Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Major banks accused of manipulating the variable-rate market are seeking to get the court to toss out the second amended whistleblower complaint filed by municipal advisor Johan Rosenberg.

November 13 -

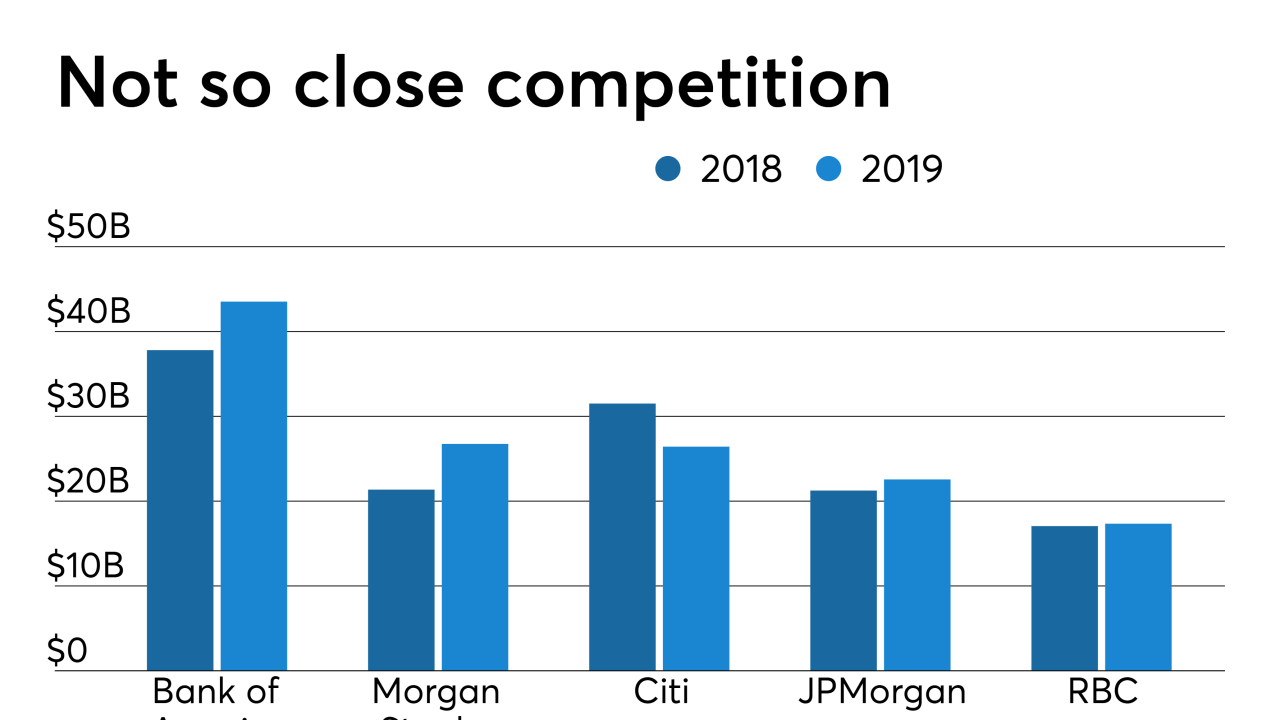

Municipal underwriters saw increased business, as demand for muni bonds jumped through the roof. Top muni underwriters accounted for $267.51 billion in 7,310 deals, up from $239.33 billion in 6,406 transactions in the first nine months of 2018.

October 7 -

The legal teams for Baltimore and Philadelphia asked the court to reject the banks’ plausibility argument as well as their claim that the suit is barred by a four-year statute of limitations.

October 1 -

Thomas Muldoon should properly have placed his orders as dealer stock orders, the SEC found, but instead asked representatives to submit them as retail orders.

September 3 -

Two courts have interpreted a legal question key to the VRDO lawsuits very differently.

August 29 -

The complaint filed by Philadelphia and Baltimore fails to rise to the level of specificity needed to prove conspiracy, Wall Street banks told a federal judge.

July 31 -

Wells Fargo Securities head of public finance Chuck Peck breaks down today’s "tough" municipal market landscape, discusses how he plans to change the firm's direction, and why he embraces the challenges of the position. Hosted by Aaron Weitzman.

July 11 -

The judge ruled for Peter Cannava, who had denied wrongdoing even after Wells Fargo and other defendants settled charges.

June 12 -

The amended lawsuit references inside sources who allegedly confirm that the banks worked together in violation of antitrust law.

June 3 -

Adding $374 million alleged in New York to the three other cases also filed by Johan Rosenberg brings the total damages claimed to $1.58 billion.

May 22