-

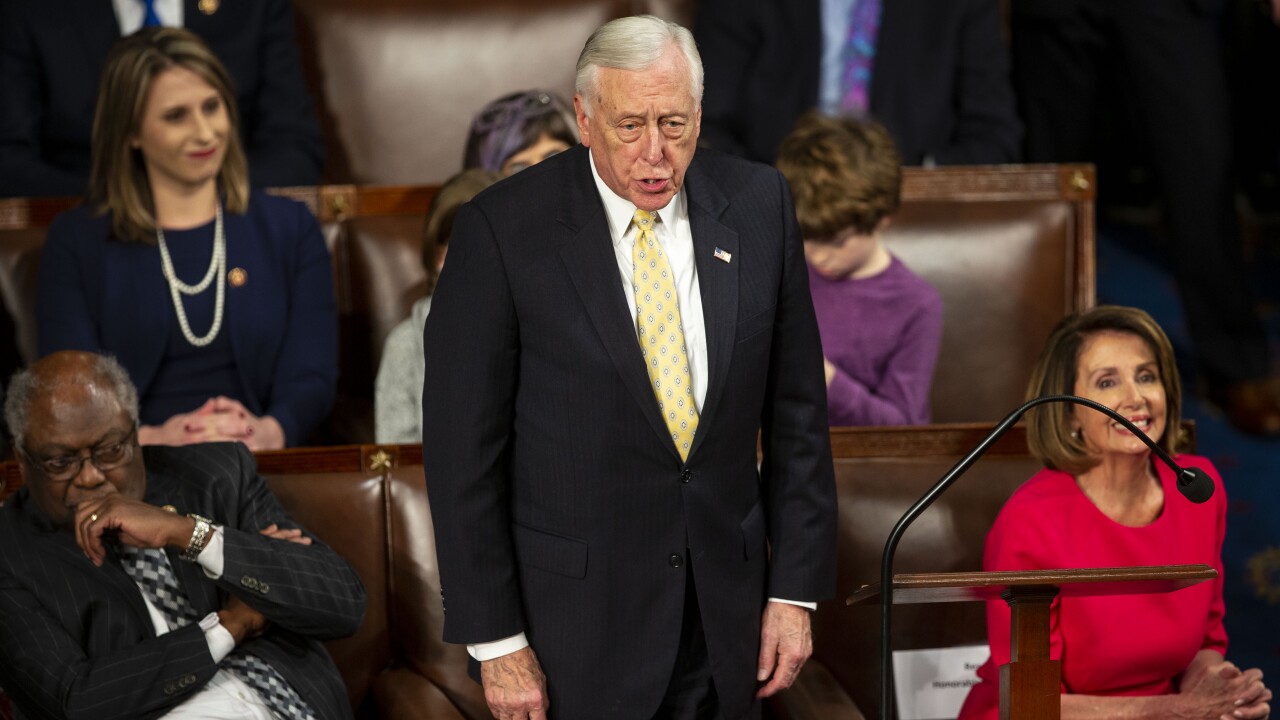

A top House Democrat warned the Trump administration not to engage in debt limit brinksmanship that could halt trading in state and local government securities.

January 30 -

The Treasury Department's February quarterly refunding of $84.0 billion will raise $29.9 billion new cash.

January 30 -

The U.S. Treasury Monday estimated it will borrow $365 billion of net marketable debt in the first quarter of 2019, assuming a $320 billion cash balance on March 31.

January 28 -

Federal subsidy payments made to issuers of Build America Bonds are continuing even as Congress remains deadlocked over funding for government agencies.

January 10 -

It’s unclear if monthly federal subsidy payments on Build America Bonds will be made.

January 8 -

Newly issued Treasury securities held in stripped form decreased about $1.105 billion in December.

January 8 -

The House approved rules changes Thursday that include restoration of the so-called Gephardt rule that links passage of the annual budget resolution to a debt ceiling increase.

January 4 -

The Federal Register publication of the finalized PAB regulation takes effect April 1, but part of it can be implemented by issuers immediately.

January 2 -

President Trump expressed confidence in the Treasury secretary, Federal Reserve and U.S. economy on Tuesday.

December 26 -

The tax fix is being lost in the rush by Congress to enact a temporary spending measure to keep the government operating through Feb. 8.

December 19 -

The Treasury Department announced its auction closing schedule for the holiday weeks.

December 18 -

Newly issued Treasury securities held in stripped form decreased about $2.210 billion in November.

December 7 -

The U.S. Treasury yield curve may continue to flatten irrespective of what the latest jobs report shows.

December 7 -

The Internal Revenue Service has told bond attorneys that the law doesn’t explicitly say that veterans are a special needs population under the rules for the tax-exemption for multifamily private activity bonds.

December 3 -

One section of the U.S. Treasuries yield curve just inverted for the first time in more than a decade.

December 3 -

Treasury Secretary Steven Mnuchin privately asked bond dealers and investors whether they want the Federal Reserve to tighten monetary policy by raising interest rates or through faster cuts in its securities portfolio.

November 28 -

The federal government ran a $100.5 billion deficit in October.

November 13 -

Newly issued Treasury securities held in stripped form increased about $12.227 billion in October.

November 6 -

The Treasury Department Inspector General for Tax Administration plans to audit the IRS' use of a much-feared enforcement tool under which it can impose penalties for the misconduct of municipal bond transaction participants such as underwriters, lawyers, municipal advisors or their firms.

October 31 -

The Libor changeover isn't officially due for three years, but the change could have big ramifications for munis and is already underway.

October 2