There’s no rest for the weary as more deals are set to hit the municipal bond market on Wednesday, topped off by offerings from San Jose and Chicago.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was stronger in early trading.

The 10-year muni benchmark yield fell to 2.259% on Wednesday from the final read of 2.303% on Tuesday, according to

The MBIS benchmark index is updated hourly on the

U.S. Treasuries were stronger on Wednesday. The yield on the two-year Treasury dropped to 1.79% from 1.82%, the 10-year Treasury yield declined to 2.32% from 2.36% and the yield on the 30-year Treasury decreased to 2.70% from 2.74%.

Top-rated municipals finished stronger on Tuesday. The yield on the 10-year benchmark muni general obligation fell six basis points to 1.99% from 2.05% on Monday, while the 30-year GO yield dropped eight basis points to 2.58% from 2.66%, according to the final read of MMD’s triple-A scale.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.4% compared with 86.3% on Monday, while the 30-year muni-to-Treasury ratio stood at 94.3% versus 96.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 48,824 trades on Tuesday on volume of $13.79 billion.

Primary market

On Wednesday, Jefferies priced Chicago’s Sales Tax Securitization Corp.’s $574.53 million of sales tax securitization bonds for institutions after holding a retail order period on Tuesday.

The $174.56 million of Series 2017A tax-exempts were priced as 5s to yield from 1.77% in 2020 to 2.55% in 2030.

The $399.97 million of Series 2017B taxables were priced to yield from about 100 basis points over the comparable Treasury in 2031 to about 105 basis points over the comparable Treasury security in 2032 and about 90 basis points over the comparable Treasury in 2043.

On Tuesday, the $174.56 million of Series 2017A tax-exempts were priced for retail as 5s to yield from 1.83% in 2020 to 2.65% in 2030. The $399.97 million of Series 2017B taxables were priced for retail to yield from about 100 basis points over the comparable Treasury security in 2031 to about 75 basis points over the comparable Treasury in 2034 and about 100 basis points over the comparable Treasury in 2043.

The deal is rated AA by S&P Global Ratings and AAA by Fitch Ratings and Kroll Bond Rating Agency.

Stifel is expected to price the San Jose Successor Agency to the Redevelopment Agency’s $1.67 billion deal, consisting of $1.34 billion of Series 2017A-T taxable senior allocation refunding bonds and $325.89 million of Series 2017B subordinate tax allocation refunding bonds.

The senior bonds are rated AA by S&P and Fitch while the subordinate bonds are rated AA-minus by S&P and Fitch.

RBC Capital Markets is expected to price the Oklahoma Turnpike Authority’s $685.91 million of turnpike system bonds.

The deal is rated Aa3 by Moody’s Investors Service and AA-minus by S&P and Fitch.

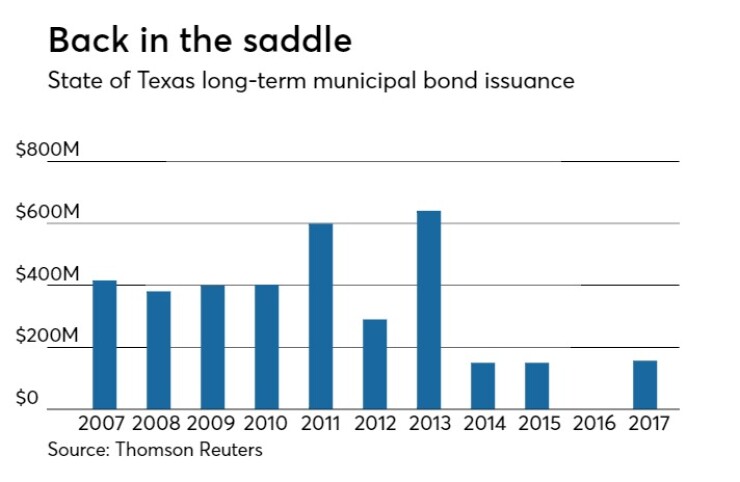

In the competitive arena, Texas is selling $156.84 million of general obligation college student loan bonds subject to the alternative minimum tax.

The deal is rated triple-A by Moody’s and S&P.

Since 2007, the Longhorn State has issued roughly $3.58 billion of bonds, with the most issuance occurring in 2013 when it sold $641 million of bonds. The state did not come to market in 2016 and issued only $150 million each in 2015 and 2014.

Bond Buyer 30-day visible supply at $18.6B

The Bond Buyer's 30-day visible supply calendar decreased $3.08 billion to $18.61 billion on Wednesday. The total is comprised of $5.14 billion of competitive sales and $13.48 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.