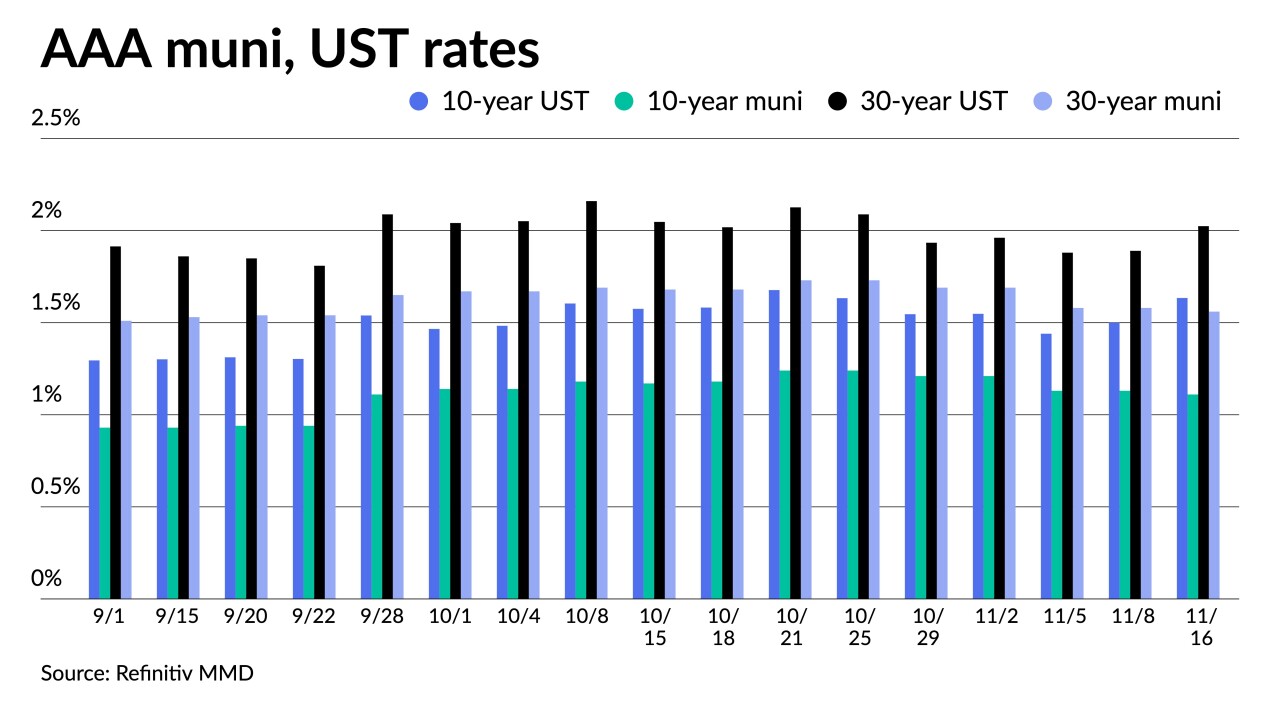

Powell says the FOMC will consider ramping up tapering when more information about Omicron and its impacts are known, further flattening the UST yield curve.

November 30 -

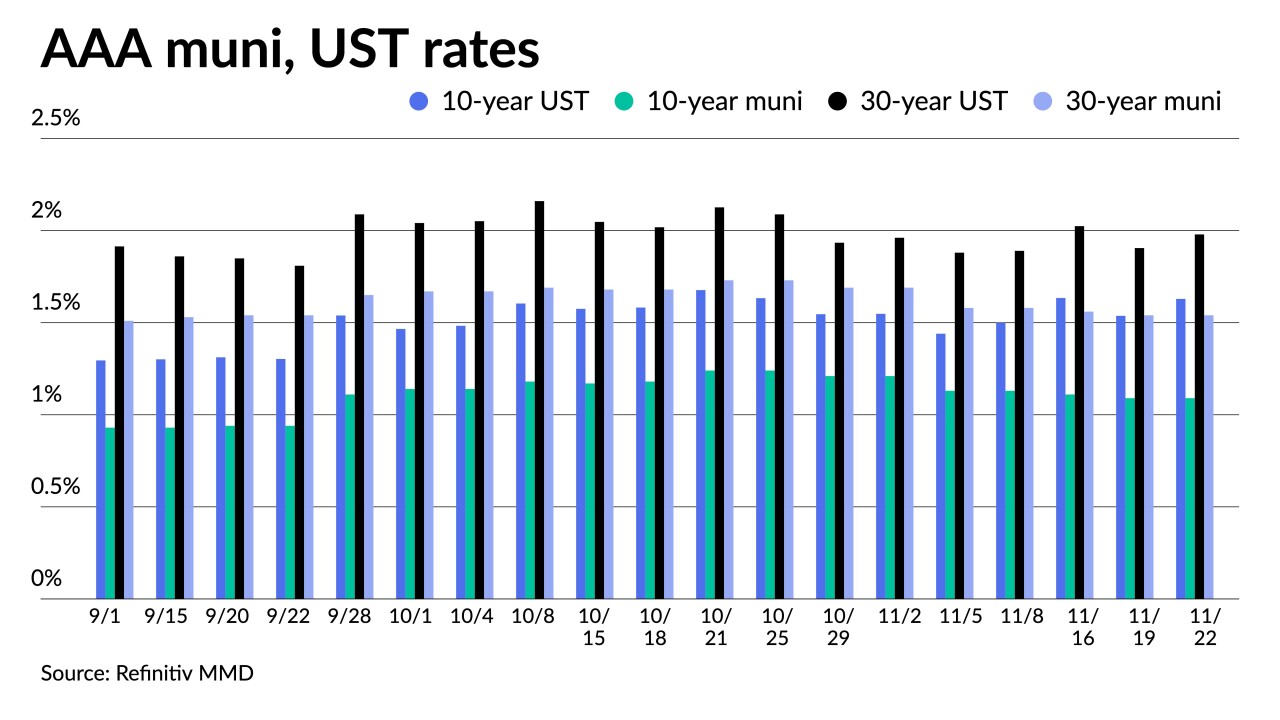

Rising rates and rising inflation are key concerns for municipal bond buyers.

November 30 -

The House is expected to introduce another temporary government funding bill this week before turning to the debt ceiling issue.

November 29 -

If enacted, Build Back Better would promote economic growth and likely have a limited impact on inflation, ratings agencies say.

November 24 -

This week will be all about the secondary market given that the majority of issuance was priced earlier in the month while Dec. 1 coupon payments should make secondary offerings look attractive.

November 22 -

The Thanksgiving holiday-shortened week, next-to-no supply and few economic data releases should keep munis steady.

November 19 -

The U.S. DOT wants to make applying for grants in the $1.1 trillion infrastructure bill as easy as possible. More than 40 new programs will be created under the new law.

November 18 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

November 16 -

Treasury may have some leeway when interpreting the new tax and buysiders say it's unlikely to hurt demand even if it becomes law.

November 16 -

Federal Reserve Bank of St. Louis President James Bullard said the central bank should speed up its reduction of monetary stimulus in response to a surge in U.S. inflation.

November 16 -

President Joe Biden Monday signed into law a $1.1 trillion infrastructure bill.

November 15 -

The inability to advance refund has cost issuers up to $10 billion since 2020, according to Municipal Market Analytics, a figure lobbyists hope will help make their case.

November 12 -

By lowering the amount of private activity bonds needed to finance low-income housing, the provision would free up PABs volume for other projects.

November 11