-

DASNY finished the first half of 2018 as the nation’s second largest issuer with $3.2 billion in bonds sold.

August 24 -

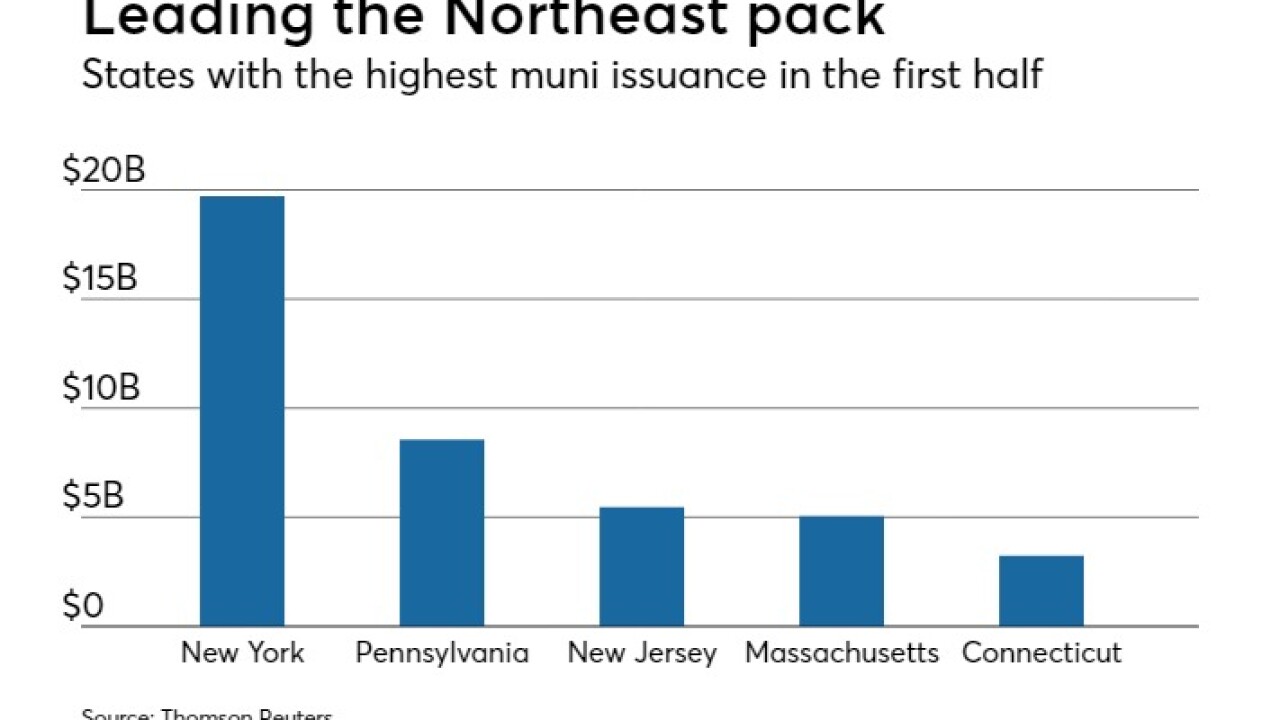

Northeast municipal bond issuance sank 11.7% in the first half of 2018 compared to a year earlier, reflecting a national trend driven by federal tax changes.

August 17 -

The market was quiet on Friday ahead of a $7.5 billion new issue calendar as more than $50 billion in August redemptions frees up cash to buy bonds.

August 3 -

Municipal bond buyers were singing “I love New York” on Wednesday as they grabbed bonds from two Empire State issuers.

July 25 -

Two big New York issuers came to market on Wednesday as municipal bonds were little changed in secondary action.

July 25 -

California’s Infrastructure bank hit the municipal market with a big note offering on Monday, while a New York City Transitional Finance Authority deal was offered to retail buyers.

July 24 -

The big New York City issue was priced for retail investors and a large California note issue was offered to buyers, while municipals turned weaker in secondary trade.

July 24 -

Municipals turned weaker on Monday as traders prepared their strategies ahead of the week’s issuance.

July 23 -

New York issues again dominate as the bond calendar dips to $5.3 billion in the new week.

July 20 -

Requests for municipal bond identifiers rose in June for the fourth month in a row as the Dormitory Authority of New York sold $1.79 billion of bonds to a supply-starved market.

