Municipal bonds were little changed on Monday as the market awaits this week's new issue slate.

Bank of America Merrill Lynch revised its forecast for yearly volume to $365 billion from its original prediction of $400 billion, according to a market comment released Monday.

The new forecast calls for $248 billion of new money and $117 billion of refundings.

Year-to-date long-term municipal bond issuance totals $155 billion, BAML said, and that is made up of $112 billion in new money and $43 billion in refundings. BAML said first half issuance is likely to total $165 billion, comprising $118 billion of new money and $47 billion of refundings.

“New money issuance has been very strong for the year-to-date and is on track to far exceed last year's total of $202 billion,” BAML muni research strategist Yingchen Li writes in the report. “In our 2018 year ahead, we forecasted $220 billion of new money issuance for the year. This is now likely a great underestimate.”

BAML said over the past few years, new money growth has been about 15% or more on a year-over-year basis. Seasonal and growth patterns, together with better GDP growth this year, now suggest new money issuance in the second half should be approximately $130 billion. This will bring the yearly total of new money volume for 2018 to approximately $248 billion.

However, BAML said refunding volume has been lagging in 2018 as the Tax Cut and Jobs Act of 2017 eliminated tax-exempt advance refundings. Additionally, interest rates have remained high throughout the first half. Year-to-date, BAML said refunding issuance is far lower than the $99 billion in the same period last year.

For second half refunding, BAML said it was looking at three factors: the pool of $180 billion of available bonds eligible for current refunding; the market’s ongoing search for alternatives to advance refunding; and new legislation that may be proposed to repeal the ban on tax-exempt advance refundings.

“Taken together, we think that $70 billion of refunding volume is more reasonable for the second half," Li wrote. "If the ban on tax-exempt advance refundings is repealed in the final months of the year, a year-end rush to market may again be possible. In that case, a large surge in refunding activity should be expected. But, at this point, this is not clear.”

Primary market

Volume for this week is estimated at $5.33 billion, composed of $3.99 billion of negotiated deals and $1.34 billion of competitive sales.

On Tuesday, Los Angeles is selling $1.54 billion of 2018 tax and revenue anticipation notes. The notes are due June 27, 2019.

The financial advisor is Montague DeRose & Associates; bond counsel is Squire Patton. The TRANs are rated MIG1 by Moody’s Investors Service and SP1-plus by S&P Global Ratings.

On Wednesday, the city will sell $321.81 million of general obligation bonds, consisting of $276.24 million of Series 2018A taxable social bonds; $34.995 million of tax-exempt Series 2018B GO refunding bonds; and $10.57 million of taxable Series 2018C GO refunding bonds.

Financial advisors are Public Resources Advisory Group and Omnicap Group; bond counsel is Nixon Peabody. The bonds are rated AA by S&P.

In the negotiated sector, the Dormitory Authority of the State of New York is coming to market with a $342.68 million deal. Raymond James & Associates is set to price DASNY’s Series 2018-1 municipal health facilities improvement program lease revenue bonds, New York City issue, on Wednesday after a one-day retail order period. The deal is rated Aa2 by Moody’s and AA-minus by S&P.

Barclays Capital is expected to price the Connecticut Health and Educational Facilities Authority’s $300 million of revenue bonds for Yale University on Tuesday. The deal is rated triple-A by Moody’s and S&P.

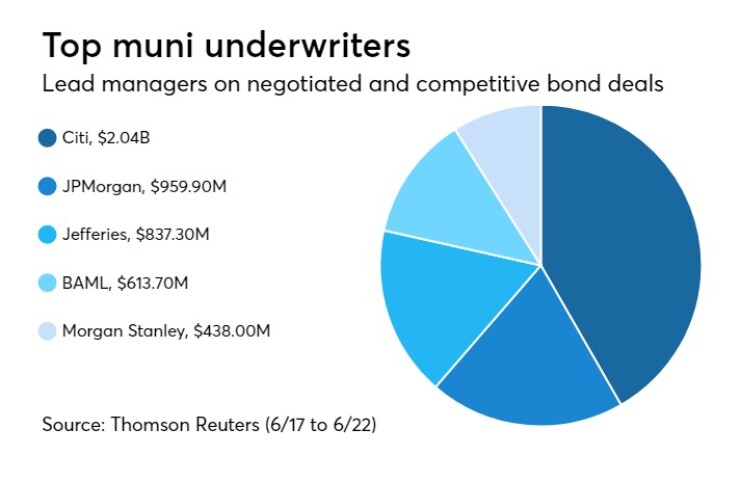

Prior week's top underwriters

The top municipal bond underwriters of last week included Citigroup, JPMorgan Securities, Jefferies, Bank of America Merrill Lynch and Morgan Stanley, according to Thomson Reuters data.

In the week of June 17 to June 22, Citi underwrote $2.04 billion, JPMorgan $959.9 million, Jefferies $837.3 million, BAML $613.7 million, and Morgan Stanley $438.0 million.

