-

The state Senate approved the proposed constitutional amendment on a party-line vote.

May 2 -

Municipal bond sales sank 28.2% from April 2018 as issuers awaited clarity on federal infrastructure plans.

April 30 -

The next five weeks will determine the fate of first-year governor J.B. Pritzker's proposals for the fiscally troubled state.

April 26 -

The full state Senate will weigh Gov. J.B. Pritzker's proposal to ask voters to approve a graduated tax system after it cleared a committee.

April 15 -

Municipal bond volume will fall to $5.5 billion in the upcoming week, with green deals from Illinois and Arizona.

March 29 -

After two months of gains from 2018 levels, municipal issuance sank 7% from March last year as the loss of advance refundings continues to take a toll.

March 29 -

Chicago and Illinois poured more than $1 billion of their high-yielding, low-investment-grade rated GO paper into the market on the same day.

March 27 -

Deals from the NYC TFA, Chicago, Illinois, California, Maryland and Miami-Dade County help satisfy demand.

March 26 -

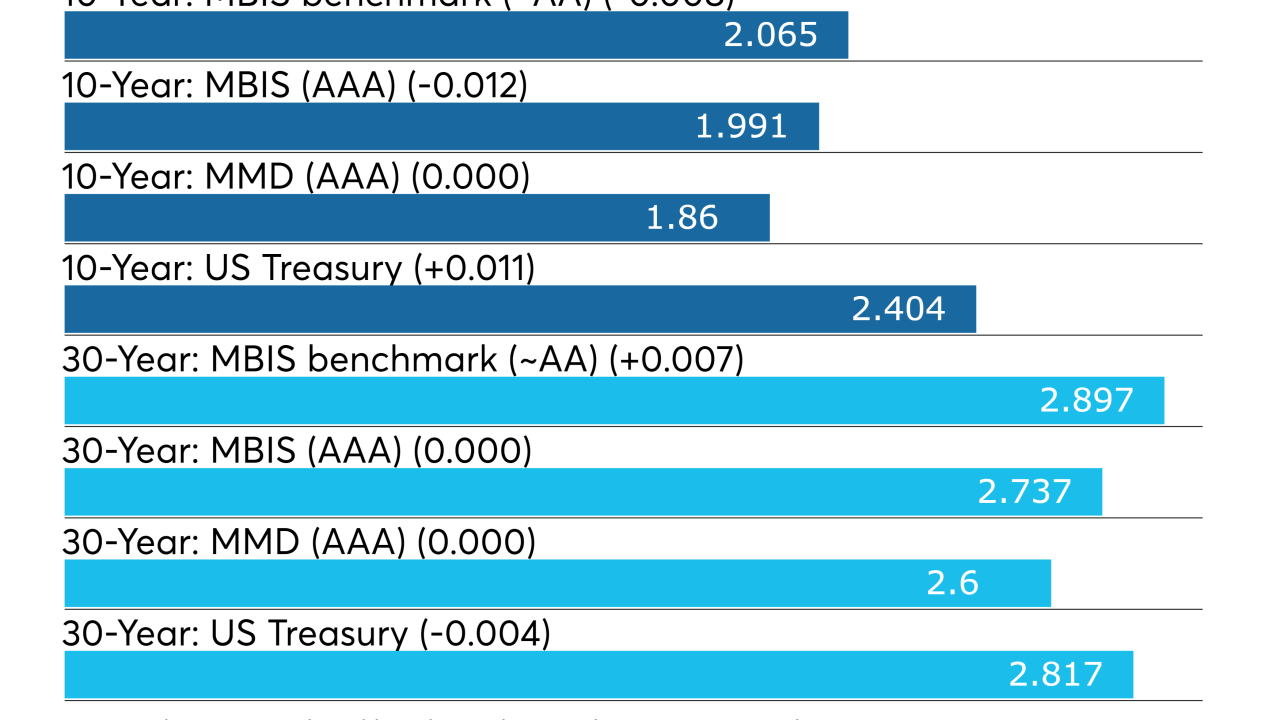

Muni rates and ratios have benefited from macro themes driving rates lower, according to a report released Monday.

March 25 -

Almost $9 billion of municipal bonds are coming to market with deals from a variety of issuers to quench the thirst of buyers experiencing a supply drought.

March 22