-

Caution is the watchword in the municipal market on Wednesday as participants await details of the Federal Reserve's monetary policy meeting.

May 2 -

Municipal bonds were mixed in late trading on Tuesday as several large deals hit the screens, led by issuers in New York and Maryland.

May 1 -

Tuesday opened with a positive tone in the municipal bond market with a forecast of heavy demand and strong technicals going into the reinvestment season.

May 1 -

Munis were stronger Monday as bond buyers kept an eye on the Federal Reserve policy makers' meeting.

April 30 -

An expansion of “backdoor borrowing” in the new New York State budget raises transparency red flags, according to Comptroller Thomas DiNapoli.

April 30 -

Municipal bond buyers are awaiting this week’s new issue supply as they keep both eyes firmly on the Federal Open Market Committee’s monetary policy meeting.

April 30 -

Weekly municipal bond volume will be down with the Federal Open Market Committee set to meet, though no interest rate increase is expected.

April 27 -

The municipal bond market will see a light new issue calendar next week as the Federal Reserve meeting on monetary policy puts a damper on new debt issuance.

April 27 -

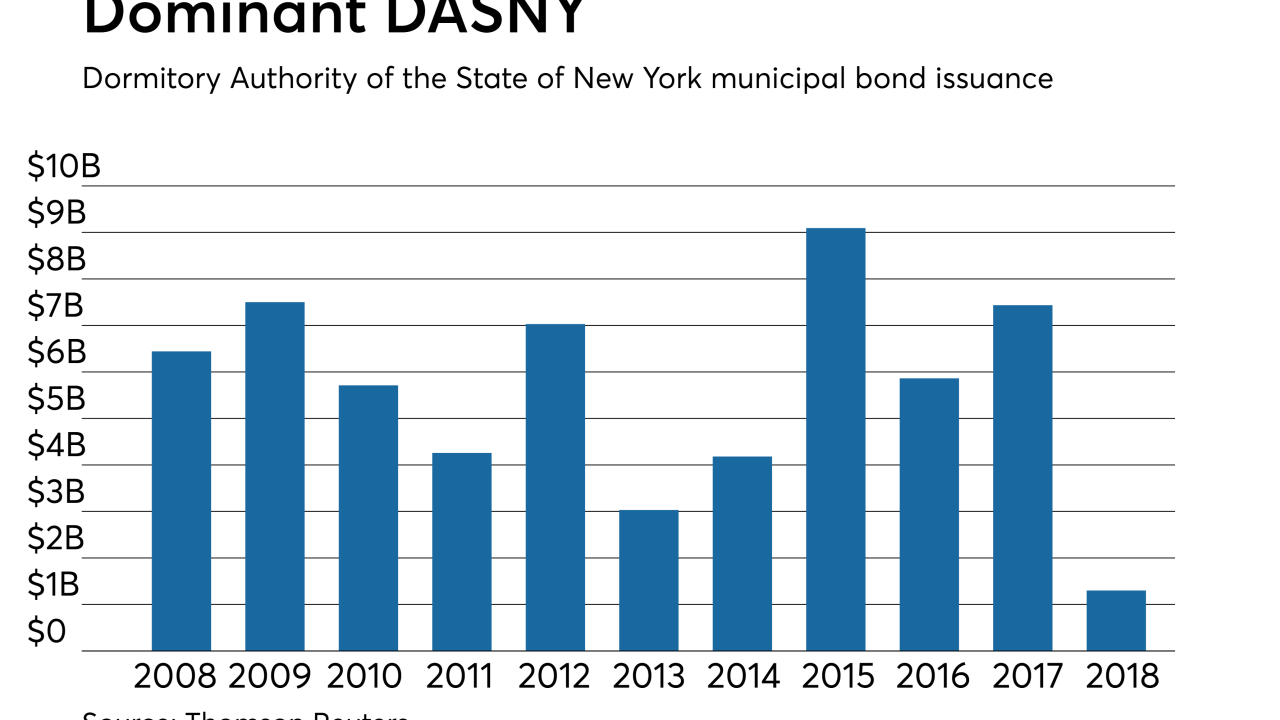

The nation’s largest municipal bond conduit issuer is expanding a program that funds upgrades with future energy savings.

April 25 -

Municipal market volume will rise by two-thirds to $7.45 billion in the coming week, led by a $2 billion taxable deal from California.

April 13 -

The budget approved over the weekend fails to address long-term fiscal challenges, according to analysts.

April 2 -

Gerrard Bushell, CEO and president of the Dormitory Authority of the State of New York, brings us up to speed on how new federal tax changes are impacting one of the nation’s largest municipal bond issuers. Andrew Coen hosts.

March 27 -

Two New York issuers dominated the municipal bond market on Tuesday, bringing over $2 billion of new supply.

March 13 -

Two New York issuers are making their presence felt on Tuesday as they hit the market with over $2 billion in municipal bonds.

March 13 -

Retail buyers got first dibs on New York City Transitional Finance Authority’s $1 billion of building aid revenue bonds

March 12 -

Coming off the biggest volume week of the year, another steady batch of issuance awaits muni traders.

March 9 -

Northeast municipal bond issuance was up 4% from 2016 to $121.3 billion.

February 23 -

New York's governor unveiled a $168 billion spending proposal for the 2019 fiscal year during his annual budget address.

January 16 -

The par value of muni underwriting fell for the top five firms as volume receded from the 2016 record.

January 5 -

The municipal bond market is looking ahead to next week’s $3.3 billion new issue slate which is dominated by GO sales from Massachusetts and taxable negotiated deals.

January 5