CHICAGO – Buoyed by about $500 million in city and state cash, Chicago Public Schools’ junk-rated paper proved an easier sell for yield-hungry buyers Thursday.

The Chicago Board of Education shaved more than 200 basis points off spread penalties on its $1.025 billion general obligation sale Thursday when compared to its last GO issue, for $500 million in July. The deal followed the board’s sale of $65 million of investment-grade rated capital improvement tax levy-backed bonds on Wednesday.

The finance team added a $112 million refunding series to the GO issue late Wednesday, pushing it over the billion dollar mark.

CPS is still paying punishing rates to borrow. But Thursday’s spreads – which initially ranged from 230 to 260 basis points to the Municipal Market Data top-rated benchmark before they were repriced by 5 to 20 bp better -- marked a sharp improvement from roughly 480bp spreads seen in the July issue. The state approved new funding later in the summer.

The finance team did not come out overly aggressive and so was able to build a strong book, enough so that the yields could be lowered, said one Chicago-based market participant.

“The buyers are in it for a yield,” the source said. “The Board of Education is still the cheapest credit in town and the credit has stabilized with the state help.”

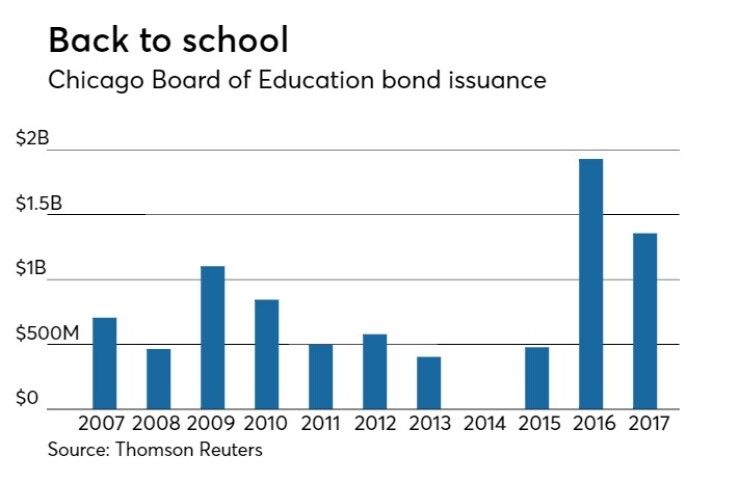

The results highlight a sharp turnaround for a district that was nearly locked out of the market in early 2016. After delaying a sale, tinkering with its structure, and some investor arm-twisting by Mayor Rahm Emanuel, the district sold bonds that paid rates as high as 8.5%.

In late August, Gov. Bruce Rauner and the General Assembly’s Democratic majorities reached agreement on an education funding package that provided CPS with $300 million more in annual aid and authority for a roughly $130 million property tax levy for pensions. Chicago also pledged $80 million to help cover CPS security costs.

“The ripple effects of the hard-fought education funding reform and management improvements continue to help CPS devote more resources to the classroom, and put the district on much stronger financial footing," Forrest Claypool, the CPS chief executive officer, said in a statement after Thursday’s pricing. "The latest example is this week’s bond sales, which generated $208 million in savings and $318 million for capital improvements.”

On the GO sale Thursday, two 10-year maturities in the deal landed at 4.55%, a 255 basis point spread to the AAA benchmark. Strong demand shaved about five basis points off those maturities. The district’s long bond in 2044 landed at a yield of 4.78%, a 212 bp spread. That was down by 20 bp from the preliminary scale.

The preliminary wire more closely reflected recent trading levels but the final pricing “was bumped 20 bps in some spots,” lowering yields, said Daniel Berger, municipal strategist at MMD.

In the district’s July sale, structured in three maturities, the district paid rates of 7.25% on a 2030 bond, a 489 bp spread to the AAA; a 7.55% rate on a 2042 bond, a 475 bp spread; and 7.65% on a 2046 bond, a 481 bp spread.

The district’s high rate of 8.5% in the early 2016 sale represented 580 basis points over the MMD AAA.

The CIT issue marked the district’s second under the A/BBB rated credit, which was established with a $729 million sale in December.

Spreads also sharply narrowed on the CIT bonds , which benefit from a revenue structure designed to insulate the debt from a potential CPS restructuring. Spreads on near comparable long bonds were shaved in half landing at 150 bp compared to 309 bp last year. The deals, however, offered differing coupons.

The short 16-year maturity in the Wednesday series landed at 3.95%, a spread of 155 basis points to the AAA, 103 bp to the single-A benchmark, and 67 bp to the BBB.

The long 29-year bond on the Wednesday sale paid a yield of 4.19%, a 150 bp spread to the AAA, a 99 bp spread to the single A, and 67 bp spread to the BBB.

The 30-year maturity in the 2016 sale paid a yield of 6.25% with a coupon for 6%, 309 basis points over the AAA although that comparison is based on a 5% coupon structure.

The district has also seen its short term interest rates on tax anticipation note borrowings shrink to 3.6% this year from 5.2% last year.

The GO sale refunds some debt for savings and will take out existing floating-rate bonds that carry a 9% rate, resulting in $175 million in long-term savings.

Portions of the GO issuance benefit from a post-default intercept provision previously added to the district’s GO-alternate revenue bonds with general state aid pledged as the alternate revenue source. General state aid now flows through an escrow before going to CPS and it would be frozen and directed to bondholders in the event of a default or bankruptcy filing.

JPMorgan and Barclays were lead managers with JPMorgan running the books.