The restructured Puerto Rico Sales Tax Financing Corp. bonds started actively trading on Friday.

Earlier in the week, COFINA swapped new bonds for old ones in the biggest municipal debt restructuring in U.S. history. What had been about $17.6 billion in COFINA bond par value became about $12 billion in new COFINA bond value. The Puerto Rico Oversight Board announced the deal on Tuesday.

The COFINA restructured Series A1 bonds, dated Aug. 8, 2018, had a principal amount at issuance of $3.479 billion, according to the Municipal Securities Rulemaking Board’s EMMA website.

The 5% bonds of July 1, 2058, dated Aug. 8, 2018, began trading on Friday at a price of 95.055, a yield of 5.30% and by late in the day were trading at a price of 98.637, a yield of 5.08%, EMMA reported. Trading volume totaled $144.912 million in 43 trades by late afternoon.

Puerto Rico’s restructuring let investors exchange subordinate-lien sales-tax bonds for about 56 cents on the dollar, while owners of the senior-lien bonds recovered 93 cents.

ICE Data Services said that now that the COFINA restructuring is complete its pricing and reference data service is evaluating the new bonds as well as legacy CUSIPS.

Primary market

Municipal bond buyers will see scant supply in the upcoming week as the Presidents’ Day holiday takes a bite out of the trading week. IHS Markit’s Ipreo forecasts weekly bond volume will hit $2.8 billion , composed of $1.62 billion of negotiated deals and $1.4 billion of competitive sales.

Topping the new issue slate is a general obligation bond sale from Louisiana. The Pelican State will competitively sell $309.845 million of Series 2019A GOs on Thursday. Proceeds will be used to finance various improvement projects.

The financial advisor is Lamont Financial Services; the bond counsel are Breazeale Sachse and Butler Snow.

The deal is rated AA-minus by S&P Global Ratings and Fitch Ratings.

The state last competitively sold GOs on Sept. 12, 2017 when Bank of America Merrill Lynch won the $300.09 million of Series 2017B GOs with a true interest cost of 2.9496%.

On Wednesday, Collin County, Texas, is competitively selling $151.285 million of Series 2019 limited tax permanent improvement GOs.

The financial advisor is Hilltop Securities; the bond counsel is Bracewell. The deal is rated AAA by S&P.

In the negotiated sector, Wells Fargo Securities is expected to price the North Carolina medical care Commission’s $206.71 million of Series 2019A-D healthcare facilities revenue bonds for the Wake Forest Baptist Obligated Group on Wednesday.

The deal is rated A2 by Moody’s Investors Service and A by S&P.

On Wednesday, two transportation sales from California issuers are on tap.

Bank of America Merrill Lynch is set to price the San Francisco Bay Area Toll Authority’s $125 million of Series 2019S-H subordinate toll bridge revenue bonds.

The deal is rated A1 by Moody’s and AA-minus by S&P and Fitch.

And RBC Capital markets is expected to price the San Francisco City and County Airport Commission’s $125 million of special facilities lease revenue bonds for the SFO Fuel Co. The deal consists of Series 2019A bonds subject to the alternative minimum tax and Series 2019B taxable bonds.

The deal is rated A1 by Moody’s and A by S&P.

Bond Buyer 30-day visible supply at $4.34B

The Bond Buyer's 30-day visible supply calendar decreased $1.05 billion to $4.34 billion for Friday. The total is comprised of $1.93 billion of competitive sales and $1.07 billion of negotiated deals.

Lipper: Muni bond fund inflows

Investors in municipal bond funds kept their confidence and put cash into them in the latest week, according to Lipper data released on Thursday.

Funds that report weekly said $1.451 billion came in during he week ended Feb. 13 after inflows of $1.149 billion in the previous week.

Exchange traded funds reported inflows of $821 million, after outflows of $378.137 million in the previous week. Ex-ETFs, muni funds saw inflows of $1.449 billion after inflows of $1.528 billion in the previous week.

The four-week moving average remained positive at $1.125 billion, after being in the green at $998.486 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds had inflows of $998.428 million in the latest week after inflows of $712.920 million in the previous week. Intermediate-term funds had inflows of $417.524 million after inflows of $604.747 million in the prior week.

National funds had inflows of $1.240 billion after inflows of $1.013 billion in the previous week. High-yield muni funds reported inflows of $452.473 million in the latest week, after inflows of $296.447 million the previous week.

