-

Municipal supply will slip in the holiday-shortened trading week, but that doesn't mean there won't be things to watch for in the market.

April 12 -

All eyes were on the enormous California offering. PREPA bonds have risen this month as investors anticipate a deal to restructure its debt is gaining support.

April 11 -

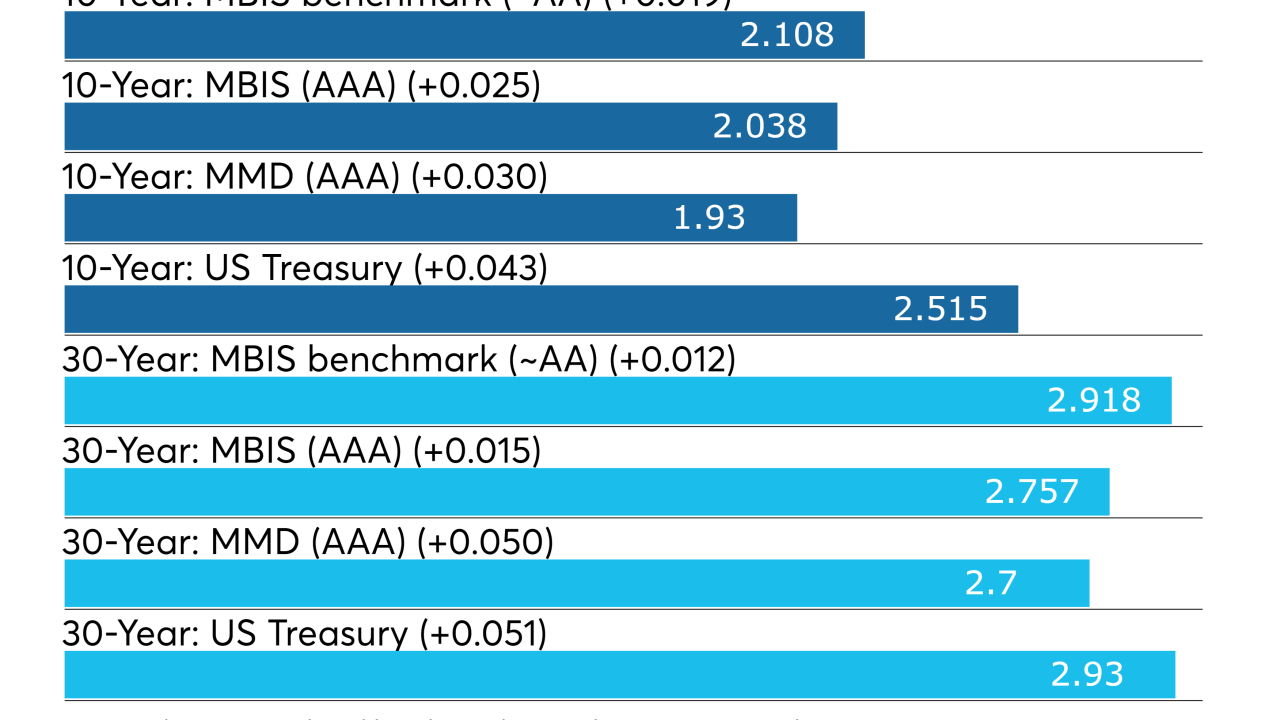

Underwriters circulated a premarketing wire on California’s $2 billion GOs as the NYC water authority deal came to market.

