California’s Infrastructure bank hit the municipal market with a big note offering on Monday, while a New York City Transitional Finance Authority deal was offered to retail buyers. Municipals bonds weakened in the secondary market.

Primary market

JPMorgan Securities priced for retail the New York City Transitional Finance Authority’s $850 million of Fiscal 2019 Series A Subseries A1 tax-exempt future tax secured subordinate bonds on Tuesday.

The deal is rated Aa1 by Moody’s Investors Service and AAA by S&P Global Ratings and Fitch Ratings.

The issue will be priced for institutions on Wednesday, when the TFA is also competitively selling $300 million of taxable bonds in two offerings, including $165.5 million of Fiscal 2019 Series A Subseries A3 future tax secured subordinate bonds and $134.5 million of Fiscal 2019 Series A Subseries A2 future tax secured subordinate bonds.

Wells Fargo Securities priced and repriced the California Infrastructure and Economic Development Bank’s $281.45 million of Series 2018A, B, C and D revenue bonds in index mode of LIBOR floating-rate notes on Tuesday.

The I-Bank issue, for the California Academy of Sciences in San Francisco, is rated A2 by Moody’s.

Since 2008, the I-Bank has issued about $7.5 billion of securities, with the most issuance occurring in 2008 when it sold $1.8 billion of debt. It sold the least amount of securities in 2014 when it issued $109.4 million.

Wells Fargo also priced and repriced the Port of Corpus Christie Authority of Nueces County, Texas’ $207.7 million of senior lien revenue bonds, consisting of Series 2018A bonds not subject to the alternative minimum tax and Series 2018B taxable bonds. The deal has underlying ratings of A1 from Moody’s and A-plus from S&P.

JPMorgan Securities priced and repriced the Humble Independent School District, Texas’ $114.815 million of Series 2018 unlimited tax school building bonds. The deal is backed by the Permanent School Fund guarantee program and rated triple-A by Moody’s and S&P.

In the competitive arena on Tuesday, Lancaster, Pennsylvania, sold $118.3 million of Series of 2018 general obligation bonds.

Bank of America Merrill Lynch won the bonds with a true interest cost of 3.8794%.

The deal is insured by Build America Mutual and rated A3 by Moody’s and AA by S&P.

The financial advisor is Concord Public Financial Advisors; the bond counsel is Barley Snyder.

Proceeds from the sale will be used to fund general municipal projects, including upgrades and improvements to the city’s sewer, water and stormwater systems.

On Wednesday, BAML is set to price the Dormitory Authority of the State of New York’s $559 million of Series 2018A tax-exempt and Series 2018B taxable revenue bonds for the Montefiore Obligated Group. The deal is rated Baa2 by Moody’s and BBB by S&P.

JPMorgan is expected to price the Idaho Health Facilities Authority’s $315.85 million of Series 2018B revenue bonds for St. Luke’s Health System on Wednesday. The deal is rated A3 by Moody’s and A-minus by S&P.

Tuesday’s Sales

New York

California

Texas

Pennsylvania

Bond Buyer 30-day visible supply at $8.08B

The Bond Buyer's 30-day visible supply calendar decreased $1.22 billion to $8.08 billion for Wednesday. The total is comprised of $3.44 billion of competitive sales and $4.64 billion of negotiated deals.

Why munis offer value

Municipals are offering value, stability, and reliability amid recent volatility within the fixed-income class, according to Jeffrey Lipton, head of municipal research and strategy and fixed-income research at Oppenheimer & Co.

“From a total return perspective, munis are outperforming U.S. Treasuries and corporates year-to-date,” he said in a report released Monday. The market remains stable ahead of the Federal Open Market Committee meeting scheduled for July 31 and Aug. 1 as the markets are “not pricing in a meaningful probability of a rate hike,” according to Lipton.

“Overall, we find munis to be resilient and in the wake of global uncertainty we find their investment reliability to be quite compelling,” he added.

A technical imbalance in the municipal market has helped to shield the asset class from more volatile price swings and has led to improving returns, Lipton continued.

Citing Lipper’s latest data on U.S. fund flows for municipal bond mutual funds, Lipton said the addition of approximately $1.26 billion in assets during the last reporting period was the largest inflow since April 2017.

He said the inflows reflect “not only scarcity value but also favorable investment attributes offered by the asset class.”

“We remain sanguine on our outlook for the second half of the year and anticipate that munis will finish the year with modest single digit positive returns,” Lipton wrote. “But of course, we have to be mindful that any unforeseen Central Bank move could disrupt the momentum and return the asset class to negative territory.”

Secondary market

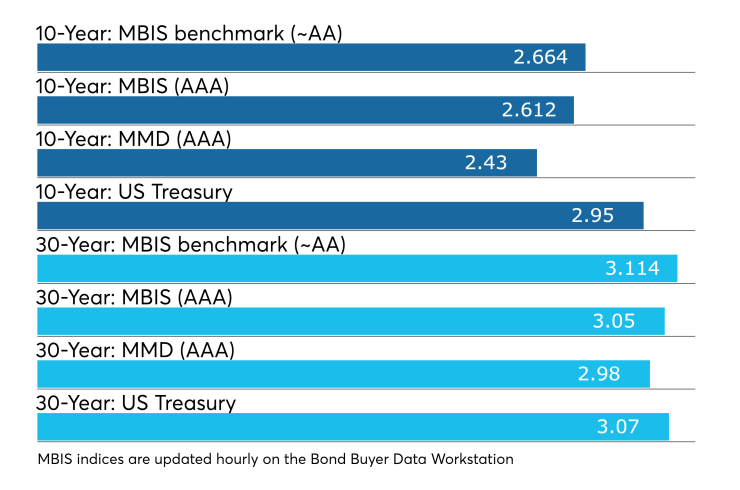

Municipal bonds were weaker on Tuesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as two basis points in the one- to 30-year maturities.

High-grade munis were also weaker, with yields calculated on MBIS’ AAA scale rising as much as two basis points across the curve.

And municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the 10-year muni general obligation yield rising one basis point while the yield on the 30-year muni maturity gained two basis points.

Treasury bonds were weaker as stocks traded higher.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 82.4% while the 30-year muni-to-Treasury ratio stood at 96.8%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 35,891 trades on Monday on volume of $8.47 billion.

California, New York and Texas were the states with the most trades, with the Golden State taking 14.903% of the market, the Empire State taking 14.595% and the Lone Star State taking 10.261%.

Treasury auctions $55B 4-week bills

The Treasury Department Tuesday auctioned $55 billion of four-week bills at a 1.880% high yield, a price of 99.853778. The coupon equivalent was 1.909%. The bid-to-cover ratio was 2.84.

Tenders at the high rate were allotted 26.78%. The median rate was 1.850%. The low rate was 1.830%.

Treasury sold $35B 2-year notes

The Treasury Department Tuesday auctioned $35 billion of two-year notes with a 2 5/8% coupon at a 2.657% yield, a price of 99.938070. The bid-to-cover ratio was 2.92.

Tenders at the high yield were allotted 19.42%. The median yield was 2.610%. The low yield was 2.188%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.