Bond Buyer 30-day visible supply at $6.94B

The Bond Buyer's 30-day visible supply calendar increased $331.0 million to $6.94 billion on Monday. The total is comprised of $2.45 billion of competitive sales and $4.50 billion of negotiated deals.

Secondary market

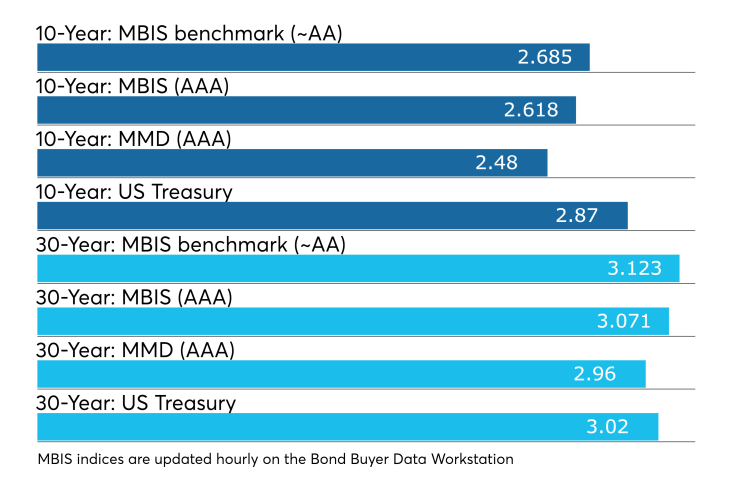

Municipal bonds were slightly stronger on Monday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the one- to 30-year maturities.

High-grade munis were also little changed, with yields calculated on MBIS’ AAA scale falling less than one basis point across the curve.

Municipals were unchanged along Municipal Market Data’s AAA benchmark scale, which showed yields steady in both the 10-year muni general obligation and the 30-year muni maturity.

Treasury bonds were stronger as stock prices dropped.

On Friday, the 10-year muni-to-Treasury ratio was calculated at 85.7% while the 30-year muni-to-Treasury ratio stood at 97.4%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 30,796 trades on Friday on volume of $8.88 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 18.76% of the market, the Lone Star State taking 10.864% and the Empire State taking 10.798%.

Prior week's actively traded issues

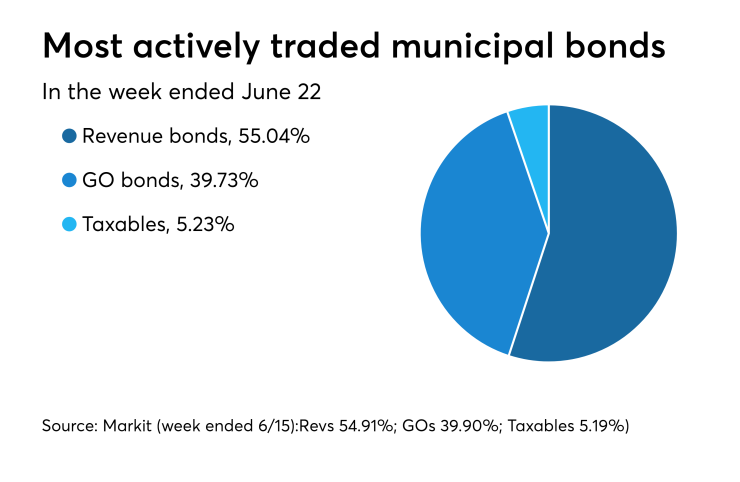

Revenue bonds comprised 55.04% of new issuance in the week ended June 22, up from 54.91% in the previous week, according to

Some of the most actively traded bonds by type were from Illinois, California and Puerto Rico issuers.

In the GO bond sector, the Adams County School District No. 172, Ill., 3.75s of 2038 traded 19 times. In the revenue bond sector, the Golden State Tobacco Securitization Corp., Calif., 5s of 2047 traded 137 times. And in the taxable bond sector, the Puerto Rico Sales Tax Financing Corp.6s of 2038 traded 12 times.

Treasury to sell $35B 4-week bills

The Treasury Department said it will sell $35 billion of four-week discount bills Tuesday. There are currently $89.999 billion of four-week bills outstanding.

Treasury auctions discount bills

Tender rates for the Treasury Department's latest 91-day and 182-day discount bills were mixed, as the three-months incurred a 1.900% high rate, unchanged from 1.900% the prior week, and the six-months incurred a 2.085% high rate, up from 2.075% the week before. Coupon equivalents were 1.936% and 2.136%, respectively. The price for the 91s was 99.519722 and that for the 182s was 98.945917.

The median bid on the 91s was 1.875%. The low bid was 1.850%. Tenders at the high rate were allotted 90.39%. The bid-to-cover ratio was 2.89.

The median bid for the 182s was 2.060%. The low bid was 2.020%. Tenders at the high rate were allotted 57.86%. The bid-to-cover ratio was 3.00.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.