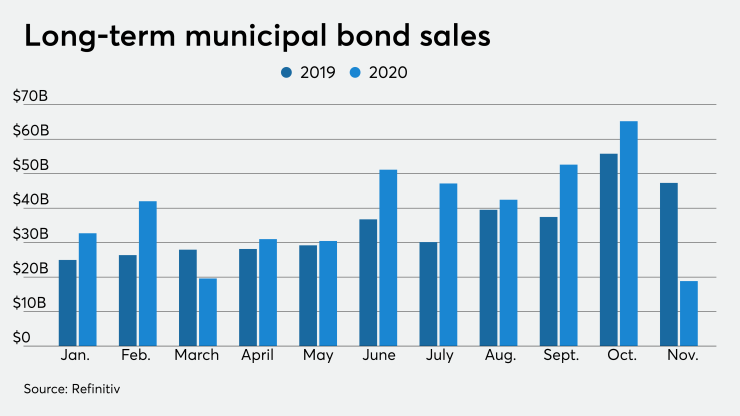

The municipal bond market saw the lowest monthly issuance total of the year in November, but that did not stop this year’s total volume passing 2019’s and all but confirms 2020 will end with a new record.

Muni bond issuance took a nosedive in November to the tune of $18.84 billion in 735 deals, much lower than the $47.31 billion in 1,193 transactions in November of 2019.

Even with the sudden slow-down in volume this past month, 2020 volume stands at $440.83 billion in 11,892 transactions. There was $426.34 billion in 11,594 issues in 2019. The record for yearly volume is $448.61 billion, that was set back in 2017. This week alone is near $8 billion.

“November issuance activity was entirely expected,” according to Tom Kozlik, head of municipal strategy and credit at Hilltop Securities. “The lower level was mostly due to the fact that issuers were rushing to complete financings before the 2020 elections. However, the fact that there were two mid-week holidays did not help either. I do not think that the third wave of COVID has played into the November calendar and I do not think that it will drastically impact the December calendar either.”

“We expect December will also be below average,” Kozlik said. “Expecting much more than a below average month could be an aggressive expectation.”

Looking ahead to next year, Kozlik anticipates issuance to drop in 2021, just like it did in 2011 and 2018.

“This time it could take some time, probably measured in years and not months, for new-money issuance momentum to return,” he said. “That is what it is going to take to hit another record year.”

Kozlik’s forecast of $450 billion for 2020 was the closest to correct, as everyone else was lower.

“For this year, I expected new money to be strong, but what really drove my expectation, even in December 2019, was that I thought rates would continue to be low and that there would be more refunding issuance.”

For 2021, he expects “only” $375 billion of issuance in 2021.

“Because of the fact that issuance was accelerated into 2020 and because issuers, especially state and local governments, will be taking steps to repair their balance sheets,” Kozlik said. “We do not think that issuers will be in a position to add higher new-money payments to their budgets. Refunding issuance should be plentiful in 2021 as interest rates remain low.”

Taxable munis have been mostly responsible for the issuance surge this year, but were down 59.4% year-over-year to $4.82 billion from $11.86 billion.

New-money issuance was 52.4% lower to $11.00 billion and refunding volume decreased 70.8% to $5.71 billion.

Issuance of revenue bonds was lower to $7.51 billion, while general obligation bond sales fell to $11.33 billion from $13.48 billion.

Negotiated deal volume sank 59.6% to $15.34 billion. Competitive sales were 55.5% lower to $3.47 billion.

Deals wrapped by bond insurance in November were down 35.4% to $1.29 billion in 126 deals from $2.00 billion in 160 transactions the same month last year.

Only one sector was in the green year-over-year for the month, while the rest declined by at least 47.6%.

General purpose deals moved higher to $8.86 billion from $7.99 billion.

One type of issuer increased volume from a year ago, while issuance by the others declined by 26.65.

Issuance from state governments rose 17.1% to $5.59 billion from $4.77 billion.

California continues to lead all states in terms of long-term muni bonds sold so far this year. All issuers in the Golden State have accounted for $66.78 billion. Texas is second with $56.43 billion, New York is third with $46.89 billion, Florida follows in fourth with $19.08 billion and Ohio rounds out the top five with $17.17 billion.

The rest of the top 10 are: Pennsylvania with $16.72 billion, Massachusetts is next with $14.25 billion, followed by Illinois at $12.15 billion, then Virginia with $11.98 billion and Michigan with $11.27 billion.