Although minutes from the Federal Open Market Committee's June meeting should yield no surprises, the market will focus on conversations about yield curve control, which Fed Chair Jerome Powell acknowledged did occur.

And while the talks were reportedly preliminary, and no one expects implementation before its September meeting, “The markets are increasingly pricing in a form of yield curve control, with the short end and belly remaining in a narrow trading range,” said Marvin Loh, senior global macro strategist for State Street.

But, he added, “This appears premature to us, and we don’t think that YCC is a foregone conclusion. Fed speakers also appear mixed on the topic, so understanding where the committee stands on YCC and timing has short to intermediate market implications.”

Other than those conversations, Loh doesn’t expect anything “overly surprising” to come out of the minutes. “Fed members have had ample time and opportunity to express their views and have done so,” he said. “There is general unanimity that rates are not going to need to be changed for several years, with only two members seeing the need to raise rates over the next three years.”

The Fed’s projections are at bit “more dour” than broad market consensus, Loh said, noting there is a wide range of opinions about gross domestic product and the unemployment rate that led to the median expectations.

“Getting a sense of how the committee views risk from the virus and restarting the economy as it impacts these projections provides insight into how patient they will be during this data normalization period,” he said.

While the Fed has made over $3 trillion in credit available through a variety of their emergency programs, loh noted, “very little of these funds have been actually utilized.”

“With most of these programs set to expire within the next six months, the minutes may point to catalyst that may drive a different approach to the facilities, which can be extended, possibly have their terms changed, or pivoted to other purposes,” Loh said. “Treasury also has capacity to seed another $2 trillion in programs, all which has implications for the size of the balance sheet.”

Consumer confidence

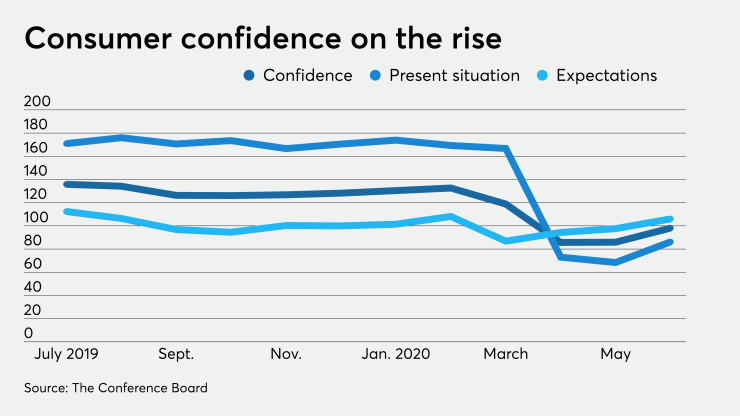

The Conference Board's Consumer Confidence Index rose to 98.1 in June from a downwardly revised 85.9 in May, first reported as 86.6.

Economists polled by IFR Markets projected a 91.6 level.

The present situation index gained to 86.2 in June from 68.4 in May, while the expectations index climbed to 106.0 from 97.6.

“Consumer Confidence partially rebounded in June, but remains well below pre-pandemic levels,” said Lynn Franco, senior director of economic indicators at The Conference Board. “The re-opening of the economy and relative improvement in unemployment claims helped improve consumers’ assessment of current conditions, but the Present Situation Index suggests that economic conditions remain weak. Looking ahead, consumers are less pessimistic about the short-term outlook, but do not foresee a significant pickup in economic activity. Faced with an uncertain and uneven path to recovery, and a potential COVID-19 resurgence, it’s too soon to say that consumers have turned the corner and are ready to begin spending at pre-pandemic levels.”

Chicago PMI

The Chicago Business Barometer rose to 36.6 in June, from 32.2 in May, according to the ISM-Chicago.

“Among the main five indicators, Production and New Orders saw the largest monthly gains, while Supplier Deliveries and Employment faltered,” according to the release.

Economists expected the barometer to read 45.0.

Dallas Fed services survey

Texas service sector activity “picked back up” in June, according to the Federal Reserve Bank of Dallas.

The general business conditions index for current conditions on company outlook, rebounded to positive 2.2 from negative 30.2, while the general business activity index also increased to positive 2.1 from negative 41.7.

The revenue index climbed into expansion territory at positive 5.7 in June from negative 28.1 in May.

The employment index narrowed to negative 1.9 from negative 10.4.

Looking ahead six months, both the company index and the general business activity index returned to positive territory at 6.2 and 6.8, respectively, after May's readings of negative 5.9 and negative 11.1.

S&P/Case-Shiller

Home prices grew 4.7% nationally year-over-year in April, up from 4.6% in March, according to S&P CoreLogic Case-Shiller.

The national index grew 1.1% on an unadjusted basis in April from March, while the 10-city and 20-city composites rose 0.7% and 0.9%, respectively. After seasonal adjustment, the national index grew 0.5%, the 10- city rose 0.3%, and the 20-city also increased 0.3%.