All eyes were on the enormous California offering Thursday and the market continues to be issuer friendly with lowering yields even as AAA benchmarks were little changed. Meanwhile, Puerto Rico Electric Power Authority bonds have risen this month as investors anticipate a deal to restructure its debt is gaining support.

Morgan Stanley priced and repriced for institutions $2.02 billion of general obligation bonds for the state of California (Aa3/AA-/AA-) bumping yields across the curve. Momentum from the widely successful retail order period on Wednesday, carried over to today, as the deal was bumped and ending up coming 3-4 basis points tighter than initial talk.

The 10-year with a 5% coupon was repriced to 2.06% (+14 to AAA benchmarks) from 2.08% earlier in the day and from 2.10% during the retail pricing.

The long bond, 5s of 2045, yielded 2.77%, bumped from 2.80% earlier in the day. Those bonds were not offered to retail investors.

A recent block trade on Wednesday of last month's 30-year 5% GO traded at 2.85% from its original 3.18% when it priced in March — a 33 basis point difference.

However the deal wasn't for everyone.

“We looked at spreads on the Cal GO offering and you could say it is priced on the cheaper side of where it has been trading over the past few months,” said Robert Wimmel, head of municipal fixed income at BMO. “You could see some spread tightening, good relative price performance, over the next several weeks. But for a non-Cal investor, the absolute yield is still much lower than what you can find in other states. So, we passed.”

Elsewhere in the primary, New York City (Aa1/AA/AA) sold $121.5 million of Fiscal 2008 Series L Subseries L-6 GOs. The bonds were won by Morgan Stanley.

"The supply/demand balance remains very favorable for munis — however, the market is pushing a rock up a hill at this point," said one New York trader.

He noted that the past month has seen an extreme flattening of the curve as rate projections shift and cash goes searching for better returns.

"Critical to the rally/tightening/flattening continuing will be the fund flows," the trader said. "They remained positive but off the high levels last week and it will be interesting to see if they stay positive this close to tax time."

In general, another trader said that ratios are still tight, but will likely remain that way as long as the market continues to see are seeing large weekly inflows.

“Next week is tax day and we will start seeing if the large year-to-date inflows will slow down after tax season,” he said.

Thursday’s bond sales

PREPA

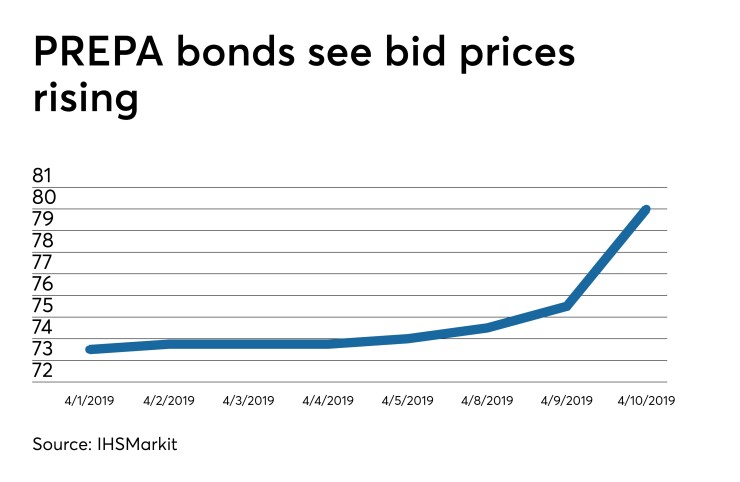

Puerto Rico Electric Power Authority bonds have risen this month, and jumped significantly in the past two days, as investors anticipate a deal to restructure its debt is gaining support.

The details of the latest plan aren't yet public, but in the

According to IHS Markits end-of-day valuations for a 7% of 2043 PREPA CUSIP over the past month, shows a rise in bid prices.

On March 1, the bid price was 70.3 and rose as high as 71.5 on the last day of March. It continued its upward trajectory in the first week of April, landing at 74 on April 5. The past few days it has jumped, going from 75.5 on April 9 to 80 on April 10.

“IHS Markit observed stronger trading activity in Puerto Rico Electric Power Authority debt this week based on the news of bondholders potentially reaching a restructuring agreement with Assured Guaranty Corp. The marks a positive step in reducing the bankrupt utility’s $9 billion of obligations,” Markit said.

