Federal Reserve

Federal Reserve

-

"If the banking stresses start to bring inflation down for us, then maybe we're getting closer to being done. I just don't know right now," said Federal Reserve Bank of Minneapolis President Neel Kashkari.

May 22 -

Federal Reserve Chair Jerome Powell gave a clear signal he is inclined to pausing interest-rate increases next month and said that tighter credit conditions could mean the policy peak will be lower.

May 19 -

Federal Reserve Bank of Dallas President Lorie Logan said the case for pausing interest rate increases at the central bank's June meeting isn't yet clear, while her colleague Gov, Philip Jefferson sounded ready to be patient.

May 18 -

The FOMC meets June 13-14. Join us June 15 at 2 p.m., Eastern time, as Jeffrey Cleveland, chief economist at Payden & Rygel, provides his take on the meeting statement, Federal Reserve Board Chair Jerome Powell's press conference and the latest Fed projections.

-

Two Federal Reserve officials signaled they favored pausing interest rate increases, while a third policymaker said the central bank's task in subduing inflation was not complete.

May 15 -

The Federal Reserve meeting May 2-3 will be closely watched for hints about what the FOMC's next move is. Join BNP Pariba U.S. Economist Yelena Shulyatyeva at 11 a.m. May 4 as she takes a look at the meeting and Chair Powell's press conference.

-

The Federal Reserve Board governor said adopting policies on climate change are not necessary and risk hurting the central bank's credibility.

May 11 -

The Federal Reserve said that banks reported tighter standards and weaker demand for loans in the first quarter, extending a trend that began before recent stresses in the banking sector emerged.

May 8 -

Federal Reserve Bank of St. Louis President James Bullard said he thinks the U.S. central bank can still achieve a soft landing, with inflation returning to the Fed's 2% target without triggering a significant downturn.

May 5 -

Still no clarity as the banking crisis adds to the difficulty of predicting an economy still feeling COVID impacts and uncertainty about the prospects for a recession.

April 24 -

Federal Reserve Bank of St. Louis President James Bullard said he favored continued interest-rate hikes to counter persistent inflation, while recession fears are overblown.

April 18 -

Richmond Federal Reserve Bank President Thomas Barkin said he wants to see more evidence that U.S. inflation is easing back to the central bank's goal of 2%.

April 17 -

Federal Reserve Governor Christopher Waller said he favored more monetary policy tightening to reduce persistently high inflation, although he said he was prepared to adjust his stance if needed if credit tightens more than expected.

April 14 -

Strong demand in the primary market is leading to the oversubscription of many new issues. Municipals and USTs were better again as macroeconomic concerns pressure equities.

April 12 -

Federal Reserve policymakers scaled back their expectations for rate hikes this year after a series of bank collapses roiled markets last month, and stressed they would remain vigilant for the potential of a credit crunch to further slow the economy, a record of the meeting showed.

