As the second quarter begins, estimates for municipal bond redemptions and implied reinvestments total almost $100 billion, Kimberly Olsan, senior vice president at FTN Financial and contributor to Court Street Group Research, wrote in a report released Monday.

She noted that if any of the next three months come with less than $30 billion of new issuance, the broader market could see a net-supply deficit.

“That factor alone is causing credit spreads to compress, especially in short-dated maturities where single-As are trading with less than 10 basis point differentials to AAAs,” Olsan wrote. “Even the most distressed state credits are seeing a boost — Connecticut’s GO deal priced the 10-year maturity 23 basis points tighter than its August 2018 sale. Forward supply for early April appears more benign at under $7 billion, which should enable current gains to more or less remain intact.”

Issuance fell 7% in March to $24.25 billion from $26.08 billion in March 2018. While supply was down last month, it was up 14.4% for the quarter on a year-over-year basis. In the first quarter, volume totaled $75.03 billion versus $65.56 billion in the same period last year.

Issuance has been soft for several reasons, according to Court Street’s George Friedlander, who cited growing concerns about climate change and the pressure to adapt projects to new technology.

“All of a sudden there is increased pressure for state and local governments to move toward a reduced carbon footprint, but with scant-to-negligible guidance from the Federal government as to what role they might play as part of the team,” Friedlander said. The bottom line, he said, is that this challenge “very likely is part of the reason why issuances intended to fund new projects remains sparse.”

Infrastructure and pensions should also be a focus, according to BofA.

“Munis saw excess demand and an issuance shortfall in the face of a Fed-induced global bond market rally,” according to a Monday research report from BofA. “We expect more of the same for munis. The dearth of infrastructure financing and the ban on tax-exempt advance refundings have been notable. Infrastructure comes at the expense of pensions.”

The report added that while other post-employment benefits [OPEBs] unfunded liabilities do not grab the headlines as much as unfunded pension liabilities “arguably, rightfully, as they are easier to reform or modify — they can prove almost-as-pernicious as those unfunded pension liabilities.”

Like unfunded pension liabilities, BofA cited a recent report from Moody's Investors Service that warns that "if unaddressed, rising OPEB expenses threaten to further 'crowd out' other local government spending priorities, like for infrastructure investments."

BofA said "though state and local government infrastructure investment reached record levels on a nominal basis in 2018 — hitting $398.3 billion at annual rates in the fourth quarter — as a percentage of GDP, state and local investment remains well below peak levels of 2.55% in 2Q09; as of 4Q18, it amounted to 1.91% of GDP."

Primary market

This week’s volume is estimated at $5.5 billion, consisting of $4.2 billion of negotiated deals and $1.3 billion of competitive sales.

Action kicks off on Tuesday when Citigroup is expected to price the Michigan Finance Authority’s (Aa2/AA+/NR) $300 million of taxable school loan revolving fund term-rate revenue bonds. The offering will consist of variable-rate and fixed-rate debt.

Also on tap, BofA Securities is set to price the Lee Memorial Health System (A2/A+/NR) in Florida’s $250 million issue of fixed-rates and R-FLOATS.

JPMorgan Securities is expected to price the Board of Regents of the Arizona State University System’s (Aa2/AA/NR) $196.78 million of green revenue and revenue bonds.

Anne Arundel County, Md., (Aa1/AAA/NR) will competitively sell $302 million of GOs in two sales consisting of $224.05 million consolidated general improvement GOs and $78.32 million of consolidates water and sewer GOs.

Proceeds will be used finance various capital improvements and to refund certain outstanding debt. The financial advisor is Public Resources Advisory Group; the bond counsel is McKennon Shelton.

N.Y. plans $3.5B bond sales in Q2

New York State, New York City and their major public authorities plan to sell $3.54 billion of municipal bonds in the second quarter, State Comptroller Thomas DiNapoli announced on Monday.

The sales include $1.77 billion of new money and $1.77 billion of refundings, consisting of $2.53 billion in April, of which $1.21 billion is for new money and $1.32 billion for refunding and reoffering purposes; $405.5 million in May, all of which is for new money; and $606.5 million in June, of which $156.5 million is for new money and $450 million for refunding purposes.

The calendar includes anticipated bond sales from the City of New York, the Dormitory Authority of the State of New York, the New York City Housing Development Corp., the New York City Municipal Water Finance Authority, the New York State Environmental Facilities Corp., the New York State Housing Finance Agency, and the Port Authority of New York & New Jersey.