Secondary market

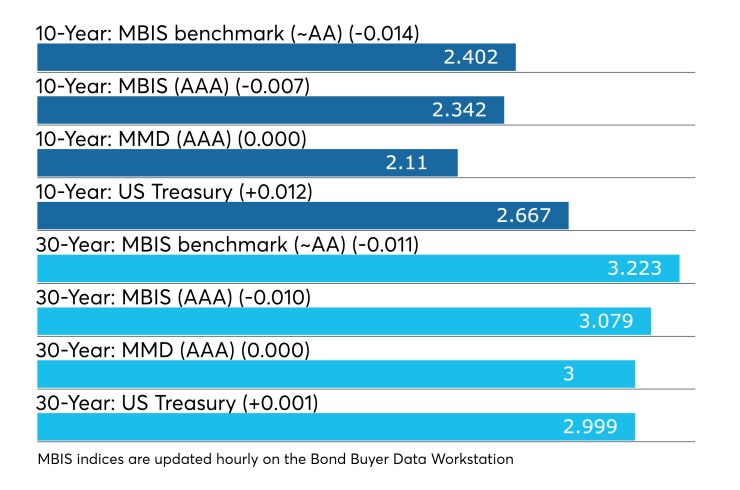

Municipal bonds were stronger Friday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the one- to 30-year maturities. High-grade munis were also stronger with muni yields falling as much as one basis point across the curve.

Municipals were steady on Municipal Market Data’s AAA benchmark scale, which showed the yield on both the 10-year muni general obligation and the 30-year muni maturity remaining unchanged.

Treasury bonds were weaker as stock prices traded up.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 79.2% while the 30-year muni-to-Treasury ratio stood at 100.1%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

"The market has been strong all week," said Eric Kazatsky, portfolio manager at Clark Capital Management Group. "Wednesday and Tuesday there was very little concessions to be had on the secondary. Yesterday, strong demand continued as some deals were bumped. It shows what sort of cash is sitting around, especially for lower dollar structures as bonds have rallied."

He added that over a year has passed since the implementation of federal tax reform, and high tax states are just beginning to feel the implications. As tax returns are beginning to be filed, residents in the high tax coastal jurisdictions may face some unpleasant surprises, resulting in a realization that the municipal bond tax-exemption is still an efficient way to shield taxable income.

"However, while limited supply in the municipal market has already led to a rise in bond valuations, budget impacts resulting from federal tax reform will call into question the relative value of bonds from respective high tax states," he said.

The federal tax measure, which placed a $10,000 cap on SALT (State and Local Tax) deductions, led to a flurry of tax prepayments in late 2017, impacting the flow of taxes in states such as California, New York, New Jersey and Connecticut.

"A secondary impact, which has been the narrowing of bond spreads, has been a result of consistently strong separately managed account inflows and limited municipal new issue supply."

He noted that what this means is that for residents seeking municipal bonds from these states, it has become a more expensive endeavor. However, for the go-anywhere investors less impacted by state taxes, like a Texas or Florida resident, the choice for assessing relative value has become cloudier at times.

"While the municipal market has thousands of unique obligors, bonds from California, Texas, New York and New Jersey make up a disproportionately large portion of the market. We believe portfolio construction should consist of credit diversification but also relative value calls."

Previous session's activity

The Municipal Securities Rulemaking Board reported 41,197 trades on Thursday on volume of $15.96 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.589% of the market, the Empire State taking 12.282% and the Lone Star State taking 10.556%.

Week's actively traded issues

Some of the most actively traded munis by type in the week ended Feb. 15 were from Puerto Rico, Texas and Michigan issuers, according to

In the GO bond sector, the Puerto Rico 8s of 2035 traded 59 times. In the revenue bond sector, the Texas 4s of 2019 traded 37 times. In the taxable bond sector, the Michigan State University 4.496s of 2048 traded 49 times.

Week's actively quoted issues

Puerto Rico, Maryland and California names were among the most actively quoted bonds in the week ended Feb. 15, according to IHS Markit.

On the bid side, the Puerto Rico Sales Tax Financing Corp. revenue 6s of 2042 were quoted by 111 unique dealers. On the ask side, the University of Maryland revenue 3.375s of 2039 were quoted by 223 dealers. Among two-sided quotes, the California taxable 7.55 of 2039 were quoted by 25 dealers.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.