Municipal bonds were little changed on Monday as the market awaits the week's new issue slate, which is estimated at $5.33 billion.

The day featured little trading activity, as investors were worried about the future of interest rates and the yield curve, according to one Philadelphia trader.

“It just doesn’t seem like there is a real commitment to the market,” he said. “It has more to do with everything being driven by headline news, like the state of affairs in D.C., political statements and policy, like tariff wars," and not market dynamics.

“In general, you don’t have a lot of people to commit in any strong way,” the trader said. Investors are confused by the “yo-yo-ing” of the market.

“Trying to trade within a window is very difficult -- especially if you are hedged on the other side of the window,” he said. “The Street is very frustrated; everyone is trying to find a way to make money, but the risk is very high right now because no one wants to take on commitments if they don’t have a place to put it.”

An Indiana trader echoed the comments on the tone of the market where munis were underperforming Treasuries and investors were prepping more for the upcoming holiday than for the July 1 redemptions. “Mondays seem to be pretty quiet so far this summer,” he said.

He said there was a sense of the summer doldrums starting ahead of the July 4 holiday and that the next couple of weeks would be much of the same.

“By the end of the week people will be looking to get out for the vacation and holiday,” he said, though he held out some hope that demand for July 1 redemptions would perk up activity before Friday. “We’re hoping that will get things moving a little.”

BAML cuts muni issuance prediction to $365B

Bank of America Merrill Lynch revised its forecast for yearly volume to $365 billion from its original prediction of $400 billion, according to a market comment released Monday.

The new forecast calls for $248 billion of new money and $117 billion of refundings.

Year-to-date long-term municipal bond issuance totals $155 billion, BAML said, and that is made up of $112 billion in new money and $43 billion in refundings. BAML said first half issuance is likely to total $165 billion, comprising $118 billion of new money and $47 billion of refundings.

“New money issuance has been very strong for the year-to-date and is on track to far exceed last year's total of $202 billion,” BAML muni research strategist Yingchen Li writes in the report. “In our 2018 year ahead, we forecasted $220 billion of new money issuance for the year. This is now likely a great underestimate.”

BAML said over the past few years, new money growth has been about 15% or more on a year-over-year basis. Seasonal and growth patterns, together with better GDP growth this year, now suggest new money issuance in the second half should be approximately $130 billion. This will bring the yearly total of new money volume for 2018 to approximately $248 billion.

However, BAML said refunding volume has been lagging in 2018 as the Tax Cut and Jobs Act of 2017 eliminated tax-exempt advance refundings. Additionally, interest rates have remained high throughout the first half. Year-to-date, BAML said refunding issuance is far lower than the $99 billion in the same period last year.

For second half refunding, BAML said it was looking at three factors: the pool of $180 billion of available bonds eligible for current refunding; the market’s ongoing search for alternatives to advance refunding; and new legislation that may be proposed to repeal the ban on tax-exempt advance refundings.

“Taken together, we think that $70 billion of refunding volume is more reasonable for the second half," Li wrote. "If the ban on tax-exempt advance refundings is repealed in the final months of the year, a year-end rush to market may again be possible. In that case, a large surge in refunding activity should be expected. But, at this point, this is not clear.”

Primary market

The calendar this week is composed of $3.99 billion of negotiated deals and $1.34 billion of competitive sales.

On Tuesday, Los Angeles is selling $1.54 billion of 2018 tax and revenue anticipation notes. The notes are due June 27, 2019.

The financial advisor is Montague DeRose & Associates; bond counsel is Squire Patton. The TRANs are rated MIG1 by Moody’s Investors Service and SP1-plus by S&P Global Ratings.

On Wednesday, the city will sell $321.81 million of general obligation bonds, consisting of $276.24 million of Series 2018A taxable social bonds; $34.995 million of tax-exempt Series 2018B GO refunding bonds; and $10.57 million of taxable Series 2018C GO refunding bonds.

Financial advisors are Public Resources Advisory Group and Omnicap Group; bond counsel is Nixon Peabody. The bonds are rated AA by S&P.