April 12 -

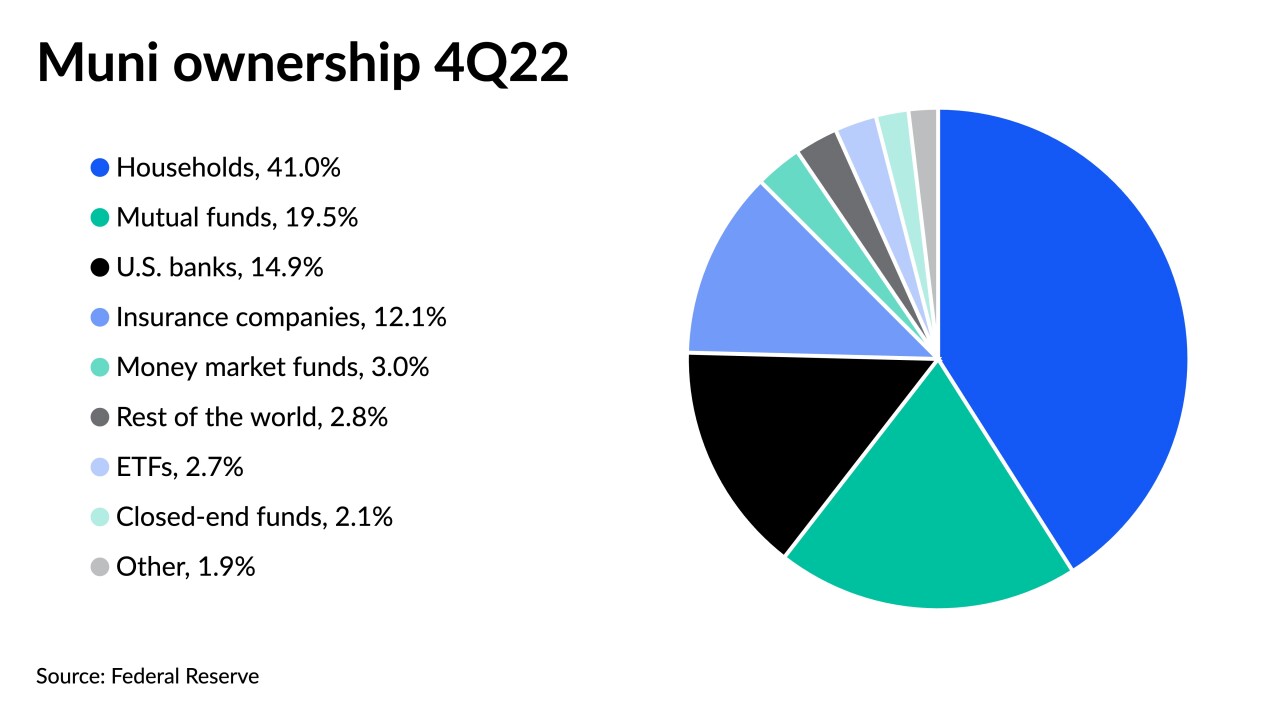

Household and U.S. bank ownership of individual bonds fell and the total face amount of munis outstanding was down 0.6% quarter-over-quarter and down 1.4% year-over-year, Fed data shows.

