Municipal bonds were mixed at mid-session as several large deals hit the screens, led by issuers in New York and Maryland.

Tuesday opened with a positive and stronger tone in the municipal market with a forecast of heavy demand and strong technicals going into the spring reinvestment season, according to a New York trader.

“The tone is very positive and the market seems a lot firmer than the read we are getting on the MMD curve where they are talking about a 1 basis point bump,” he said. “I have seen it two to four basis points better in some instances.”

The market was buoyed by several factors, including the presence of two primary market deals in the higher education sector — one for Columbia University and the other for Case Western University.

He said the deals were doing “very well” based on their name recognition and scarcity of higher education paper in the market lately.

In addition, he said, the market is breathing a collective sigh of relief after the getting through the first quarter, tax season, and the last day of April, respectively. The offered side of the market is paying up for blocks of bonds and there is evidence of technical strength.

“We are entering a seasonally positive period of May, June, and July,” he said. “I think with that as a backdrop we will continue to see some firmness.”

“Municipal technicals are strong and that allows for better bidding to occur and when you put the reinvestment dollars behind that, it allow for a more positive tone,” he explained.

The Federal Open Market Committee’s meeting on rates this week should not impact investor behavior, he added.

“There is nothing more hawkish coming out of the Fed — we are fully aware that we are looking at three to four hikes [this year],” he said. “There’s still money to put to work in our sector and any move that would substantially raise rates in general could spook the muni market, but that magical 3% in 10 years [on the Treasury] seems to be holding for a while and that’s taking some of the negative psychology out of the other market.”

Secondary market

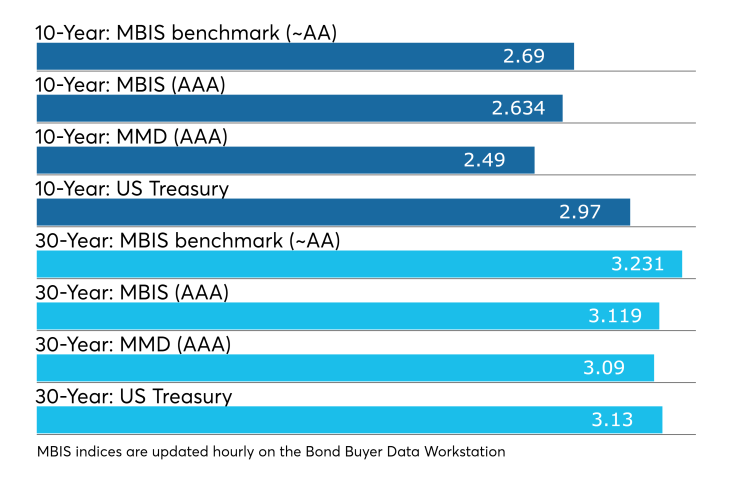

Municipal bonds were mostly stronger on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell as much as one basis point in the three- to 30-year maturities, rose less than one basis point in the one-year maturity and were unchanged in the two-year maturity.

High-grade munis were mixed as yields calculated on MBIS’ AAA scale fell by as much as one basis point in the one- to seven-year and 16- to 30-year maturities and rose less than a basis point in the eight- to 15-year maturities.

In secondary trade, munis were mixed, according to Municipal Market Data’s AAA benchmark scale, which showed yields rising by as much as two basis points in the 10-year and gaining as much as one basis point in the 30-year maturity.

Treasury bonds were little changed on Monday, as stocks turned lower.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.8% while the 30-year muni-to-Treasury ratio stood at 99.9%, according to MMD.

Primary market

Goldman Sachs priced the Dormitory Authority of the State of New York’s $326.04 million of Series 2018 A&B revenue bonds for Columbia University after holding a one-day retail order period.

The deal is rated triple-A by Moody’s Investors Service and S&P Global Ratings.

Piper Jaffray priced the Fort Bend Independent School District, Texas’ $131.55 million of Series 2018 unlimited tax refunding bonds.

The deal, backed by the Permanent School Fund guarantee program, is rated AAA by S&P and Fitch Ratings.

JPMorgan Securities priced the Albuquerque Municipal School District No.12, N.M.’s $110 million of general obligation school building bonds.

The deal, which is backed by the New Mexico School District Enhancement Program, is rated Aa2 by Moody’s and AA by S&P.

In the competitive arena on Tuesday, Prince George’s County, Md., sold $416.76 million of Series 2018A limited tax general obligation consolidated public improvement bonds.

Bank of America Merrill Lynch won the bonds with a true interest cost of 2.995%. Proceeds will be used to finance various capital improvements.

The deal is rated triple-A by Moody’s, S&P and Fitch Ratings.

Since 2008, the county has sold about $2.78 billion of securities, with the most issuance occurring in 2017 when it sold $639 million and the least in 2012 when it sold $34 million.

Tuesday’s bond sales

New York:

Texas:

New Mexico:

Maryland:

Bond Buyer 30-day visible supply at $10.61B

The Bond Buyer's 30-day visible supply calendar increased $2.11 billion to $10.61 billion on Tuesday. The total is comprised of $4.13 billion of competitive sales and $6.47 billion of negotiated deals.

Treasury auctions $45B 4-week bills

The Treasury Department Tuesday auctioned $45 billion of four-week bills at a 1.650% high yield, a price of 99.871667.

The coupon equivalent was 1.675%. The bid-to-cover ratio was 3.04.

Tenders at the high rate were allotted 95.47%. The median rate was 1.630%. The low rate was 1.600%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.