April 9 -

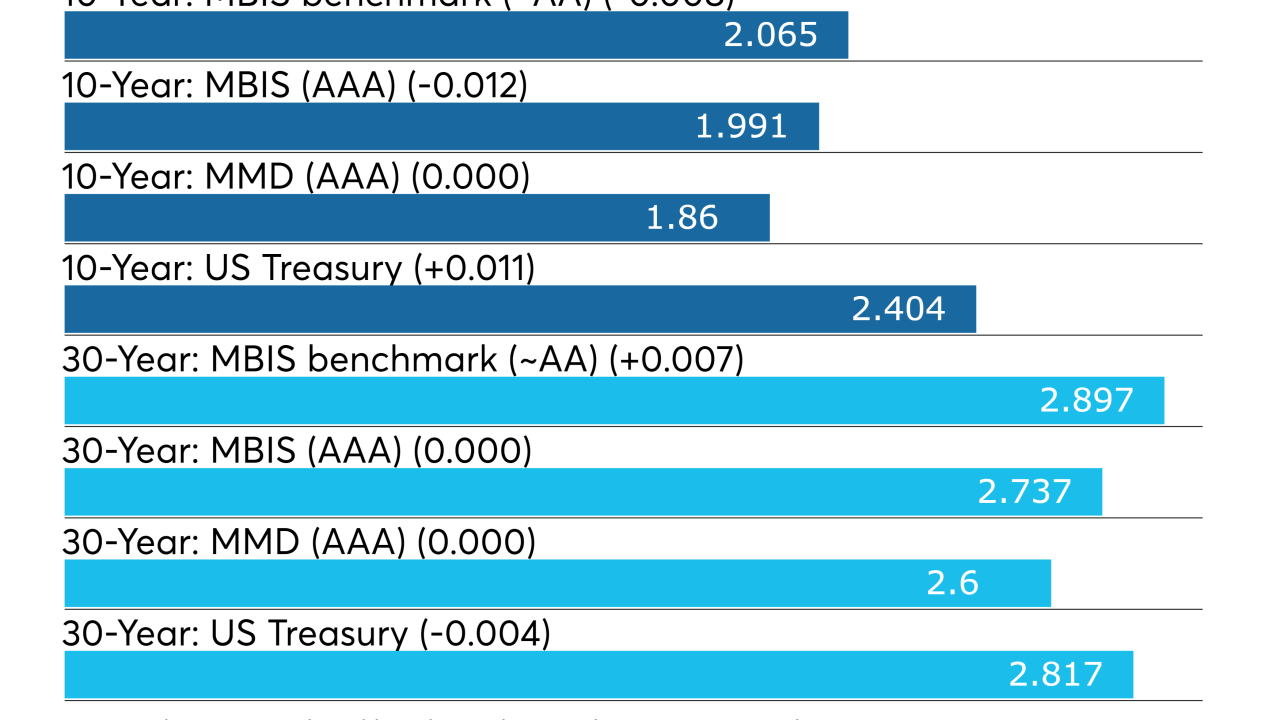

New York City’s water authority kicked off the week by offering bonds to individual investors on Monday.

April 8 -

With plenty of cash looking to go to work, investors are not loving the calendar or what small allocations they will be allotted as we draw near the end of tax season.

