New York City’s water authority kicked off the week by offering bonds to individual investors on Monday ahead of the week’s $6.69 billion supply calendar.

Primary market

Siebert Cisneros Shank & Co. priced the New York City Municipal Water Finance Authority’s (Aa1/AA+/AA+) $500 million of tax-exempt fixed-rate second general resolution revenue bonds for retail investors ahead of the institutional pricing on Tuesday.

About $150 million of the proceeds from the Fiscal 2019 Subseries FF-1 and Fiscal 2019 Subseries FF-2 bonds will be used to fund capital projects while the remaining proceeds will be used to refund some bonds for savings.

Barclays Capital and Raymond James are co-senior managers on the deal.

Jefferies is set to price the California Community Housing Agency’s (NR/NR/NR) $194 million of Series 2019A workforce housing revenue bonds for the Annadel Apartments.

Goldman Sachs is expected to price the Tuscaloosa County Industrial Development Authority, Ala.’s (NR/NR/NR) $612 million of Series 2019A Gulf Opportunity Zone refunding bonds for the Hunt Refining project.

Also this week, California (Aa3/AA-/AA-) is coming to market with a $2.1 billion sale of GOs. Morgan Stanley is expected to price the mostly refunding deal on Thursday after a one-day retail order period.

California was in the negotiated market on March 6 when it issued $2.29 billion of GOs.

“At that time, Citigroup priced 5s of 4/2024 at 1.76% (+8 basis points), 5s of 4/2029 at 2.31% (+24 basis points), 5s of 4/2035 (29c) at 2.81% (+24 bps) 5s of 4/2038 (29c) were priced at 2.96% (+21 basis points),” Daniel Berger, chief municipal strategist at Refinitive Municipal Market Data, wrote in a Monday market comment. “Currently, MMD has assessed the spreads for Cal GOs at +4 basis points for five-years, +12 basis points for 10-years, +17 basis points for 15-years and +17 basis points for 20-years.”

The state was last in the market on March 26 when it competitively sold $843 million of GOs in two sales, which were won by Jefferies and Wells Fargo Securities. The state was the largest issuer of municipal debt in the first quarter.

In the competitive arena this week, the East Side Union High School District, Calif., (NR/NR/NR) is selling $140 million of Series B 2016 Election GOs. Proceeds will be used for school facility projects and increasing student computer and technology access.

Dale Scott Co. is the financial advisor; Jones Hall is the bond counsel.

Round Rock, Texas, (PSF: NR/NR/AAA) is selling $159.49 million of Series 2019 unlimited tax school building bonds on Tuesday.

Hilltop Securities is the financial advisor; Bracewell and the state Attorney General are the bond counsel.

Monday’s bond sale

Bond Buyer 30-day visible supply at $8.36B

The supply calendar rose $295.6 million to $8.36 billion on Monday, composed of $2.11 billion of competitive sales and $6.25 billion of negotiated deals.

Secondary market

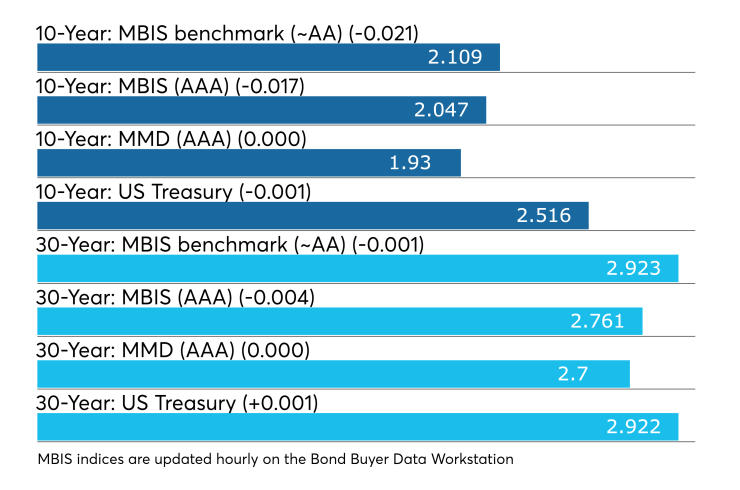

Munis were mostly stronger on the MBIS benchmark scale Monday, which showed yields falling two basis points in the 10-year maturity and dipping less than a basis point in the 30-year maturity. High-grade munis were little changed, with yields dropping less than one basis point in both the 10- and 30-year maturities.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year GO muni and the 30-year muni remained unchanged.

The 10-year muni-to-Treasury ratio was calculated at 76.6% while the 30-year muni-to-Treasury ratio stood at 92.2%, according to MMD.

Treasuries were little changed as stocks traded lower.

“The ICE Muni Yield Curve is trading around the previous session’s levels,” ICE Data Services said in a Monday market comment. “High-yield and tobaccos are similarly unchanged."

Previous session's activity

The MSRB reported 33,543 trades Friday on volume of $8.90 billion. California, New York and Texas were most traded, with the Golden State taking 15.808% of the market, the Empire State taking 12.652% and the Lone Star State taking 10.771%. The most actively traded issue was the Polk County, Fla., Series 2013 revenue refunding 5s of 2043 which traded 25 times on volume of $40.10 million.

Week's actively traded issues

Revenue bonds made up 54.01% of total new issuance in the week ended April 5, down from 54.34% in the prior week, according to

Some of the most actively traded munis by type were from Connecticut, Florida and Oregon issuers.

In the GO bond sector, the Connecticut 4s of 2038 traded 45 times. In the revenue bond sector, the Florida DFC 6.5s of 2049 traded 147 times. In the taxable bond sector, the Port of Portland 4.237s of 2049 traded 23 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the $42 billion of three-months incurred a 2.375% high rate, down from 2.380% the prior week, and the $36 billion of six-months incurred a 2.395% high rate, up from 2.380% the week before. Coupon equivalents were 2.429% and 2.465%, respectively. The price for the 91s was 99.391778 and that for the 182s was 98.796778.

The median bid on the 91s was 2.350%. The low bid was 2.320%. Tenders at the high rate were allotted 74.26%. The bid-to-cover ratio was 3.07.

The median bid for the 182s was 2.370%. The low bid was 2.340%. Tenders at the high rate were allotted 35.40%. The bid-to-cover ratio was 3.14.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.