Municipal bond issuance spiked in November as the market responded to tax overhaul plans that may ban both advance refundings and private activity bonds after the end of the year.

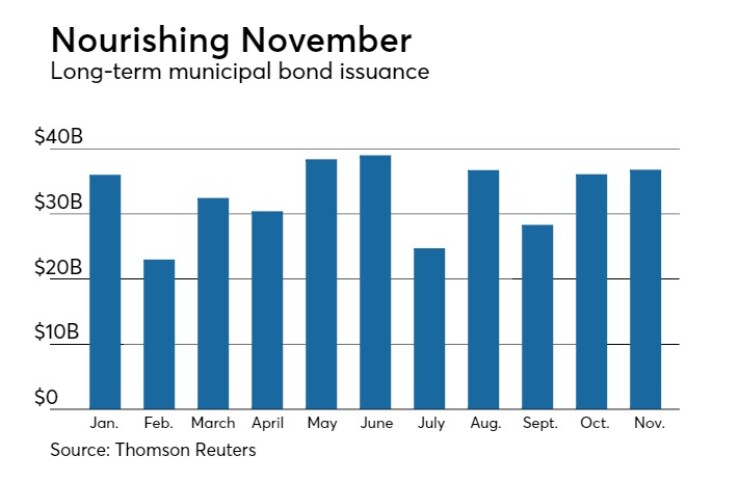

November municipal bond volume was the third biggest this year, up 10.6% from the same month in 2016. If the recent trend continues, December volume could surge to a record level.

Data from Thomson Reuters shows monthly volume rose to $36.79 billion in 971 transactions from $33.27 billion in 1,070 deals in November 2016. With 11 months down and one to go, total volume for the year stands at $364.61 billion in 10,252 transactions, down from $430.84 billion in 12,770 deals in the same period of 2016.

Last year at this time, volume was down and the market was quiet as bond yields skyrocketed in reaction to the presidential election results. Now, it seems the opposite will happen, as the prospect of tax reform has issuers running and jumping into market.

“The volume bump of the past weeks and likely the next several weeks is fueled primarily by advance refundings from issuers seeking to get under the wire should any final tax reform legislation eliminate use of tax exempt borrowing for advance refundings,” said Alan Schankel, managing director and municipal strategist at Janney.

Schankel said he wouldn't be surprised to see some nonprofit hospital and private universities jump into the market, pushing up deals that had been scheduled for 2018. The Illinois Finance Authority approved the sale of $300 million of revenue bonds for Hospital Sister Services Inc. during a special meeting on Thursday, adding to the rush of municipal issuers trying to get deals done before year-end.

The market spent most of the year balancing low supply and high demand, but the tax reform commotion has turned that upside down.

“Demand is still robust, but supply is simply overwhelming at the moment,” said Mikhail Foux, director of research at Barclays Capital. “Investors have ample cash holdings, and in addition will get close to $35 billion in redemptions. Cheaper levels should incentivize investors; for a while we have been saying that this market correction represents a buying opportunity.”

The spike in issuance has caused the market to readjust, as it usually does, when volume is higher, yields tend to increase as well.

“The rising rates of the past couple of weeks could slow the supply deluge, since some refundings may become uneconomical at higher rates,” said Schankel.

Refundings vaulted up from a year earlier to $15.63 billion in 309 deals from $9.65 billion in 377 deals. New money deals increased 6.7% to $15.93 billion in 577 transactions from $14.93 billion in 556 deals in November of 2016.

“This is refundings’ last hurrah, as a big portion of December supply will be advance refundings pulled from the first quarter of 2018 – likely on the order of roughly 30% of total volume,” Foux said. “If advance refundings are indeed eliminated, next year’s refundings volume will only be $60-80 billion.”

Foux said that refundings will continue dominating the total supply in December and that new money issuance will be down, although the market will be getting some new money PAB deals pulled from 2018. With all of that being said, Barclays believes that new money supply will make a strong come back next year.

The value of combined new money and refunding deals for the month dipped 39.9% to $5.22 billion from $8.69 billion a year earlier. Issuance of revenue bonds gained 6.8% to $22 billion, while general obligation bond sales gained 16.7% to $14.78 billion.

Negotiated deals improved 18.7% to $27.37 billion and competitive sales increased by 21.7% to $8.91 billion. Taxable bond volume dipped to $2.22 billion from $2.82 billion, while tax-exempt issuance increased by 10.3% to $32.68 billion.

Deals wrapped by bond insurance fell 41% year over year to $1.41 billion in 133 transactions from $2.38 billion in 171 deals.

As far as the sectors go, seven were in the green. Environmental facilities rose to $354 million from $184 million, development rose to $2.19 billion from $1.18 billion, general purpose increased to $8.07 billion from $6 billion, transportation was up 19.8% to $7.02 billion from $5.86 billion, education rose to $10.83 billion from $9.76 billion, housing increased to $1.62 billion from $1.48 billion and electric power edged up to $1.26 billion from $1.22 billion.

The other sectors were in the red with utilities falling 33.6% to $2.72 billion from $4.10 billion, health care dropping 21.8% to $1.74 billion from $2.23 billion and public facilities down to $968 million from $1.24 billion.

As for the different types of entities that issue bonds, five were in the green. Counties and parishes surged to $3.51 billion from $2.02 billion, state agencies were up 61.1% to $10.91 billion from $6.77 billion, state government issuance was up 60% to $4.28 billion from $2.67 billion, colleges and universities rose 48% to $1.48 billion from $999 million and direct issuer issuance grew to $69 million from $28 million.

On the other end of the spectrum, cities and towns dropped 49.6% to $3.41 billion from $6.77 billion, local authorities dipped to $4.48 billion from $5.05 billion and local authorities slid to $4.48 billion from $5.05 billion.

California remained the state with the most issuance, as it has all year. Issuers in the Golden State have sold $58.86 billion so far this year. New York came in second with $41.35 billion, followed by Texas with $36.01 billion. Illinois is next with $17.79 billion and Pennsylvania rounds out the top five with $17 billion.

Given all of what is on the line with the tax reform possibilities, it makes predicting what will happen in December even harder than it usually is.

But one thing is certain, according to Foux.

“Volume in December is clearly going to be much higher than normal," he said. "We are thinking it will probably end up in the $40-through-$50 billion range.”

Schankel agreed, adding that he would not be surprised to see final December volume to hit $50 billion or more, with refunding comprising the majority.