-

The governor approved a law authorizing the state to issue bonds to finance transportation projects backed by Deepwater Horizon settlement revenue.

July 3 -

Alabama’s highest-ever education budget and Louisiana’s largest increase in a decade are both credit positive, Moody’s says.

June 14 -

To avoid a fuel tax increase, settlement funds the state received to compensate for the 2010 Gulf oil rig explosion will back transportation projects.

June 6 -

The public-private partnerships will finance projects in Belle Chasse and Lake Charles.

May 31 -

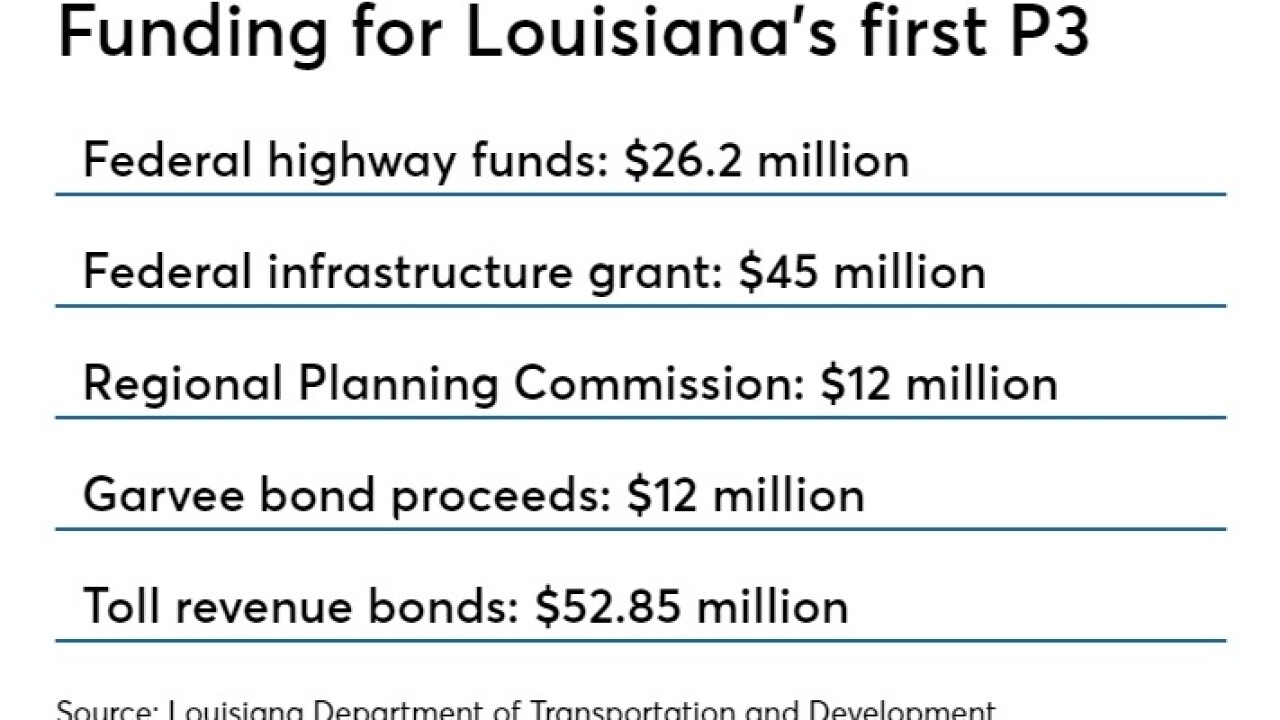

The cash-strapped state’s public-private partnership will pay for a fixed-span bridge to replace an aging lift bridge and tunnel in Belle Chasse.

May 29 -

The standalone grant anticipation revenue vehicle bond deal is the first of several tranches the state will issue over the next few years.