In the negotiated sector, the Dormitory Authority of the State of New York is coming to market with a $342.68 million deal. Raymond James & Associates is set to price DASNY’s Series 2018-1 municipal health facilities improvement program lease revenue bonds, New York City issue, on Wednesday after a one-day retail order period. The deal is rated Aa2 by Moody’s and AA-minus by S&P.

Barclays Capital is expected to price the Connecticut Health and Educational Facilities Authority’s $300 million of revenue bonds for Yale University on Tuesday. The deal is rated triple-A by Moody’s and S&P.

Prior week's top underwriters

The top municipal bond underwriters of last week included Citigroup, JPMorgan Securities, Jefferies, Bank of America Merrill Lynch and Morgan Stanley, according to Thomson Reuters data.

In the week of June 17 to June 23, Citi underwrote $2.04 billion, JPMorgan $959.9 million, Jefferies $837.3 million, BAML $613.7 million, and Morgan Stanley $438.0 million.

Secondary market

Municipal bonds held firm on Monday, according to a late read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the one-year, three- to 25-year and 28-year maturities and were unchanged in the two-year, 26- and 27-year and 29- and 30-year maturities.

High-grade munis were also stronger, with yields calculated on MBIS’ AAA scale falling as much as one basis point across the curve.

Municipals were unchanged along Municipal Market Data’s AAA benchmark scale, which showed yields steady in both the 10-year muni general obligation and the 30-year muni maturity.

Treasury bonds were stronger as stock prices dropped.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 84.3% while the 30-year muni-to-Treasury ratio stood at 96.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 30,796 trades on Friday on volume of $8.88 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 18.76% of the market, the Lone Star State taking 10.864% and the Empire State taking 10.798%.

Prior week's actively traded issues

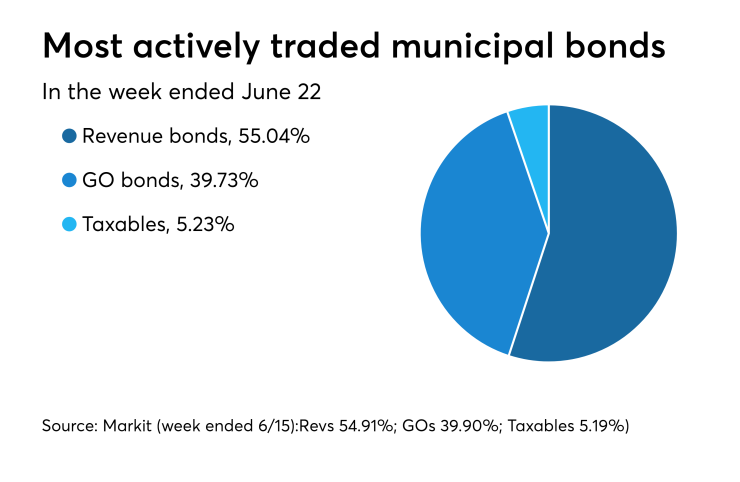

Revenue bonds comprised 55.04% of new issuance in the week ended June 22, up from 54.91% in the previous week, according to

Some of the most actively traded bonds by type were from Illinois, California and Puerto Rico issuers.

In the GO bond sector, the Adams County School District No. 172, Ill., 3.75s of 2038 traded 19 times. In the revenue bond sector, the Golden State Tobacco Securitization Corp., Calif., 5s of 2047 traded 137 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp.6s of 2038 traded 12 times.

Treasury to sell $35B 4-week bills

The Treasury Department said it will sell $35 billion of four-week discount bills Tuesday. There are currently $89.999 billion of four-week bills outstanding.

Treasury auctions discount bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the three-months incurred a 1.900% high rate, unchanged from 1.900% the prior week, and the six-months incurred a 2.085% high rate, up from 2.075% the week before. Coupon equivalents were 1.936% and 2.136%, respectively. The price for the 91s was 99.519722 and that for the 182s was 98.945917.

The median bid on the 91s was 1.875%. The low bid was 1.850%. Tenders at the high rate were allotted 90.39%. The bid-to-cover ratio was 2.89.

The median bid for the 182s was 2.060%. The low bid was 2.020%. Tenders at the high rate were allotted 57.86%. The bid-to-cover ratio was 3.00.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.