-

The promotion for Heather Wendell was among a series of key appointments made by acting chief executive Janice Jackson.

January 11 -

The par value of muni underwriting fell for the top five firms as volume receded from the 2016 record.

January 5 -

Chief Executive Officer Forrest Claypool will step down at the after being accused of lying and engaging in a cover-up of an ethics probe of a top aide.

December 11 -

The municipal bond market focused on the burgeoning new issue calendar as participants waited for a U.S. Senate vote on tax reform, which may come before the end of this week.

November 27 -

The municipal bond market this week will keep an eye on the building new issue calendar as traders wait for the U.S. Senate to vote on a tax reform proposal which could come as early as Thursday.

November 27 -

The rush to market is set to begin as the municipal bond market will see a hefty new issue slate for the upcoming week at a time of year when it is usually rather sleepy.

November 27 -

The municipal bond market is looking ahead to the Thanksgiving week’s $4.2 billion new issue calendar, which is headlined by the New York Metropolitan Transportation Authority’s $2 billion green bond offering.

November 17 -

After a busy week filled with many new deals, the municipal bond market is looking ahead to the Thanksgiving week’s calendar, which is headlined by the New York Metropolitan Transportation Authority’s $2 billion green bond offering.

November 17 -

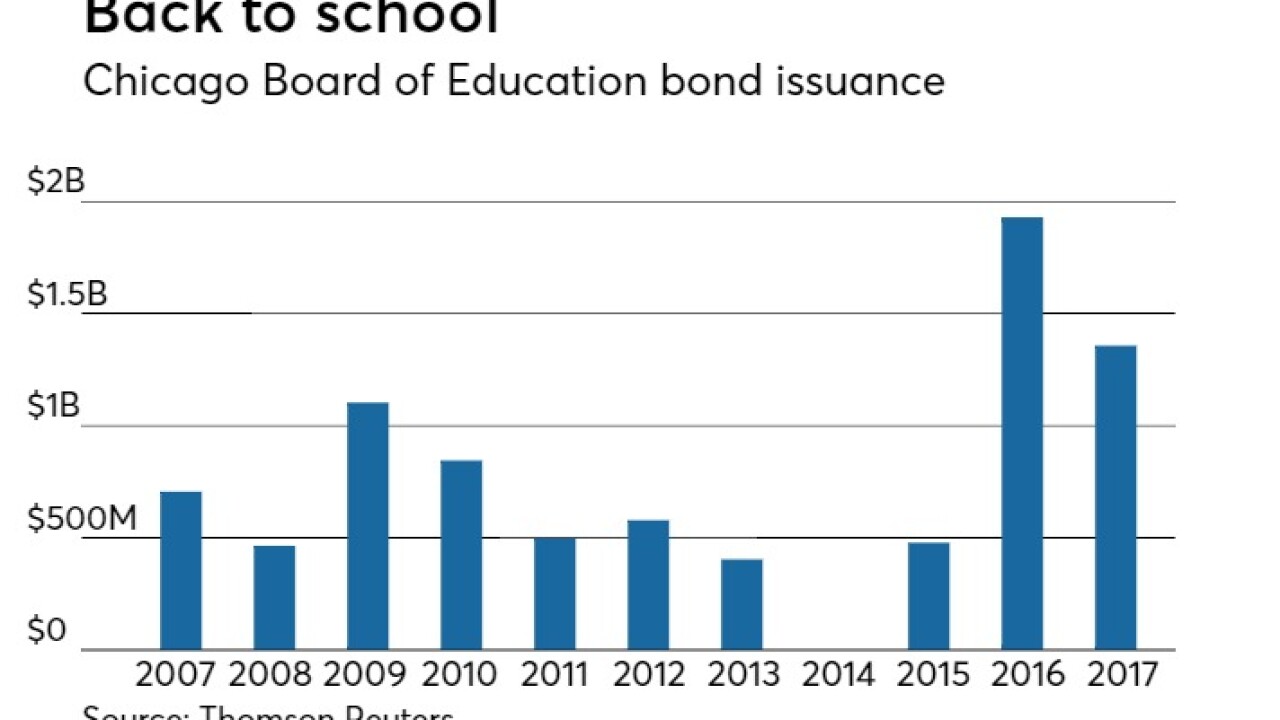

The junk-rated school district pared down spreads after bolstering its balance sheet.

November 17 -

The Chicago Board of Education lowered borrowing costs as it returned to the market on Thursday, selling $1.03 billion of general obligation bonds.

November 16 -

The Chicago Board of Education made a second run at the primary market on Thursday as it returned to offer $1.03 billion of general obligation bonds to muni buyers.

November 16 -

The Chicago Board of Education makes a second run at the primary market on Thursday as it returns to offer $857 million of general obligation bonds to muni buyers.

November 16 -

The Illinois Tollway's $300 million deal and the first part of the Chicago Board of Education’s $922 million bond offering came to market on Wednesday. In secondary trading, municipals were stronger on the day.

November 15 -

The first part of the Chicago Board of Education’s $922 million bond offering came to market on Wednesday as the board’s $64.9 million of dedicated capital improvement tax bonds were priced.

November 15 -

Two big deals from Illinois issuers are scheduled for sale on Wednesday as the Chicago Board of Education gets set to hit the market with the first part of its double-barreled offering and Illinois toll bonds are slated to be priced.

November 15 -

Municipal bond traders will see a chunky new issue calendar this week as the market’s focus will be on Washington, where Congress will continue to work on tax reform legislation.

November 13 -

The municipal market will get another healthy dose of issuance in the final full week before Thanksgiving. The calendar is chock full of deals from Illinois, as all issuers look to price bonds before the tax laws change.

November 10 -

Chicago's Board of Education is pricing more than $900 million, citing positive rating actions and a better balance sheet.

November 10 -

Kroll Bond Rating Agency and S&P Global Ratings both revised their outlooks.

October 31 -

Chicago Public Schools got a boost to BB-minus as the district readies a new money and refunding deal.

October 27