The Dormitory Authority of the State of New York is prepping another large bond deal as part of a busy 2017 for the conduit issuer.

DASNY is slated to issue up to $1.8 billion of state personal income tax bonds in a competitive deal on Oct. 3 to tackle infrastructure enhancements and refund debt.

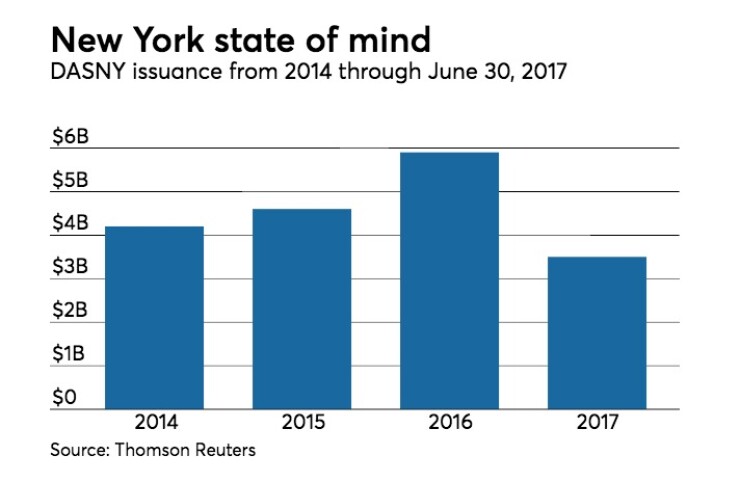

DASNY finished the first half of 2017 as the nation’s second-most-prolific issuer with $3.5 billion bonds sold, according to Thomson Reuters data. A previous $1.7 billion state personal income tax revenue refunding bond deal in June was the largest transaction to hit the municipal market during the first six months of the year.

“We’ve had a fantastic year with volume,” said Gerrard Bushell, president and CEO of DASNY. “Issuance for DASNY has been very steady.”

Morris Peters, a spokesman for the New York State Division of Budget, said $1.4 billion of the bonds sold in next month's deal will fund capital projects, including facility upgrades to the City University of New York and community colleges as well as grants to libraries and healthcare facilities.

Proceeds from an additional $400 million of the bonds will be used for refinancing existing state debt, which Peters said should produce debt service savings of more than $50 million. Public Resources Advisory Group is financial advisor on the deal.

“We’re clearly seeing demand as it relates to institutions thinking about their long-term capital needs,” said Bushell. “There are clearly needs for hospitals and universities to maintain and upgrade their existing infrastructure.”

DASNY was founded in 1944 and had an outstanding bond portfolio of roughly $47.9 billion as of June 30. The conduit issuer has expanded well beyond its original purpose of financing the construction of dormitories at 11 state teachers’ colleges to aid higher education, healthcare and library institutions throughout New York.

“In New York State because the state does a lot of borrowing through authorities rather than general obligation bonds they rely on more borrowing from DASNY and other conduits,” said Moody’s Investors Service analyst Marcia Van Wagner.

DASNY’s $1.7 billion deal in late June was rated Aa1 by Moody’s, reflecting the state’s strong personal income tax revenue base. Moody’s said the state's total personal income tax receipts have averaged 6% annual growth since 2004. The new bond deal is slated to get rated in the last week in September.

S&P Global Ratings assigned DASNY’s PIT bonds its AAA long-term rating with a stable outlook in June, citing high maximum annual debt service coverage. It also affirmed its AAA rating and stable outlook on DASNY's state sales tax revenue bonds ahead of a $1.35 billion sale in July.

DASNY has been active this year financing enhancements to State University of New York campuses. The conduit issuer sold $150 million of tax-exempt bonds in May through its SUNY Dormitory Facilities Program for residence hall capital projects across the New York State. It also completed roughly $30 million of upgrades to State University of New York dorms over a 90-day period prior to the fall semester through the program, which backs bonds through student residence hall fees.

Private colleges have also turned to DASNY for capital enhancements. Last year DASNY completed its largest offering for a private client in 72 years with an $829 million bond sale for New York University to fund a new building for its medical school and an applied science center in Brooklyn. It also issued $50 million in green bonds a year ago on behalf of Columbia University for its new Manhattanville campus that will house the Jerome L. Greene Science Center.

The NYU deal involved hybrid financing that was offered as $582.9 million tax-exempt series and $246.2 million in taxable bonds, and Bushell said other private colleges have also expressed interest in similar transactions. The taxable bonds enabled the university to utilize a portion of its Brooklyn science center space for start-ups and other private uses. NYU went back to DASNY this year for another hybrid deal involving $450 million in tax-exempt bonds and $227.8 million in taxable bonds for additional capital upgrades.

“We’re recognizing that part of the mission of universities and hospitals in a realigned economy is to build relationships inside and outside the institutions,” said Bushell.

Bushell said another new approach he hopes takes flight is a design-build method DASNY is implementing for a $20 million financing supporting a new 256-bed residence hall at SUNY Brockport. He said the design-build approach is shaving a year off the project and enables a quicker generation of revenue.

“This will be a game-changer,” said Bushell on the potential for more design-build strategies.

After taking over DASNY in 2015, Bushell conducted a listening tour in which issuers relayed the need for greater speed and flexibility accessing the bond market.

The feedback prompted DASNY to overhaul its borrowing process to enable borrowers with at least an A rating the ability to move to the market faster and reduced scenarios where debt-service reserves are required. Four colleges that benefited from this new policy for recent debt issuances, according to Bushell, are Fordham University, Pratt Institute, the New School for Social Research and Teacher’s College.

“We have had positive feedback from colleges and hospitals about the changes and processes we put in place,” said Bushell. “We have seen impact from our improvements.”

As 2017 nears a close, Bushell expects next year to also feature a number of transactions big and small. He said with the higher education and healthcare sectors constantly adjusting to change at the state and national level, institutions are more sharply focused with an eye on setting up foundations for future success.

“It is clear to us that infrastructure needs across the country and here in New York are significant,” he said. “We look forward to another active year in 2018.”