April 10 -

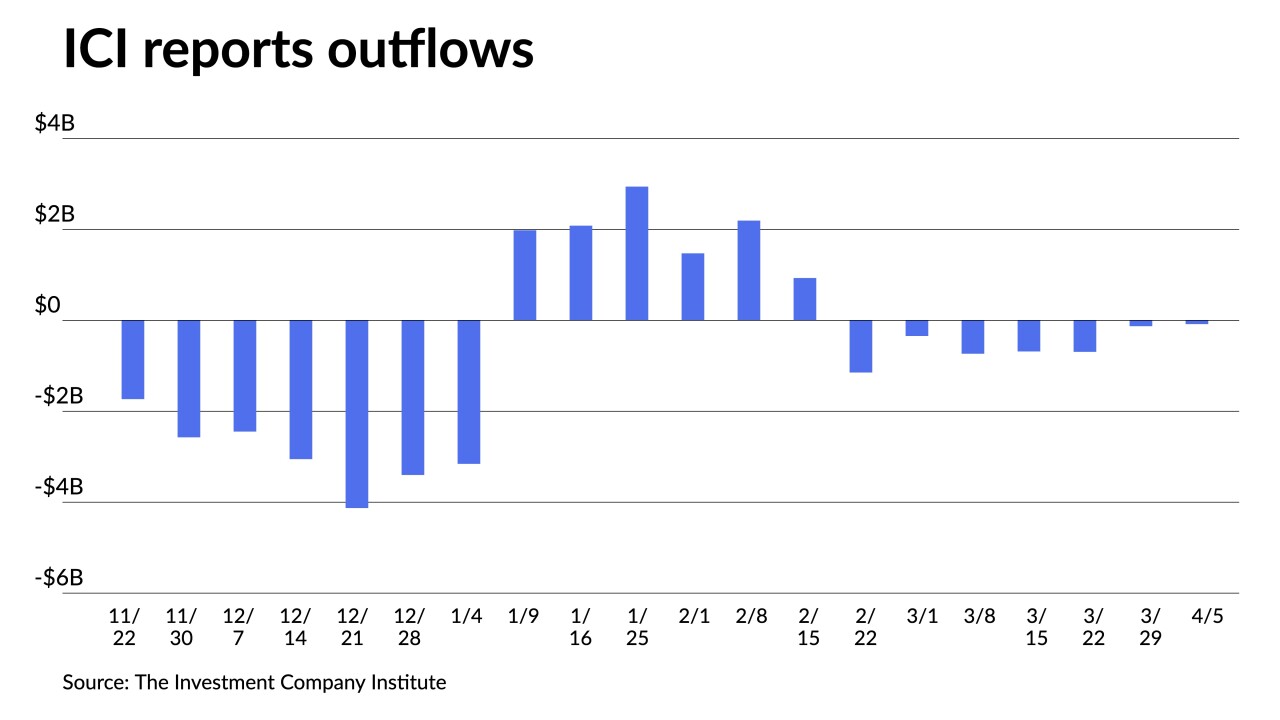

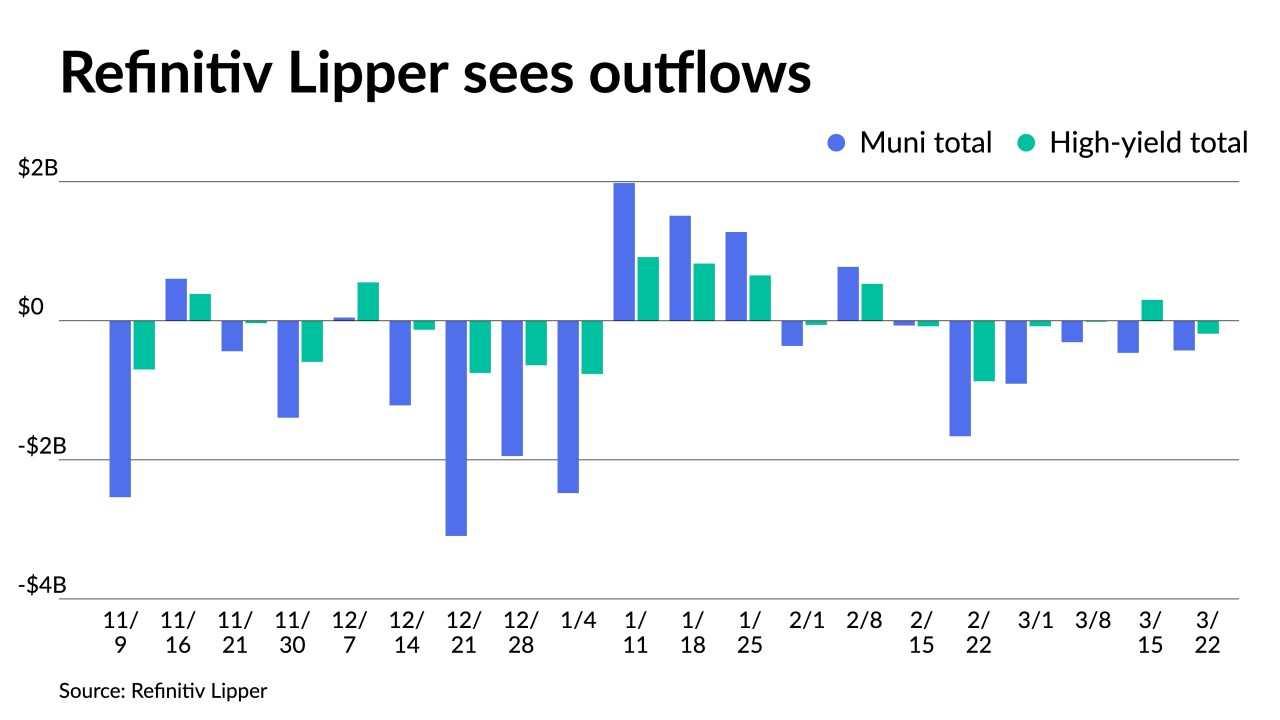

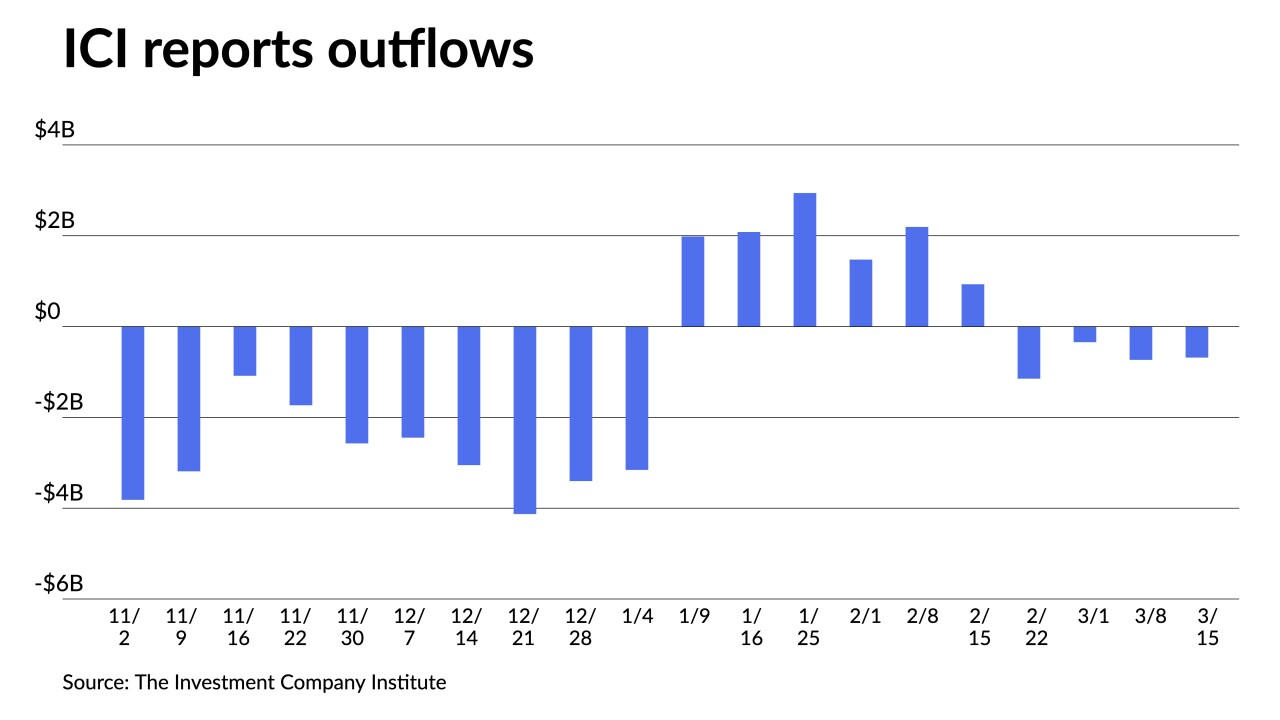

Outflows continued as Refinitiv Lipper reported $427.082 million was pulled from municipal bond mutual funds in the week that ended Wednesday after $461.123 million of outflows the week prior.

March 23 -

"In short, it appears that the end of the current tightening cycle is coming into view," said Wells Fargo Securities Chief Economist Jay Bryson.

March 22 -

Members of the Fed learned the wrong lesson from bizarrely focusing on the 1970s when they said "If history has taught us anything, it's to not let up too soon on inflation."

March 21 -

The reverberations from the Silicon Valley Bank and Signature Bank failures make the outcome of this week's Federal Open Market Committee meeting unpredictable.

March 20