The Chicago Board of Education makes a second run at the primary market on Thursday as it returns to offer $857 million of general obligation bonds to muni buyers.

Secondary market

U.S. Treasuries were weaker on Thursday. The yield on the two-year Treasury rose to 1.70% from 1.68% on Wednesday, the 10-year Treasury yield gained to 2.35% from 2.33% and the yield on the 30-year Treasury increased to 2.79% from 2.78%.

Top-rated municipal bonds finished stronger on Wednesday. The yield on the 10-year benchmark muni general obligation fell one basis point to 1.99% from 2.00% on Tuesday, while the 30-year GO yield dropped two basis points to 2.68% from 2.70%, according to the final read of Municipal Market Data’s triple-A scale.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 85.3% compared with 84.1% on Tuesday, while the 30-year muni-to-Treasury ratio stood at 96.4% versus 95.3%, according to MMD.

AP-MBIS 10-year muni at 2.274%, 30-year at 2.791%

The Associated Press-MBIS municipal non-callable 5% GO benchmark scale was stronger in early trade.

The 10-year muni benchmark yield dropped to 2.274% on Thursday from the final read of 2.295% on Wednesday, according to

The AP-MBIS benchmark index is a yield curve built on market data aggregated from MBIS member firms and is updated hourly on the

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 43,957 trades on Wednesday on volume of $14.85 billion.

Primary market

JPMorgan Securities is set to price the Chicago BOE's $857.43 million Series 2017 unlimited tax dedicated revenue general obligation bonds. This series of bonds is rated B by S&P Global Ratings, BB-minus by Fitch Ratings and BBB by Kroll Bond Rating Agency.

On Wednesday, JPMorgan priced the BOE’s $64.9 million Series 2017 dedicated capital improvement tax bonds. That series is rated A by Fitch Ratings and BBB by Kroll.

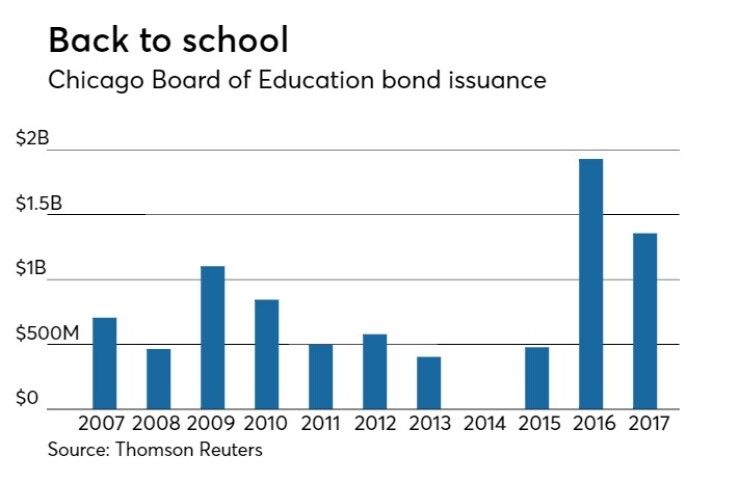

Since 2007, the BOE has sold about $8.36 billion of debt, with the most issuance occurring in 2016 when it issued $1.93 billion of bonds. The board did not come to market in 2014.

Citigroup is expected to price the South Jersey Port Corp.’s $255 million of Series 2017A and B subordinated marine terminal revenue bonds consisting of AMT and non-AMT bonds. The deal is rated Baa1 by Moody’s Investors Service.

In the competitive arena, Dallas is selling $302.85 million of Series 2017 GO refunding and improvement bonds. The deal is rated AA-minus by S&P and AA by Fitch.

Charleston County, S.C., is selling $103.18 million of Series 2017A GO capital improvement bonds. The deal is rated triple-A by Moody’s, S&P and Fitch.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar decreased $808.7 million to $6.99 billion on Thursday. The total is comprised of $1.71 billion of competitive sales and $5.28 billion of negotiated deals.

Tax-exempt money market funds see outflows

Tax-exempt money market funds experienced outflows of $39.4 million, lowering total net assets to $129.20 billion in the week ended Nov. 13, according to The Money Fund Report, a service of iMoneyNet.com.

This followed an inflow of $1.03 billion to $129.24 billion in the previous week.

The average, seven-day simple yield for the 199 weekly reporting tax-exempt funds was unchanged from 0.47% in the previous week.

The total net assets of the 834 weekly reporting taxable money funds increased $5.38 billion to $2.586 trillion in the week ended Nov. 14, after an inflow of $553.9 million to $2.581 trillion the week before.

The average, seven-day simple yield for the taxable money funds increased to 0.71% from 0.70% in the prior week.

Overall, the combined total net assets of the 1,033 weekly reporting money funds increased $5.34 billion to $2.715 trillion in the week ended Nov. 14, after inflows of $1.59 billion to $2.710 trillion in the prior week.

Data appearing in this article from Municipal Bond Information Services, including the AP-MBIS municipal bond index, is available on The Bond Buyer Data Workstation.