April 5 -

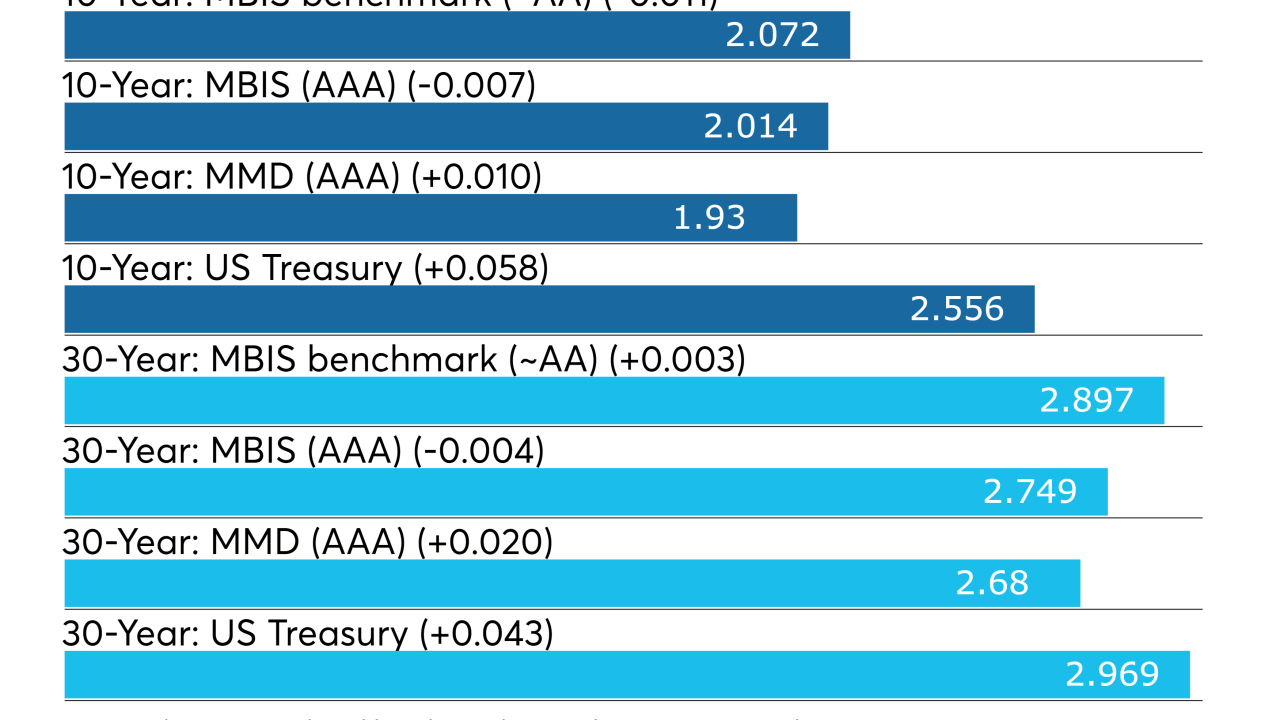

Municipals were firm on Thursday as the last of the week’s deals hit the market

April 4 -

The state collected $2.6 billion, a 9% increase over the same month of 2018, said State Comptroller Glenn Hegar.

April 3 -

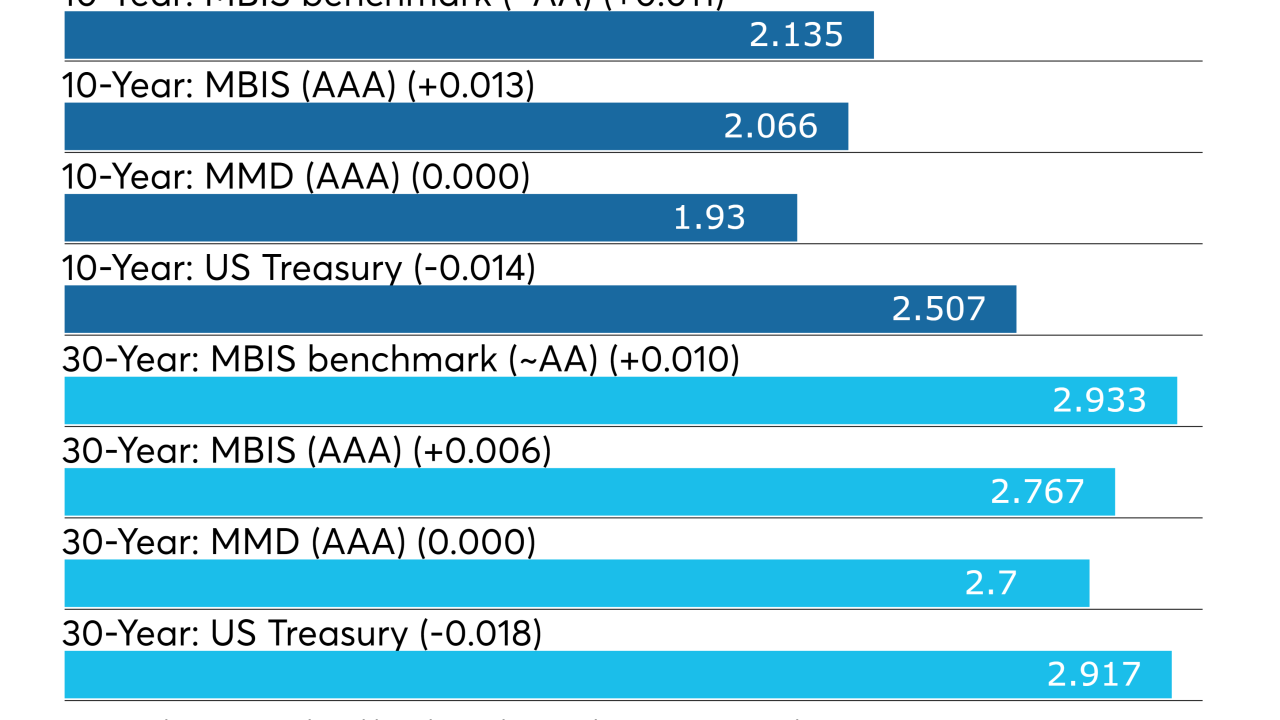

Focus remained on the municipal primary as more supply swept into the market on Wednesday.

April 3 -

The municipal bond market is facing $100 billion of municipal bond redemptions and implied reinvestments.

April 1 -

Municipal bond volume will fall to $5.5 billion in the upcoming week, with green deals from Illinois and Arizona.

March 29