Federal Reserve

Federal Reserve

-

The guessing game is over about President Biden’s pick for Federal Reserve chair, but several names are in the mix for three additional vacancies on the board, including vice chair for supervision.

December 5 -

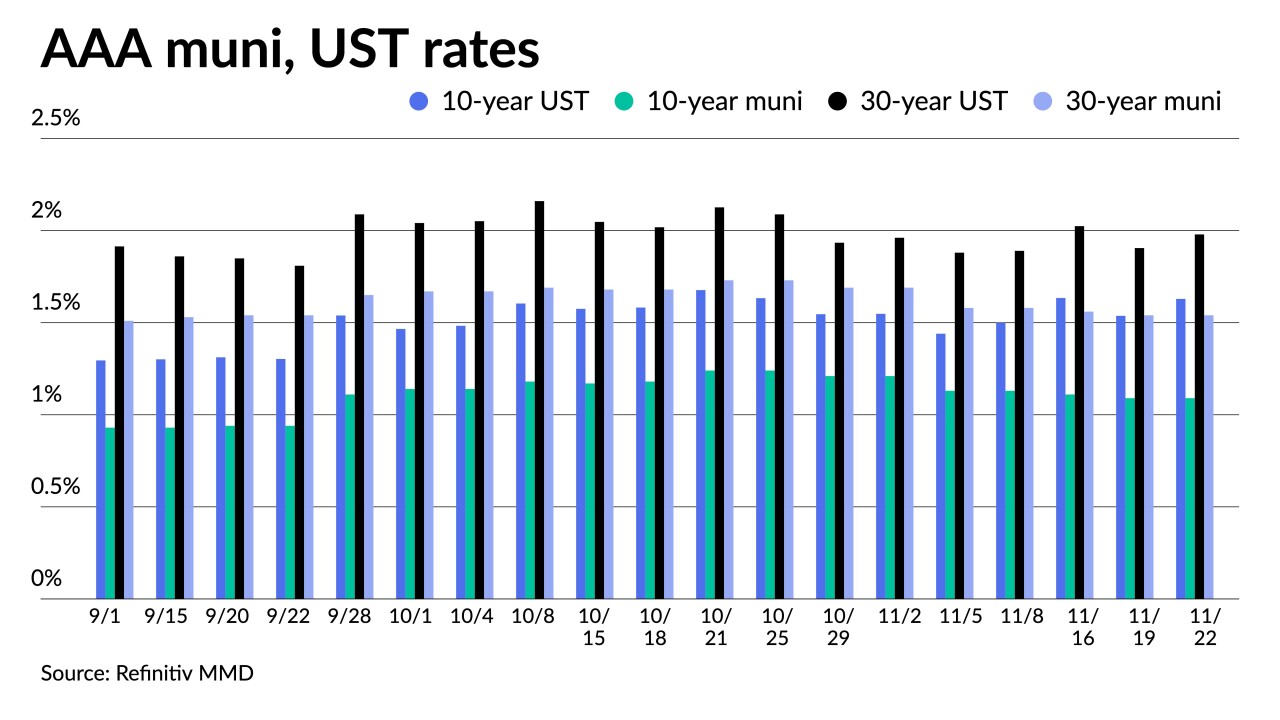

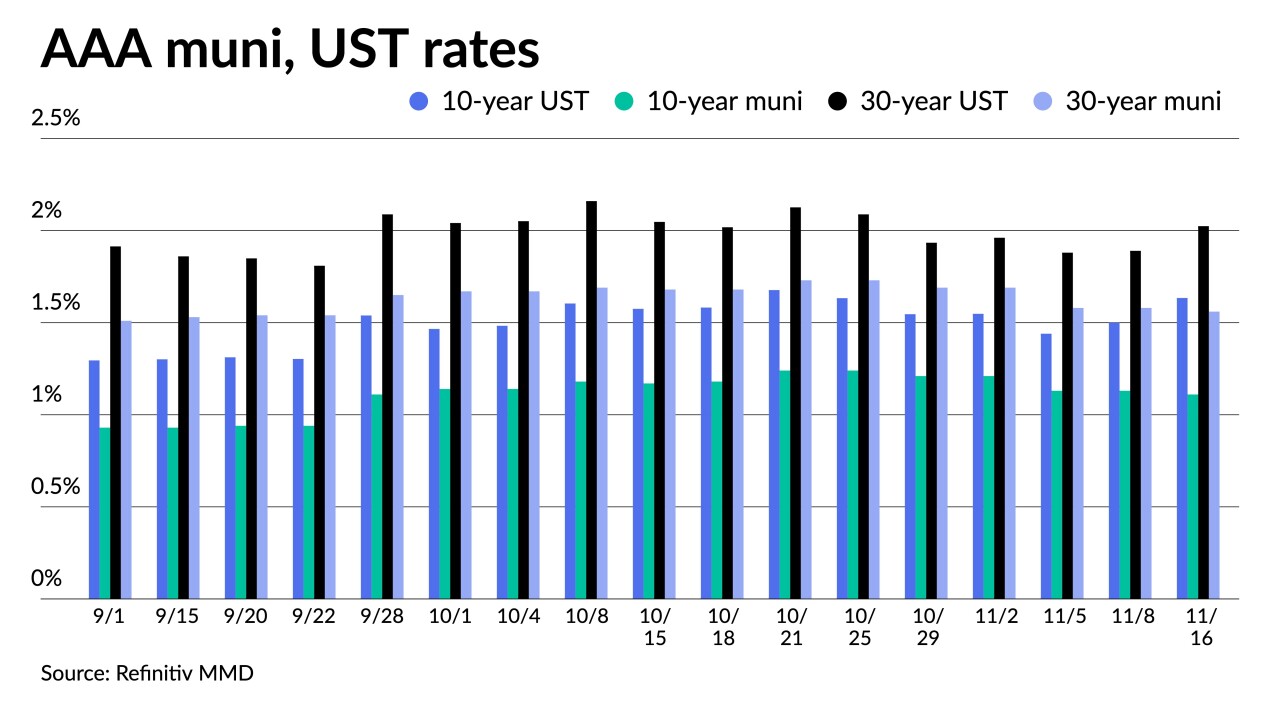

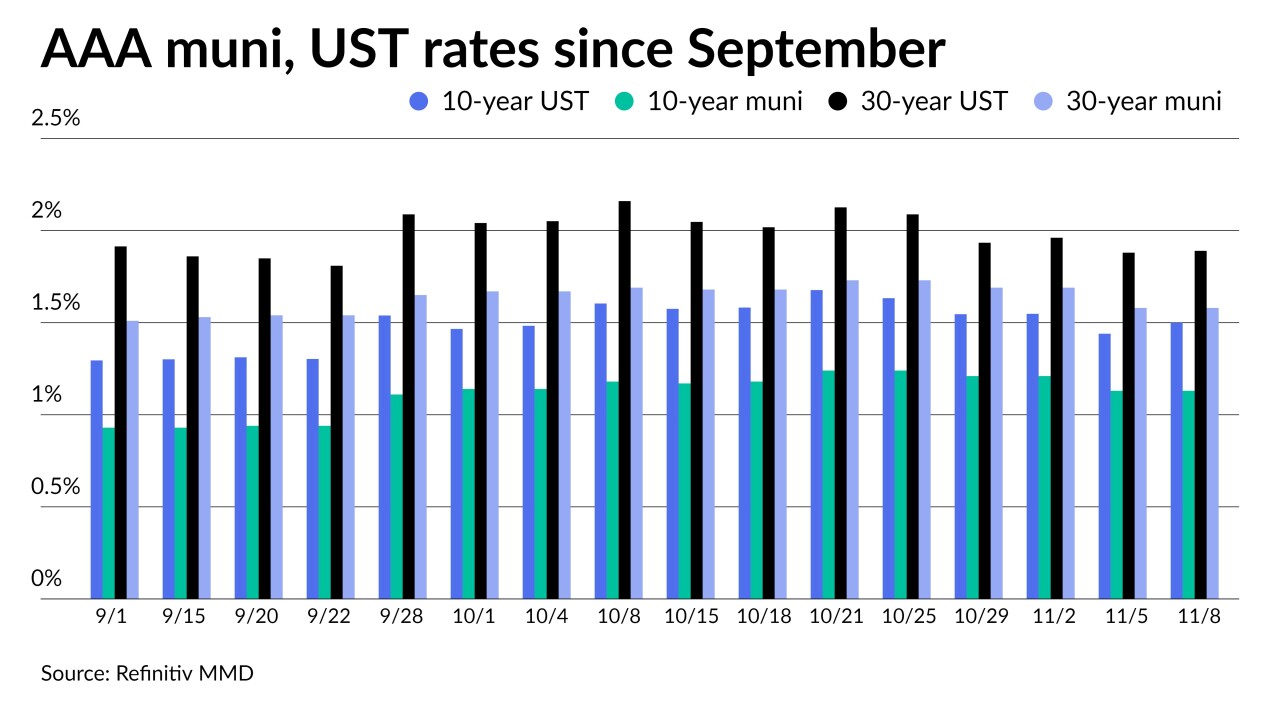

Rising rates and rising inflation are key concerns for municipal bond buyers.

November 30 -

With the leadership questions mostly answered, the Fed must figure out what to do about inflation. The markets expect the Fed will have to raise rates sooner than planned, and perhaps speed up taper to do so.

November 23 -

This week will be all about the secondary market given that the majority of issuance was priced earlier in the month while Dec. 1 coupon payments should make secondary offerings look attractive.

November 22 -

The president has selected Jerome Powell to serve a second four-year term as Federal Reserve chair and chosen Gov. Lael Brainard as the next vice chair.

November 22 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

November 16 -

Senate Banking Committee Chairman Sherrod Brown said Tuesday he has no doubt the Senate would confirm either Federal Reserve Chair Jerome Powell to a second term or his possible successor, Fed Gov. Lael Brainard.

November 16 -

Federal Reserve Bank of St. Louis President James Bullard said the central bank should speed up its reduction of monetary stimulus in response to a surge in U.S. inflation.

