WASHINGTON — The possibility of Treasury closing the window on the trading of state and local government securities — an important tool for the municipal bond market — has diminished with the restoration by the new House Democratic majority of a measure that automatically increases the nation’s debt ceiling.

A suspension of SLGS trading is among the first steps taken by the Treasury whenever the nation’s debt ceiling has been reached.

SLGS securities, according to the Treasury, are purchased by issuers with proceeds subject to yield restrictions and arbitrage rebate requirements under the Internal Revenue Code.

The issuers who use SLGS are state and local governments and other entities that issue state or local government bonds.

The House approved a package of rules changes Thursday that includes restoration of the so-called Gephardt rule that links passage of the annual budget resolution to a debt ceiling increase.

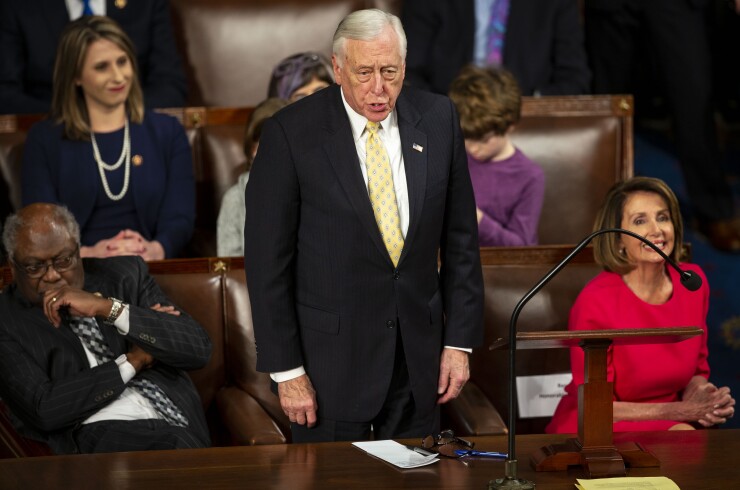

House Majority Leader Steny Hoyer, D-Md., said during Thursday’s debate that Democrats were “reinstating the Gephardt rule to prevent the default on our debt.”

Republicans abolished the rule while they were in the majority in the House because they used the debt ceiling for leverage in the debate over government spending, but Democrats have preferred to keep the issue out of political debates.

The rule was first enacted in 1979 and is named after former Rep. Richard Gephardt, D-Mo.

It was first applied in calendar year 1980, according to the Congressional Research Service, but has been repealed and reinstated several times since then.

“Of the 20 joint resolutions originated by the House under the Gephardt rule, 15 have been enacted into law,” CRS said.

The latest reinstatement is good news for the muni market during the next two years while the 116th Congress is in session, but it doesn’t resolve the short-term deadline for raising the debt ceiling by March 1.

That’s the date when the current suspension of the debt ceiling expires. The deadline for passage of a budget resolution is not until April 15 and is often not met.

In fact it could be difficult to accomplish with a divided Congress where Democrats have regained majority control of the House while Republicans have increased their majority in the Senate.

The last closing of the Treasury window for SLGS purchases was between Dec. 8, 2017 and Feb. 12, 2018.

During that closure the biggest use for SLGS – for an advance refunding – was terminated by Congress. The termination came on Jan. 1, 2018 as part of the Tax Cuts and Jobs Act.

Since that change in the tax law, the amount of SLGS outstanding has declined by $22.4 billion.

As of Dec. 31 there were 15,684 SLGS bonds and notes with a combined value of $66.2 billion, according to the Treasury.

Treasury reports there were 20,221 SLGS bonds and notes valued at a combined $86.6 billion as of Jan. 18, 2018.

Prior to the termination of advance refundings, Treasury typically sold between $5 billion and $12 billion of SLGS each month in the past, according to the nonpartisan Congressional Budget Office.

Treasury halts the trading of SLGS only when the national debt limit has been reached.

The current partial government shutdown has not affected the trading of SLGS.

An eventual deal between Congress and the White House on government funding through the Sept. 30 end of the fiscal year might include an extension of the debt ceiling suspension.