NYC water agency sets $450M sale

The New York City Municipal Water Finance Authority announced Monday that it plans to sell $450 million of tax-exempt, fixed-rate second general resolution revenue bonds on Tuesday, April 9, after a one-day retail order period.

About $150 million of the proceeds will be used to fund capital projects while the remaining proceeds will be used to refund certain outstanding bonds for savings.

The bonds will be priced by the authority’s underwriting syndicate, led by book-running lead manager Siebert Cisneros Shank & Co. with Barclays and Raymond James serving as co-senior managers on the transaction.

Bond Buyer 30-day visible supply at $7.38B

The supply calendar rose $606.5 million to $7.38 billion Monday and is composed of $2.31 billion of competitive sales and $5.07 billion of negotiated deals.

Secondary market

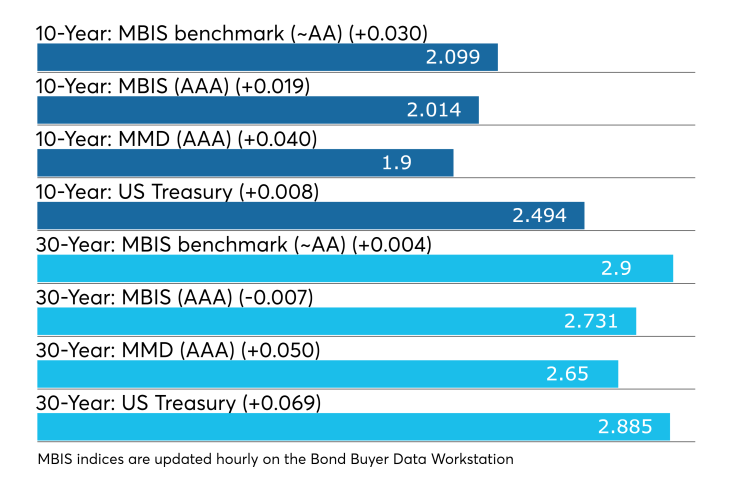

Munis were mostly weaker on the MBIS benchmark scale Monday, which showed yields rising three basis points in the 10-year maturity while one less than a basis point in the 30-year maturity. High-grade munis were also mostly weaker, with yields rising less than one basis point in both the 10-year maturity and the 30-year maturity.

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO rose four basis points while the yield on 30-year muni gained five basis points.

The 10-year muni-to-Treasury ratio was calculated at 76.1% while the 30-year muni-to-Treasury ratio stood at 91.7%, according to MMD.

Treasuries were little weaker as stocks traded higher.

“The ICE Muni Yield Curve is 2.8 basis points higher in the 30-year segment and 1.6 basis points higher in the 10-year,” ICE Data Services said in a Monday market comment. “The high-yield sector is quiet and mixed and tobaccos are unchanged. The taxable sector yields are up seven basis points in the five-year. The Puerto Rico bellwether bonds are unchanged today as well.”

Previous session's activity

The MSRB reported 32,428 trades Friday on volume of $11 billion. California, Texas and New York were most traded, with the Golden State taking 16.153% of the market, the Lone Star State taking 9.976% and the Empire State taking 8.423%. The most actively traded issue was the Puerto Rico COFINA restructured Series 2018 A-1 capital appreciation revenue zeros of 2051 which traded 59 times on volume of $51.20 million.

Week's actively traded issues

Revenue bonds made up 54.34% of total new issuance in the week ended March 29, down from 54.52% in the prior week, according to

Some of the most actively traded munis by type were from Illinois and California issuers.

In the GO bond sector, the Chicago 5.5s of 2035 traded 75 times. In the revenue bond sector, the California Educational Facilities Authority 5s of 2049 traded 102 times. In the taxable bond sector, the Illinois 5.1s of 2033 traded 20 times.

Treasury auctions discount rate bills

Tender rates for the Treasury Department's latest 92-day and 182-day discount bills were mixed, as the $45 billion of three-months incurred a 2.380% high rate, down from 2.410% the prior week, and the $39 billion of six-months incurred a 2.380% high rate, off from 2.415% the week before. Coupon equivalents were 2.434% and 2.449%, respectively. The price for the 91s was 99.391778 and that for the 182s was 98.796778.

The median bid on the 91s was 2.350%. The low bid was 2.300%. Tenders at the high rate were allotted 60.54%. The bid-to-cover ratio was 2.68.

The median bid for the 182s was 2.355%. The low bid was 2.330%. Tenders at the high rate were allotted 42.88%. The bid-to-cover ratio was 2.92.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.