Mega-deals from San Jose, Miami-Dade and Chicago hit the screens on Wednesday while yields on municipal bonds continued to move lower on a scarcity trade.

Secondary market

Worries that tax reform would cause future municipal issuance to plummet combined with concerns over expiring debt ceiling legislation and a possible government shutdown caused pressure all along the yield curve.

The MBIS municipal non-callable 5% GO benchmark scale was stronger in midday trading.

The 10-year muni benchmark yield fell to 2.220% on Wednesday from the final read of 2.303% on Tuesday, according to

The MBIS benchmark index is updated hourly on the

Top-rated municipals were stronger at mid-session. The yield on the 10-year benchmark muni general obligation fell nine to 11 basis points from 1.99% on Tuesday, while the 30-year GO yield dropped 10 to 12 basis points from 2.58%, according to a read of MMD’s triple-A scale.

U.S. Treasuries were stronger on Wednesday. The yield on the two-year Treasury dropped to 1.80% from 1.82%, the 10-year Treasury yield declined to 2.32% from 2.36% and the yield on the 30-year Treasury decreased to 2.70% from 2.74%.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.4% compared with 86.3% on Monday, while the 30-year muni-to-Treasury ratio stood at 94.3% versus 96.1%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 48,824 trades on Tuesday on volume of $13.79 billion.

Primary market

On Wednesday, Stifel sent around an indications of interest wire on the City of San Jose, Calif., Redevelopment Agency Successor’s $1.34 billion of senior taxable tax allocation refunding bonds.

The IOI has the 2018 maturity at about 20 basis points above the comparable Treasury to about 120 basis points above comparable Treasury in 2029. A term bond in 2034 was at about 100 basis points above comparable Treasury.

The deal is rated AA by S&P Global Ratings and Fitch Ratings.

Wells Fargo Securities priced Miami-Dade County, Fla.’s $940.34 million of water and sewer system revenue and revenue refunding bonds.

The $389.25 million of Series 2017A revenue bonds were priced to yield from 2.33% with a 5% coupon in 2030 to 3.12% with a 4% coupon in 2039; a 2043 maturity was priced as 4s to yield 3.16% and a 2047 maturity was priced at par to yield 3.50%.

The $551.09 million of Series 2017B revenue refunding bonds were priced to yield from 1.72% with a 3% coupon in 2021 to 3.35% with a 3.25% coupon in 2039.

The deal is rated Aa3 by Moody’s Investors Service and A-plus by S&P and Fitch.

Jefferies priced Chicago’s Sales Tax Securitization Corp.’s $574.53 million of sales tax securitization bonds for institutions after holding a retail order period on Tuesday.

The $174.56 million of Series 2017A tax-exempts were priced as 5s to yield from 1.77% in 2020 to 2.55% in 2030.

The $399.97 million of Series 2017B taxables were priced to yield from about 100 basis points over the comparable Treasury in 2031 to about 105 basis points over the comparable Treasury security in 2032 and about 90 basis points over the comparable Treasury in 2043.

On Tuesday, the $174.56 million of Series 2017A tax-exempts were priced for retail as 5s to yield from 1.83% in 2020 to 2.65% in 2030. The $399.97 million of Series 2017B taxables were priced for retail to yield from about 100 basis points over the comparable Treasury security in 2031 to about 75 basis points over the comparable Treasury in 2034 and about 100 basis points over the comparable Treasury in 2043.

The deal is rated AA by S&P Global Ratings and AAA by Fitch Ratings and Kroll Bond Rating Agency.

Goldman Sachs priced the California Department of Water Resources $326.43 million of Series AX water system revenue bonds for the Central Valley project.

The issue was priced as 5s to yield from 1.19% in 2018 to 2.44% in 2035.

The deal is rated Aa1 by Moody’s and AAA by S&P.

RBC Capital Markets priced the Pennsylvania Housing Finance Agency’s $300.21 million of single-family mortgage revenue bonds for retail investors.

