-

Municipal and Treasury bonds weakened as stocks surged to record highs in early trading.

January 24 -

MacKay Municipal Managers has released its list of the top five trends to watch for in the municipal market this year.

January 23 -

State agencies and universities are expected to generate 26% less bond volume this fiscal year, according to the Texas Bond Review Board.

January 12 -

Issuers rushing to close PABs and refunding deals propelled issuance past the single-month record set before 1986 tax reform.

December 29 -

The municipal bond market will see a second week of chunky new issuance, with almost $20 billion of new deals lining up for sale.

December 8 -

The municipal bond market was one again looking at an above-average calendar for next week, with negotiated supply alone coming in at over $17 billion.

December 8 -

Mega-deals from Chicago, San Jose, Trinity Health and Miami-Dade all hit the screens as yields on municipal bonds plunged further.

December 6 -

Mega-deals from San Jose, Miami-Dade and Chicago hit the screens on Wednesday while yields on municipal bonds continued to move lower.

December 6 -

There’s no rest for the weary as more deals are set to hit the municipal bond market on Wednesday, topped off by offerings from San Jose and Chicago.

December 6 -

The possibility of the municipal market losing both advance refundings and private activity bonds brought a spike in issuance that's likely to extend into December.

November 30 -

Texas state pensions bear the third-highest risk of a downturn-driven "budget shock" behind Alaska and Connecticut, according to Moody's Investors Service.

November 29 -

More states and localities moved ahead with infrastructure financings in October, as issuers gained confidence the municipal tax exemption will remain in place.

October 31 -

Recovery from Hurricane Harvey is expected to cost state government about $2 billion over the next two years.

October 11 -

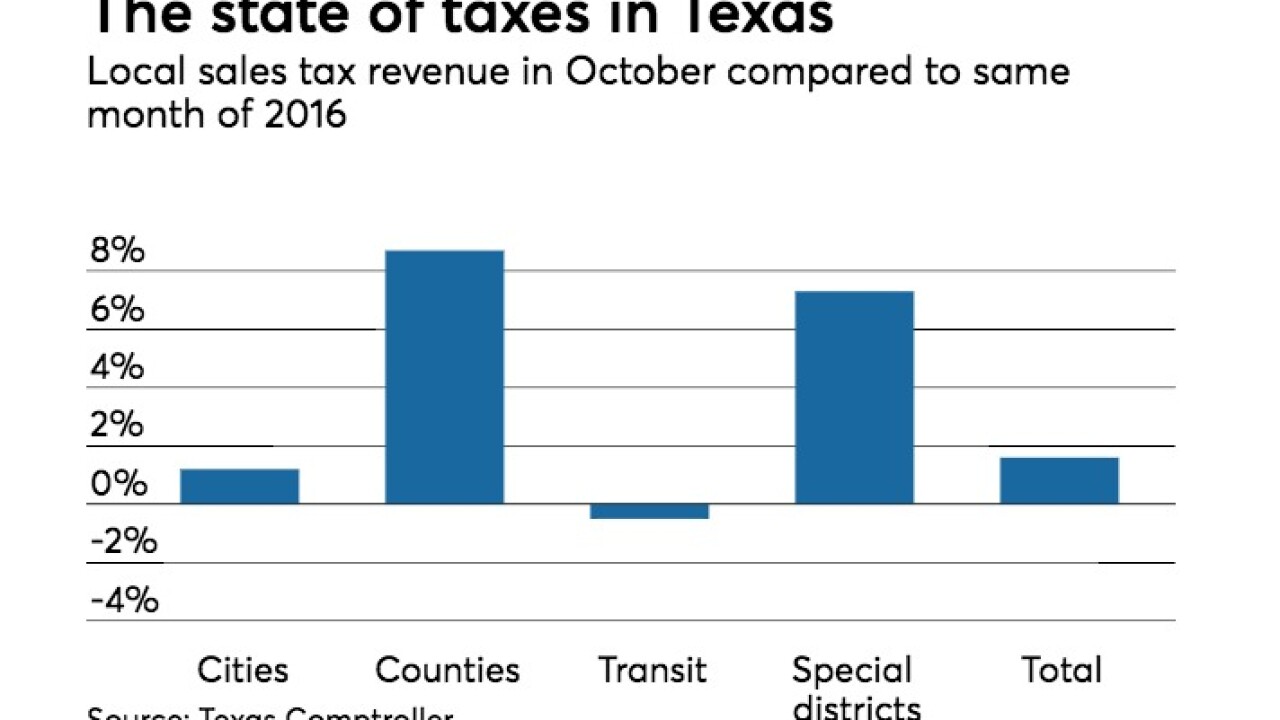

Despite Hurricane Harvey's arrival, Texas's monthly sales tax revenue rose 10.4%, according to state Comptroller Glenn Hegar.

October 6 -

Issuance of municipal bonds fell 33.9% to $26.7 billion compared to $40.4 billion in September 2016.

September 29 -

Volume shrank from August 2016, when the market was on a record-breaking run.

August 31 -

Top-shelf municipal bonds were weaker at mid-session, according to traders who are looking ahead to next week’s $6.87 billion new issue calendar.

August 25 -

Top-shelf municipal bonds were slightly weaker in early activity, according to traders, who are looking ahead to next week’s new issue slate.

August 25 -

Top-shelf municipal bonds ended unchanged on Tuesday as eight separate groups won portions of the big Texas note deal.

August 22 -

Top-shelf municipal bonds were unchanged at mid-session as the state of Texas sold the biggest note deal of the year.

August 22