July 11 -

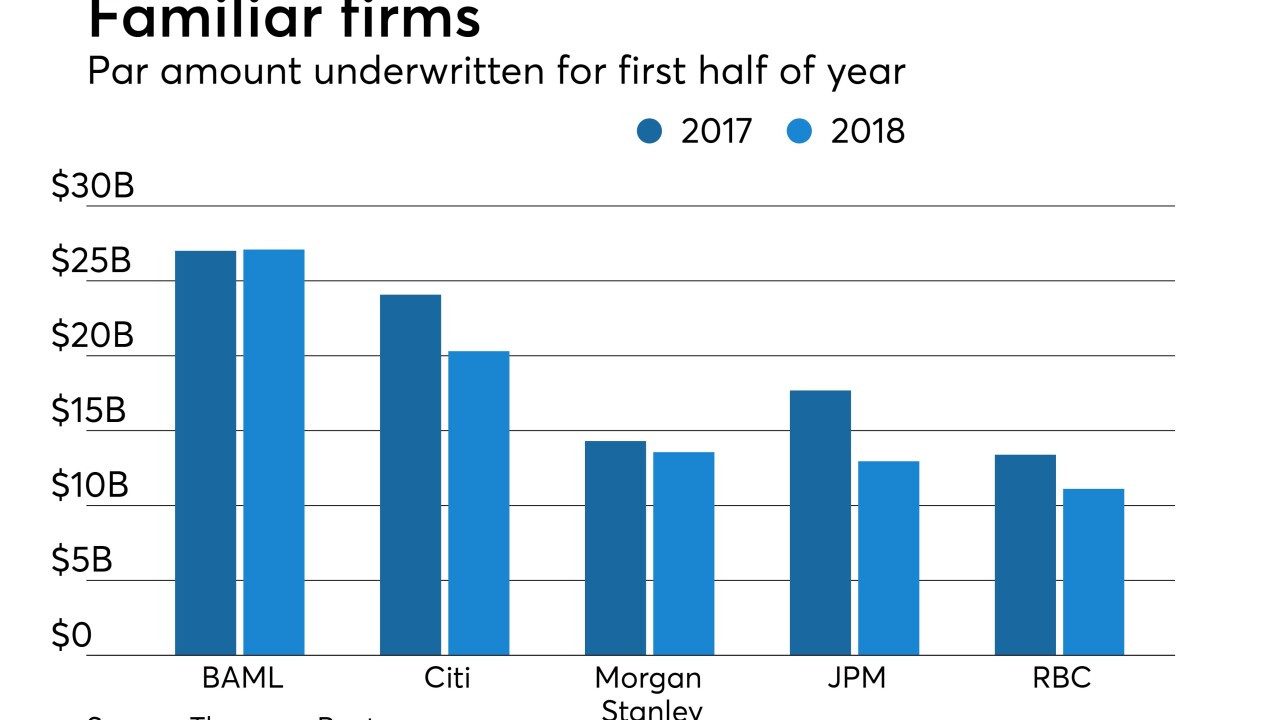

The league tables show a return to normal from the first quarter, when PFM, Citi and JPMorgan all placed lower than usual.

July 11 -

Municipal bonds were stronger at mid-session as a swell of supply swept into the market on Wednesday.

July 11 -

While munis turned in a mostly solid performance on Monday, a Charles Schwab & Co. report said they are less likely to outperform Treasurys in the second half.

July 9 -

Munis were firm at mid-session as traders get set to see some much-anticipated supply hit the screens this week.

July 9 -

Municipal bonds were stronger on Wednesday as bond buyers saw big deals come from New York and California issuers.

June 27 -

Municipal bonds were stronger Wednesday as bond deals from New York and California were coming to market.

June 27 -

Municipal bonds were little changed Tuesday as a continuation of the June-July reinvestment season made for brisk demand.

June 26 -

Municipal bonds were little changed Tuesday as traders saw big note and bond deals hit the market, led by issuers in California and New York.

June 26 -

Municipal bonds were little changed on Monday as supply concerns prompted Bank of America Merrill Lynch to cut its 2018 forecast to $365 billion of issuance.

June 25 -

Bank of America Merrill Lynch has revised its forecast for yearly municipal bond volume down to $365 billion.

June 25