-

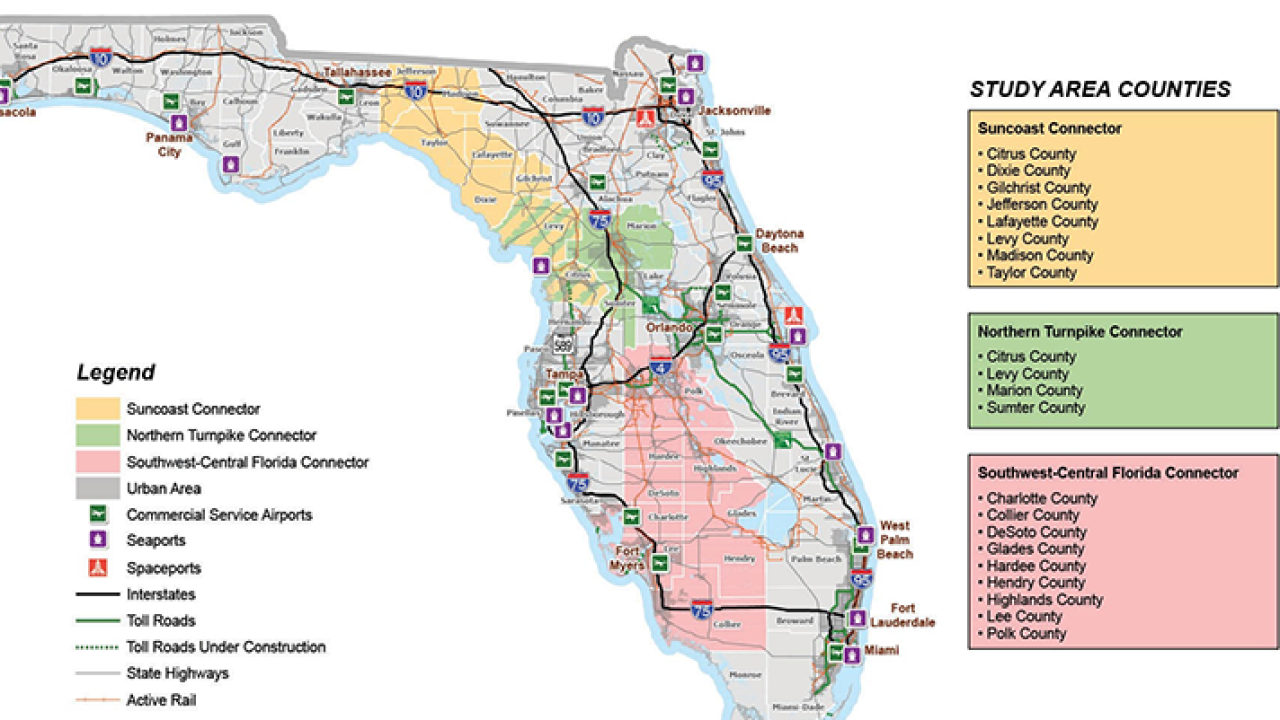

Task forces studying three proposed toll road projects failed to conclude if there is a need for the new corridors or modifications of existing roads.

December 9 -

Although November posted the lowest monthly volume total this year, issuance has already exceeded 2019's total and is on track to set a new yearly record in 2020.

November 30 -

Top-rated muni yields fell by as much as 10 basis points on the AAA curves on Wednesday the largest move better for the market since late April, early May. ICI reported $1.2B of muni bond fund inflows.

November 4 -

The Florida Department of Transportation extended the suspension of Garcon Point Bridge toll collections because it is being used as a detour.

October 30 -

Long-term municipal bond volume is on pace to set a new record of yearly issuance, thanks in part to issuers rushing to market before the election and a continued taxable boom.

October 30 -

The most significant revenue loss in Florida continues to be the drop in sales tax collections in the tourism and hospitality industries.

October 29 -

Toll collections on the Garcon Point Bridge have been suspended since mid-September because of Hurricane Sally, pitting the bond trustee against the state of Florida again.

October 21 -

Florida is taking public comments about a toll road program that would add more than 300 miles of highway across broad swaths of the state.

October 7 -

Even with revised estimates amid the pandemic, year-over-year revenue collections in Florida were down 4.6% in August compared with 2019.

September 28 -

Florida State University's voluntary disclosure on lower dormitory occupancy is an example of providing timely information, Moody's Investors Service said.

September 24 -

A multi-part study by Cornell Consulting concludes that Florida should not build three major toll roads that are under consideration.

September 23 -

The Florida Cabinet approved new money and refunding bonds, some of which may be sold as taxable debt with advance tax-exempt refundings no longer possible.

September 22 -

In a long-range revenue forecast, a state economist told lawmakers that it could take two or three years for Florida’s hard-hit tourism industry to recover.

September 14 -

The Florida State Board of Administration Finance Corp. deal was upsized by $1 billion on a day that gave muni buyers a wide variety of paper to choose from.

September 2 -

September got off to a good start as buyers had their pick of a variety of new issues, which priced into a stable market environment.

September 1 -

Price guidance was issued on California's $2.4 billion GO deal as the State of New York Mortgage Agency got ready for its first social bond issue as the ESG muni market expands.

August 31 -

In taking advantage of historically low taxable municipal bond rates, Florida's deal should be attractive for yield-starved investors, state official says.

August 31 -

Municipals were weaker on Friday, with yields on the long end finishing out the day up one basis point. Since Aug. 12, when the muni market correction began and yields moved off record low levels, the yield on 10-year muni has risen by 23 basis points while the 30-year yield is up 29 basis points, according to Refinitiv MMD.

August 28 -

State economists project Florida will lose $5.4 billion of general revenues over the next two years, partly from reduced sales and lack of tourism.

August 19 -

The Florida Department of Transportation continues litigation in an attempt to terminate the Miami-Dade County Expressway Authority.

August 5