April 8 -

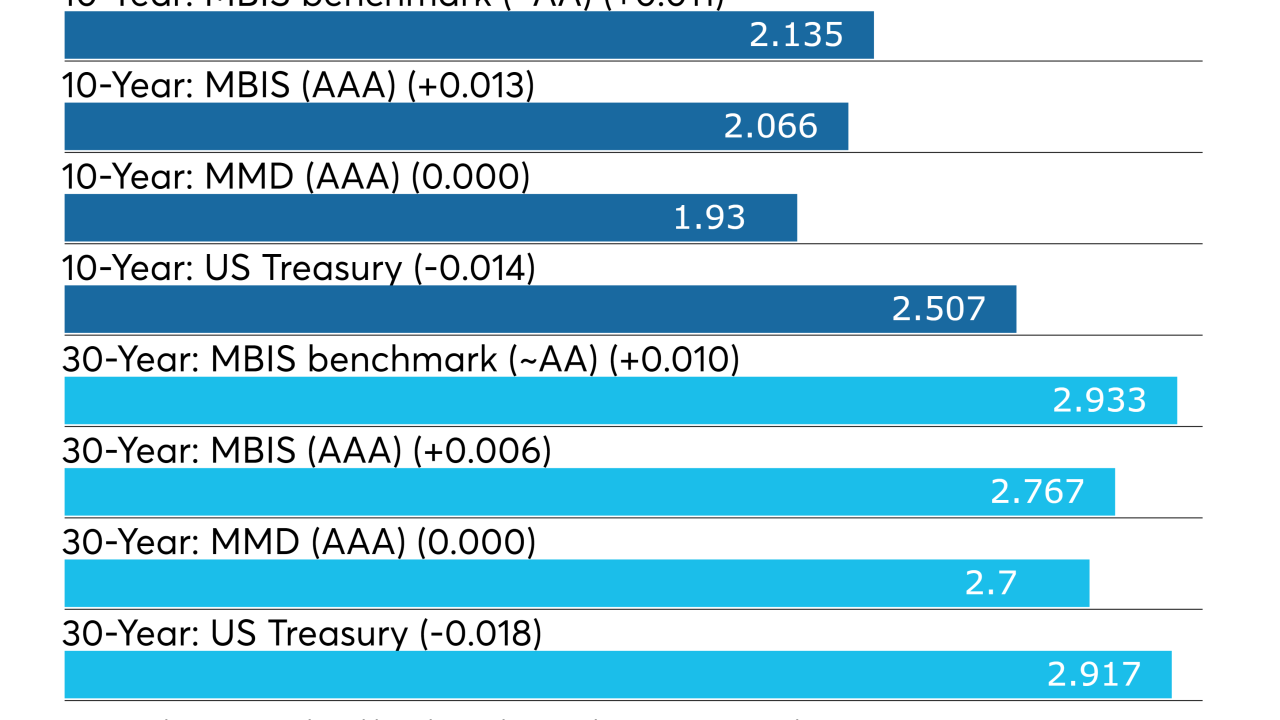

Municipals were firm on Thursday as the last of the week’s deals hit the market

April 4 -

Municipal bond buyers gave a warm reception to the two deals totaling $473 million.

February 21 -

Municipal bond buyers saw new issue supply rise on Thursday, led by issues in Louisiana and North Carolina.

February 21 -

Seasonal trends have favored munis so far this year, according to Blackrock's Peter Hayes.

February 20 -

A big competitive sale from a Texas issuer hit the screens on Wednesday,

February 20 -

Portfolio managers look likely to drive demand for this week’s new issue slate, which totals under $3 billion.

February 19 -

Munis showed strength as traders returned to work on Tuesday after the three-day holiday weekend.

February 19 -

Puerto Rico Sales Tax Financing Corp.'s restructured bonds started actively trading on Friday.

February 15 -

IHS Markit’s Ipreo forecasts weekly bond volume will hit $2.8 billion next week.

February 15 -

The Republican former state treasurer said he can help Louisiana residents better by remaining on “powerful committees” in Washington, D.C.

December 3 -

States have reversed deterioration found last May.

November 6 -

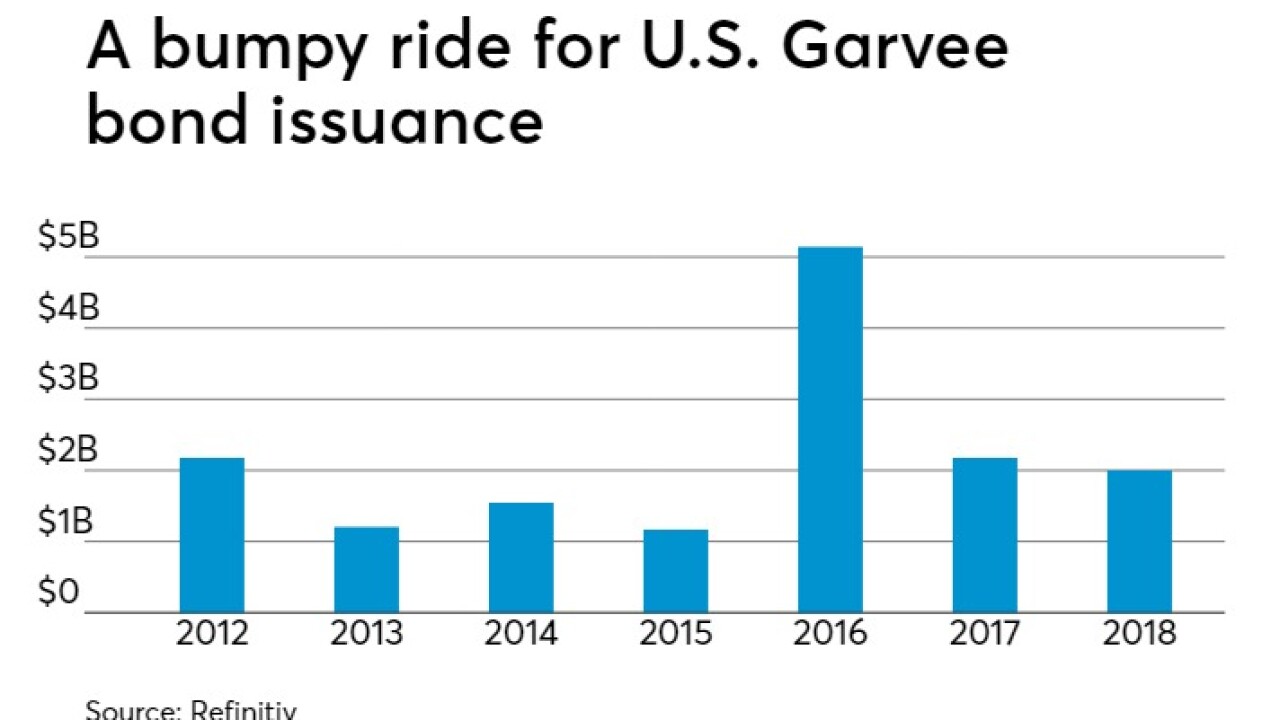

Commissioners made no mention of gun policies that led them to oust Citi and Bank of America Merrill Lynch from the deals.

September 20 -

S&P Global Ratings revised its outlook on the state’s general obligation bond rating to stable from negative and affirmed its AA-minus rating.

August 24 -

The State Bond Commission barred the banks from upcoming Garvee bond deals, and said its action may apply to other state bond issues.

August 17