The muni primary market ground to a halt as a barrage of deals triggered by tax legislation ended and vacation mode took hold.

Secondary market

The MBIS municipal non-callable 5% GO benchmark scale was mixed in trading up until the market close on Thursday.

The 10-year muni benchmark yield dipped to 2.381% from 2.386% from Wednesday’s final read, according to

The MBIS benchmark index, which is comprised of investment-grade municipal securities, is updated hourly on the

Top-rated municipal bonds reversed course and were stronger to end Thursday. The yield on the 10-year benchmark muni general obligation was one basis point lower to 2.13%from 2.13% on Wednesday, while the 30-year GO decreased by three basis points to 2.70% from 2.73%, according to a final read of MMD’s triple-A scale.

U.S. Treasuries were mostly stronger. The yield on the two-year Treasury nudged up to 1.87% from 1.86%, the 10-year Treasury yield slipped to 2.48% from 2.50% and the yield on the 30-year Treasury fell to 2.83% from 2.88%.

On Thursday, the 10-year muni-to-Treasury ratio was calculated at 85.6% compared with 85.4% on Wednesday, while the 30-year muni-to-Treasury ratio stood at 95.3% versus 94.9%, according to MMD.

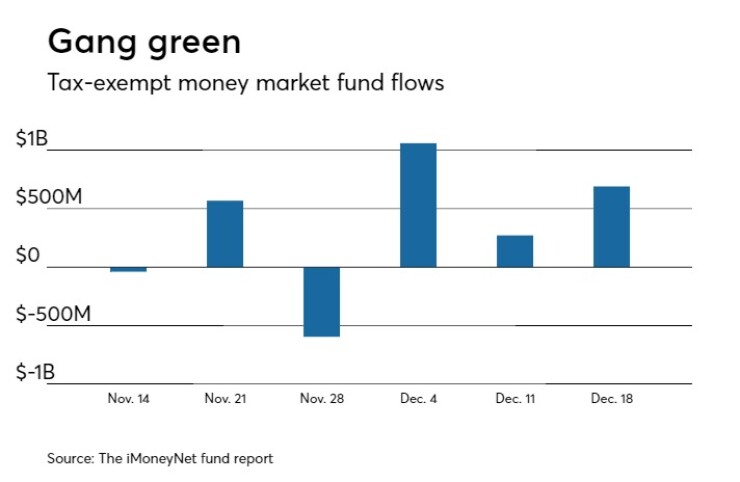

Tax-exempt money market funds saw inflows

Tax-exempt money market funds experienced inflows of $690.4 million, bringing total net assets to $131.19 billion in the week ended Dec. 18, according to The Money Fund Report, a service of iMoneyNet.com. This followed an inflow of $271.3 million to $130.50 billion in the previous week.

The average, seven-day simple yield for the 199 weekly reporting tax-exempt funds rose to 0.62% from 0.53% in the previous week.

The total net assets of the 827 weekly reporting taxable money funds decreased $22.62 billion to $2.659 trillion in the week ended Dec. 19, after an inflow of $34.30 billion to $2.682 trillion the week before.

The average, seven-day simple yield for the taxable money funds jumped to 0.85% from 0.76% from the prior week.

Overall, the combined total net assets of the 1,026 weekly reporting money funds decreased $21.93 billion to $2.791 trillion in the week ended Dec. 19, after inflows of $34.57 billion to $2.813 trillion in the prior week.

Primary market

Bank of America Merrill Lynch received the verbal award on the Las Vegas Convention and Visitors Authority’s $70.73 million of revenue refunding bonds on Thursday. The deal was priced to yield from 2.12% with a 5% coupon in 2022 to 3.66% with a 4% coupon in 2040. The deal is rated A1 by Moody’s Investors Service and A-plus by S&P Global Ratings.

The muni market has all but come to a complete stop, with the long holiday weekend around the corner. After weeks of fast and furious activity, as issuers rushed to market to beat impending tax legislation changes, market participants started the weekend early, as is often the case before a holiday.

Not a lot of issuance is expected next week, which will be shortened to three and a half trading days A good chunk of 2018 issuance was “stolen” during the supply swell, so it might be a while before we see the market booming like it has been.

At the onset of comprehensive tax reform, it was thought that advance refundings and private activity bonds would

After fighting to retain both kinds of bonds, the muni market will end up keeping

“Tax free financing is no longer available for such issues, which translates into an end of an asset class as outstanding pre-refunded issues run off and a reduction in future tax free new issuance of about 10%,” said Alan Schankel, managing director and municipal strategist at Janney, in a report released Thursday morning.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.