The $175.21 million of Series 2017-125A bonds subject to the alternative minimum tax were priced at par to yield 1.50% and 1.55% in a split 2018 maturity and from 2.90% and 2.95% in a split 2026 maturity to 3.15% and 3.20% in a split 2028 maturity, and 3.45% in 2032 and 3.70% in 2037. A 2025 maturity was not offered to retail investors.

The $125 million of Series 2017-125B non-AMT bonds were priced at par to yield 3.65% in 2042 and 3.70% in 2047.

The deal is rated Aa2 by Moody’s and AA-plus by S&P.

Bank of America Merrill Lynch priced the Michigan State Hospital Finance Authority’s $214.735 million of refunding revenue bonds for Trinity Health Credit Group.

The remarketing fixed-rate series 2008C bonds were priced to yield from 1.45% with a 5% coupon in 2018 to 2.86% with a 5% coupon in 2032.

The deal is rated Aa3 by Moody’s and AA-minus by S&P and Fitch.

BAML also priced the Kentucky Economic Development Finance Authority’s $175.715 million of taxable refunding revenue bonds for the Louisville Arena Authority, Inc.

The bonds were priced at par to yield from 2.967% in 2021 to 4.455% in 2039. The 2021 maturity was about 85 basis points above the comparable Treasury and the 2039 maturity was about 175 basis points above the comparable Treasury.

The entire deal is insured by Assured Guaranty Municipal Corp., and is rated A2 by Moody’s and AA by S&P.

Hilltop Securities priced Galveston County, Texas’ $102.375 million of bonds.

The $78.965 million of unlimited tax road and refunding bonds were priced to yield from 1.45% with a 4% coupon in 2019 to 2.99% with a 4% coupon in 2038.

The $14.54 million of limited tax flood control and refunding bonds were priced to yield from 1.45% with a 2.00% coupon in 2019 to 2.99% with a 4% coupon in 2038.

The $8.87 million of limited tax county building bonds were priced to yield from 1.45% with a 2% coupon in 2019 to 3.21% with a 3% coupon in 2038.

The deal is rated Aaa by Moody’s and AA-plus by Fitch.

In the competitive arena, Texas sold $156.84 million of general obligation college student loan bonds subject to the alternative minimum tax.

BAML won the bonds with a true interest cost of 3.1122%. The issue was priced to yield from 1.79% with a 5% coupon in 2022 to 3.12% with a 4% coupon in 2041.

The deal is rated triple-A by Moody’s and S&P.

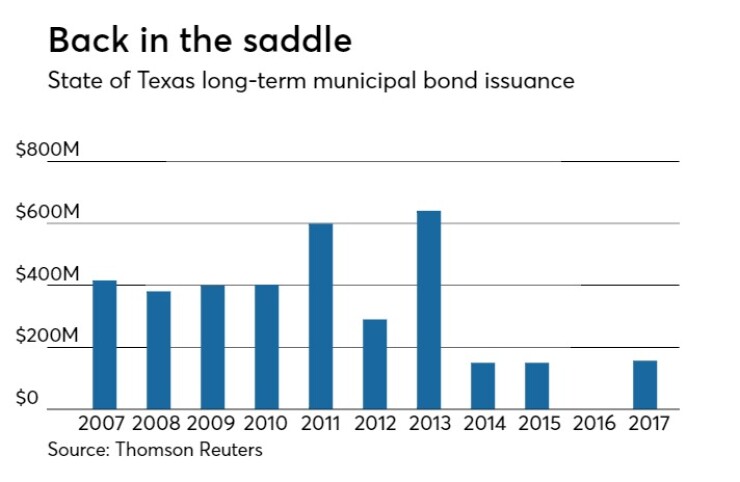

Since 2007, the Longhorn State has issued roughly $3.58 billion of bonds, with the most issuance occurring in 2013 when it sold $641 million of bonds. The state did not come to market in 2016 and issued only $150 million each in 2015 and 2014.

Bond Buyer 30-day visible supply at $18.6B

The Bond Buyer's 30-day visible supply calendar decreased $3.08 billion to $18.61 billion on Wednesday. The total is comprised of $5.14 billion of competitive sales and $13.48 billion of negotiated deals.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.