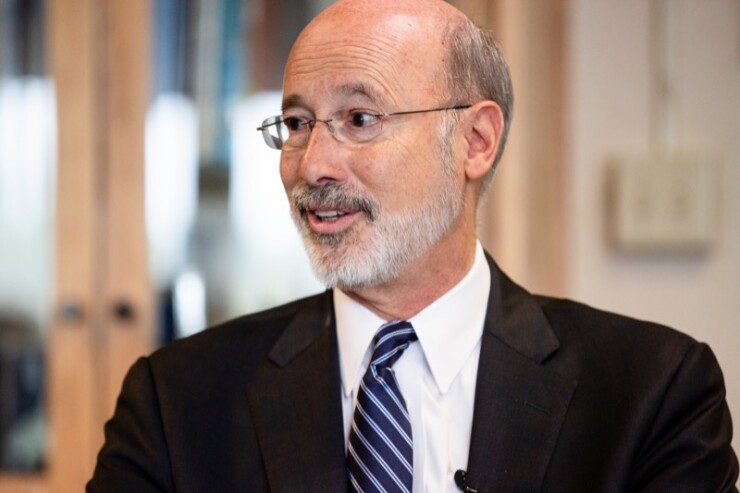

Pennsylvania Gov. Tom Wolf has a full plate of challenges when he starts his second term in January.

They include a projected $1.7 billion deficit for next year, with the commonwealth having already used one-time revenue measures such as tobacco and gambling. Long-term demographic concerns include an aging population.

"The big thing that got me was the demographics,” said Alan Schankel, a managing director at Janney Capital Markets in Philadelphia. “It’s a big challenge that Pennsylvania has because of its aging population and how to make that fit with its workforce needs."

Wolf, a Democrat, must also work with a Republican legislature.

According to the watchdog Independent Fiscal Office, revenues for fiscal 2019 are coming in $185 million ahead of projections, with corporate net income accounting for half that amount.

In addition, Wolf and lawmakers agreed on a $32.7 billion budget before the June 30 deadline, in contrast to the rancor-filled, four-months-late spending plan of the previous year.

IFO Director Matthew Knittel, though, cited gaps for the next five years. He called fiscal 2020 “a challenging budget year ahead.” The shortfall, he said, could reach $1.8 billion by fiscal 2023.

Bond rating agencies have downgraded Pennsylvania over the past three years, citing unfunded pension liability and budget imbalance.

Moody’s Investors Service rates the commonwealth’s general obligation bonds Aa3 with a stable outlook. S&P Global Ratings and Fitch Ratings assign A-plus and AA-minus ratings, respectively. Their respective outlooks are stable and negative.

“The capital markets are cautious about Pennsylvania,” Schankel said. “I think Pennsylvania gets a little better reputation than the bottom-tier states.”

Pennsylvania bonds on Tuesday were trading 55 basis points above the Municipal Market Data's AAA scale. By contrast, Illinois, Connecticut and New Jersey were trading at 170, 84 and 64 points, respectively.

“I tend to think that the [budget] options are limited. They’ve already tapped the tobacco side of things,” Schankel said. “The legislature may be ahead on this, but the government has got to get very stringent about costs. They’re going to have to cut a little bit into the fat.”

Pennsylvania has increasingly relied on the politically safe taxes and fees on tobacco, alcohol and gambling to balance its budget. According to

"Despite their small stature in state budgets, sin taxes often catch policymakers’ attention," Pew said, citing the casino-expansion bill Pennsylvania passed in October 2017. "However, this source of tax dollars, as with tobacco and alcohol, is unlikely to prove a reliable or robust funding source over the long term, at least without continued growth or higher tax rates."

Wolf, who succeeded Republican Tom Corbett in 2015, easily defeated the GOP’s Scott Wagner on Nov. 6. Wagner resigned from the state Senate to run for governor.

“Policymakers should consider recession scenarios,” Knittel said during a presentation to the County Commissioners Association of Pennsylvania in Hershey.