-

Bank of America Merrill Lynch held its No. 1 ranking among municipal underwriters as the biggest firms battled for deals in a shrinking market for new issuance.

October 5 -

Top-rated municipal bonds were unchanged at mid-session, according to traders, who were eyeing Puerto Rico’s debt.

October 5 -

The municipal market is winding up the week’s primary dealings with a negotiated sale from DASNY as traders eye Puerto Rico bonds.

October 5 -

Puerto Rico bonds plunged on Wednesday after President Donald Trump suggested the commonwealth’s debt needed to be “wiped out” to help the island recover from the devastation caused by Hurricane Maria.

October 4 -

Puerto Rico bonds took a big hit on Wednesday after President Donald Trump suggested the commonwealth’s debt needed to be “wiped out” to help the island recover from the devastation caused by Hurricane Maria.

October 4 -

Puerto Rico bonds took a hit on Wednesday after President Donald Trump suggested the commonwealth’s debt would need to be wiped clean to help the island recover from the devastation caused by Hurricane Maria.

October 4 -

Top-rated municipal bonds finished mixed on Tuesday as the Dormitory Authority of the State of New York competitively sold almost $1.7 billion of bonds in a handful of offerings.

October 3 -

Top-rated municipal bonds strengthened at mid-session as the Dormitory of the State of New York competitively sold almost $1.7 billion of bonds in a handful of offerings.

October 3 -

The municipal bond market will be watching as the Dormitory of the State of New York competitively sells $1.7 billion of bonds in five separate offerings on Tuesday.

October 3 -

Top-rated municipal bonds finished mixed on Monday, according to traders, who were seeing the first of the week’s new issues hit the screens.

October 2 -

Top-rated municipal bonds were mixed at mid-session, according to traders, who were seeing the first of the week’s new issues hit the screens.

October 2 -

Municipal bond market participants are returning to work on Monday ready to see a smaller-than-usual new issue calendar awaiting them this week.

October 2 -

Top-shelf municipal bonds ended mixed on Friday ahead of a smaller-than-average new issue calendar that is dominated by a variety of offerings from the Dormitory of the State of New York.

September 29 -

The Dormitory Authority of the State of New York is prepping another large bond deal as part of a busy 2017 for the conduit issuer.

September 22 -

Strong demand for New York State’s new free public college tuition program could disrupt the private higher education landscape.

September 8 -

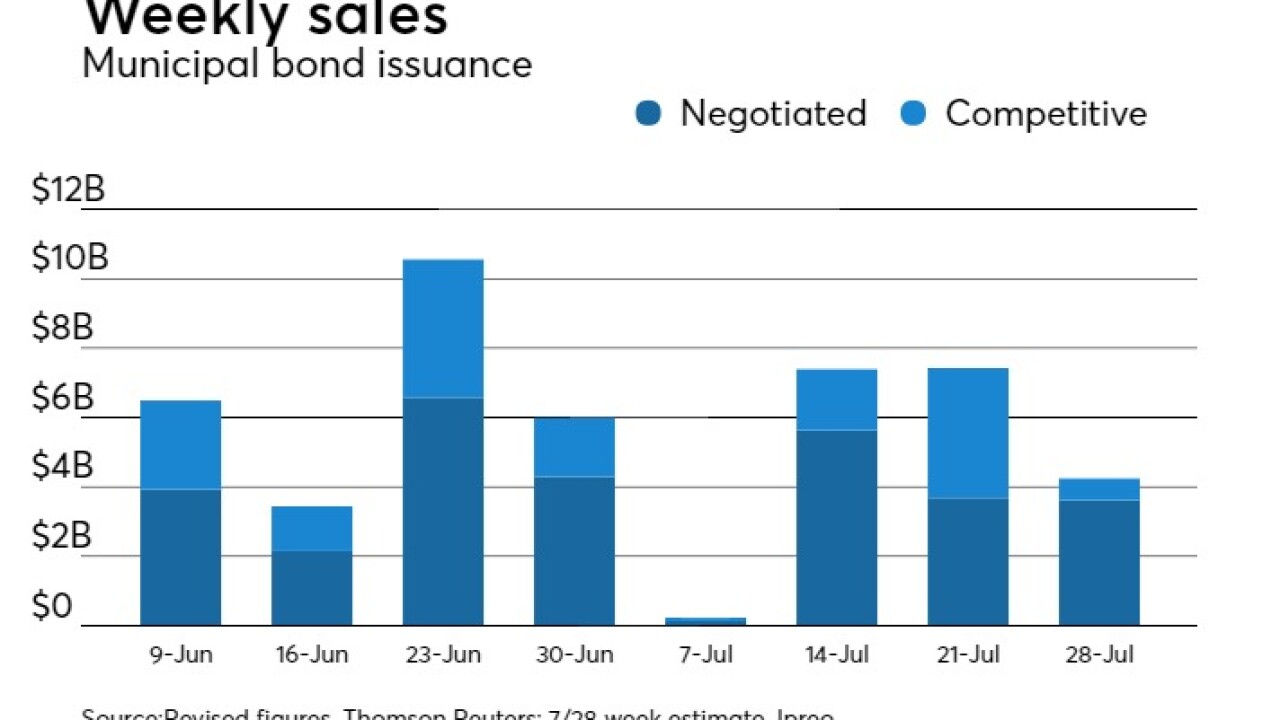

The region's slipping volume reflected a national trend.

August 18 -

Top shelf municipal bonds were stronger at mid-session, according to traders, who are looking ahead to next week’s smaller-than-average new issue calendar, which Ipreo estimates at $4.24 billion.

July 21 -

Municipal bond traders on Friday are already looking ahead to next week’s smaller-than-average new issue calendar, which will be topped by New York City’s big general obligation bond sale.

July 21 -

Top-rated municipal bonds finished stronger on Tuesday as the competitive arena heated up with the Dormitory Authority of the State of New York’s offering of four bond sales totaling almost $1.5 billion.

July 18 -

Top-rated municipal bonds were stronger at mid-session, according to traders, as the competitive arena heated up with the Dormitory Authority of the State of New York’s offering four bond sales totaling almost $1.5 billion while the state of New Mexico brought two sales totaling over $380 million.

July 18