November 16 -

San Francisco Federal Reserve Bank President Mary Daly was considered by the Biden administration for a seat on the U.S. central bank’s board and she declined, according to two people familiar with the matter.

November 15 -

Federal Reserve Governor Lael Brainard was interviewed for the top job at the U.S. central bank when she visited the White House last week, according to people familiar with the discussions. She and Fed Chair Jerome Powell are the only people who have publicly surfaced as being in the running for the post.

November 9 -

Municipals were quiet on Monday following Friday's rally and ahead of the $9.6 billion estimated to be priced early in the week before the Veterans Day holiday close Thursday. Connecticut priced for retail.

November 8 -

President Joe Biden met separately with Federal Reserve Chairman Jerome Powell and Fed Governor Lael Brainard at the White House on Thursday as he considers who will lead the central bank next year.

November 5 -

As the Federal Open Market Committee meets to discuss monetary policy, Gary Pzegeo, head of fixed income at CIBC Private Wealth will discuss his thoughts about what will come from the meeting.

-

Senior Federal Reserve officials violated the central bank’s prohibition of stock trading that may appear improper, even if specific guidelines weren’t broken, Chair Jerome Powell said.

November 4 -

President Joe Biden said he’ll announce soon his choice of nominees for chair and other vacancies on the Federal Reserve, amid a scandal over stock trades by central bank officials.

November 2 -

Jerome Powell is widely expected to be renominated to a second term as Federal Reserve chair, but his chances have been modestly dented by the revelations of stock trading by some senior Fed officials in 2020, according to economists surveyed by Bloomberg News.

November 2 -

Senate Banking Committee Chair Sherrod Brown said he expects President Joe Biden will release a combination of nominations to the board of the Federal Reserve at the time he unveils his decision on the central bank chair.

October 26 -

Jeffrey Cleveland, chief economist at Payden & Rygel, discusses the Federal Reserve’s upcoming meeting, inflation, what taper will mean, when the Fed might decide to lift off, and possible leadership changes. Gary Siegel hosts. (30 minutes)

October 26 -

Treasury Secretary Janet Yellen defended Federal Reserve Chair Jerome Powell’s record on regulating the financial system amid attacks by progressives seeking to deny him a second term — even though in the past she’s expressed some misgivings about rulemaking under his watch.

October 25 -

The Federal Reserve will ban top officials from buying individual stocks and bonds as well as limit active trading after an embarrassing scandal that led two officials to resign and clouded Chair Jerome Powell’s path to renomination.

October 21