Top-rated municipals were unchanged at mid-session, according to traders, who were eyeing Puerto Rico bonds.

Secondary market

The yield on the 10-year benchmark muni general obligation was steady from 2.01% on Tuesday, while the 30-year GO yield was flat from 2.82%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Thursday. The yield on the two-year Treasury increased to 1.49% from 1.48%, the 10-year Treasury yield gained to 2.35% from 2.33% and yield on the 30-year Treasury bond increased to 2.89% from 2.88%.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 86.2% compared with 86.3% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 98.0% versus 98.2%, according to MMD.

Puerto Rico bonds recovering

Puerto Rico bonds were trading mixed in late morning activity, with some maturities recovering from the big losses made the prior day made after Presidentb Trump hinted at a debt "wipe-out."

The Commonwealth’s Series 2012A public improvement refunding 5s of 2041 were trading at a low price of 30.99 cents on the dollar in 11 trades totaling $22.71 million compared to a low price of 27.88 in 24 trades totaling $7.31 million on Wednesday, according to the Municipal Securities Rulemaking Board’s EMMA website. The bonds were trading at a low of 35.21 on Tuesday.

Among other actively traded issues reported on EMMA on Thursday, the Buildings Authority Series 2012U revenue refunding 5.25s were trading at a low price of 28.599 in 10 trades totaling $13.6 million compared to a low price of 24.085 in 21 trades totaling $9.33 million on Wednesday. The bonds were trading at a low of 29.773 on Tuesday.

The Commonwealth Highway and Transportation Authority’s Series 2005L revenue refunding 5.25s of 2035 were trading at a low price of 99 in nine trades totaling $2.97 million compared to a low price of 98.108 in 45 trades totaling $2.48 million on Wednesday. The bonds were trading at a low of 98 on Tuesday.

The Puerto Rico Commonwealth benchmark Series 2014A general obligation 8s of 2035 were trading at a low price of 37 cents on the dollar compared to a low price of 30.25 on Wednesday, according to the Municipal Securities Rulemaking Board’s EMMA website. Activity was significantly lighter than the previous day, with $8.3 million of the 8s trading hands in six trades compared to $183.18 million in 105 trades on Wednesday.

On Wednesday, total municipal volume was very brisk at $13.4 billion, with Puerto Rico trading amounting to about 9% of the total, ranking only behind New York and California names, according to Janney’s Thursday market comment.

“Following President Trump’s Tuesday comments about wiping out PR debt, prices of most PR bonds plunged,” Janney said. “PR GO 8% of 2035, which traded as high as 53 last week, fell to 32, recovered to 39 mid-day and closed at 38.20 while COFINA seniors (5% of 2046) printed block trades around 45 (vs low 50s last week) and a large piece of subs (5 12% of 2040) traded at 11.”

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 42,466 trades on Wednesday on volume of $13.36 billion.

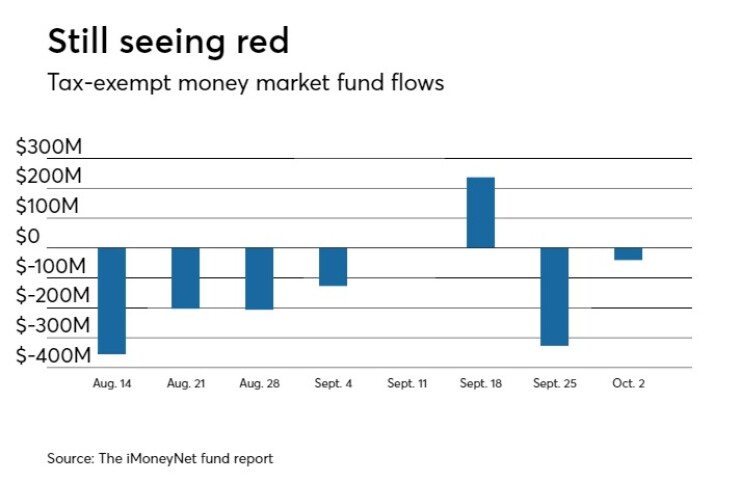

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $40.3 million, lowering total net assets to $127.86 billion in the week ended Oct. 2, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an outflow of $327.1 million to $127.90 billion in the previous week.

The average, seven-day simple yield for the 224 weekly reporting tax-exempt funds grew to 0.44% from 0.40% the previous week.

The total net assets of the 830 weekly reporting taxable money funds decreased $2.49 billion to $2.585 trillion in the week ended Oct. 3, after an inflow of $30.27 billion to $2.587 trillion the week before.

The average, seven-day simple yield for the taxable money funds remained at 0.68% from the prior week.

Overall, the combined total net assets of the 1,054 weekly reporting money funds decreased $2.53 billion to $2.712 trillion in the week ended Oct. 3, after inflows of $29.94 million to $2.715 trillion in the prior week.

Primary market

Fitch Ratings said it assigned an AA-minus rating to California’s $1.6 billion of general obligation bonds, expected to be sold competitively on Tuesday, Oct. 17.

The state's deals consist of $508.57 million federally taxable various purpose GOs, $198.655 million of tax-exempt various purpose GOs, and $881.09 million tax-exempt various purpose GO refunding bonds.

Fitch said the rating outlook is stable.

“California's AA-minus rating reflects its large and diverse economy that supports strong, albeit cyclical, revenue growth prospects, solid ability to manage expenses through the economic cycle, and a moderate level of liabilities,” Fitch said. “The state has demonstrated strong budget management during this period of economic recovery and expansion, using temporary tax revenues to eliminate the overhang of budgetary borrowing that had accumulated through two recessions."

Fitch added that California's economy is “unmatched among U.S. states in its size and diversity and is generally stable despite a considerable presence in industries prone to cyclicality.”

RBC Capital Markets is expected to price DASNY’s $301.48 million of school districts and financing program revenue bonds in five series on Thursday. The Series 2017 F, G, H, I and J bonds carry various ratings ranging from Aa2 and Aa3 from Moody’s Investors Service to A-plus from S&P Global Ratings and AA-minus from Fitch Ratings.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $284.8 million to $6.70 billion on Thursday. The total is comprised of $2.37 billion of competitive sales and $4.33 billion of negotiated deals.