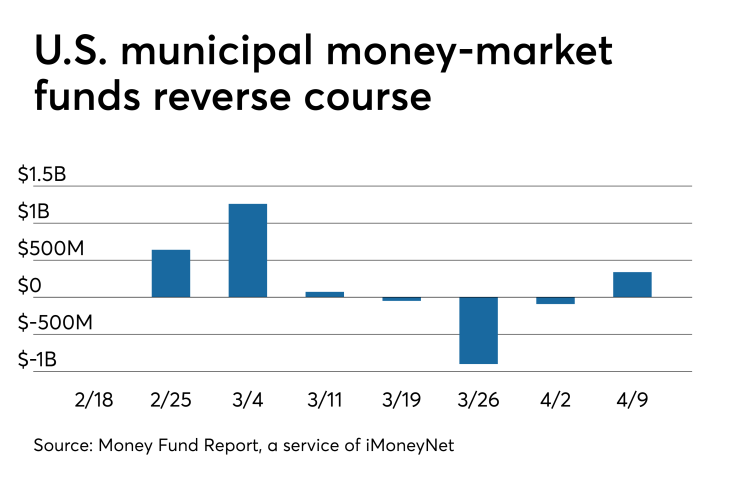

Muni money market funds back in the green

Tax-free municipal money market fund assets increased $339.1 million, raising their total net assets to $139.02 billion in the week ended April 8, according to the Money Fund Report, a service of iMoneyNet.com.

The average seven-day simple yield for the 190 tax-free and municipal money-market funds dipped to 1.09% from 1.12% last week.

Taxable money-fund assets rose $2.33 billion in the week ended April 9, bringing total net assets to $2.931 trillion.

The average, seven-day simple yield for the 812 taxable reporting funds decreased to 2.06% from 2.09% last week.

Overall, the combined total net assets of the 1,002 reporting money funds increased $2.67 billion to $3.070 trillion in the week ended April 9. It marks the 14th consecutive week total money-fund assets have exceeded $3 trillion.

Secondary market

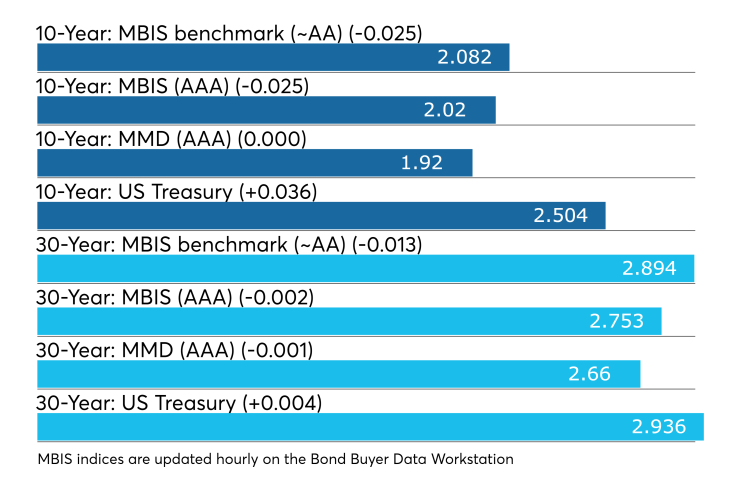

Munis were mostly stronger on the MBIS benchmark scale Thursday, which showed yields falling as many as two basis points in the 10-year muni and one basis point in the 30-year maturity. High-grade munis were mostly stronger, with yields decreasing two basis points in the 10-year maturity while declining less than one basis point in the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO muni was unchanged while the 30-year muni yield dipped one basis point.

The 10-year muni-to-Treasury ratio was calculated at 76.5% while the 30-year muni-to-Treasury ratio stood at 90.5%, according to MMD.

Previous session's activity

The MSRB reported 43,232 trades Wednesday on volume of $16.574 billion. California, New York and Texas were most traded, with the Golden State taking 15.573% of the market, the Empire State taking 11.744% and the Lone Star State taking 11.004%. The most actively traded issue was the Puerto Rico Commonwealth GO 8s of 2035 which traded 16 times on volume of $36.125 million.

Treasury auctions bonds, bills

The Treasury Department auctioned $16 billion of 29-year 10-month bonds with a 3% coupon at a 2.930% high yield, a price of 101.381292.

The bid-to-cover ratio was 2.25.

Tenders at the high yield were allotted 59.85%.

The median yield was 2.870%. The low yield was 2.488%.

Treasury also auctioned $50 billion of four-week bills at a 2.375% high yield, a price of 99.815278.

The coupon equivalent was 2.419%. The bid-to-cover ratio was 2.88.

Tenders at the high rate were allotted 74.90%. The median rate was 2.350%. The low rate was 2.330%.

Treasury auctioned $35 billion of eight-week bills at a 2.375% high yield, a price of 99.630556.

The coupon equivalent was 2.424%. The bid-to-cover ratio was 2.99.

Tenders at the high rate were allotted 58.85%. The median rate was 2.350%. The low rate was 2.320%.

Treasury auctions announced

The Treasury Department announced these auctions:

$17 billion five-year TIPs selling on April 18

$36 billion 182-day bills selling on April 15; and

$42 billion 91-day bills selling on April 15.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.