A week of increased volume is in store for investors from issuers selling airport bonds for Chicago O'Hare and exempt and taxable bonds for the New York Yankee's Stadium — a $12.6 billion calendar full of credits that are under the analyst microscope.

Taxable issuance remains a strong presence on the new-issue calendar, a trend that is seen continuing for the rest of the year.

BofA Securities has increased the size of their estimate for taxable issuance this year.

While both tax-exempt and taxable municipals remain cheap on a relative value basis, issuers may view taxable muni rates as favorably low and tax-exempt rates as too high, according to BofA.

“Our taxable muni forecast for 2020 is now $130 billion to $140 billion,” the BofA research group said Friday. “As such, we increase our total 2020 issuance forecast to $440 billion - $450 billion.”

On Friday, municipals finished little changed, with yields remaining steady along most of the AAA GO scales, however, high-yield munis can still be attractive for some buyers, according to Eric Kazatsky, senior municipal strategist at Bloomberg Intelligence.

“Despite underperformance vs. higher-rated investment grade munis, a case can still be made for high-yield municipals given adjusted relative value views vs. like-rated alternatives,” he said. “However, the sector will likely continue to see weaker demand as buyers hunt for yield in tax-free vehicles, but at the same time want to avoid headline risks and COVID-19-induced credit issues.”

Some buyers may be ignoring lower historical default ratios and less volatility vs. other fixed-rate alternatives if they are focusing on avoidance as an investment tactic.

“With option-adjusted spreads (OAS) at the wide end of their ranges, and absent a full-blown shutdown scenario again, the sector could see spreads drift back toward historical norms over the next year,” Kazatsky said.

“If you've been in municipals for more than five minutes, then you know the market hangs on every last ounce of fund-flow data to signal the depth and direction of investor sentiment,” he said. “That's why the bifurcation of investment grade and high yield municipal flows for 2020 indicates COVID-19 wounds are still very apparent when moving lower in credit.”

He said that despite large outflows in March, investment-grade credits have recovered and have produced $15 billion of new positive fund flows.

“Conversely, high-yield municipals are down on the year by $7.9 billion,” he said.

Caution prompted by market uncertainty is surfacing in the municipal market, although some say that hasn’t stopped brisk reinvestment demand.

“In general, there is a little bit of a risk-off, cautious tone,” a New York trader said Friday. The upcoming presidential election and the COVID-19 pandemic top investors’ list of worries, he said.

For instance, the trader said that negative flows over the past three week, particularly among the high-yield municipal mutual funds point to a cautious, risk-off mindset as high-grade funds continue to see positive flows.

Howard Mackey, managing director at NW Financial in Hoboken, N.J., said the negative high-yield fund flows are a result of the overall historically low yields and have come on the heels of the previously wide gap between high-grade and high-yield.

“People were trying to strive for yield and that drove the high-yield market,” Mackey said.

“When rates came down, people started to take a look at what the economy is telling us,” he said. “With no stimulus package we will probably have some serious headwinds because of the economic impact and that will not bode well for high-yield paper.”

He said high-yield bonds will continue to be “precarious” during the current economic climate, but flows into high-grade mutual funds should outpace that of high-yield funds.

“There is a lot of cash coming into mutual funds as money has to be put to work,” Mackey said, adding he expects that trend to continue “even in the face of low rates.”

Overall, Mackey said the municipal market has a fairly strong tone and despite the fact that yields have been virtually unchanged for the past few sessions, demand has remained strong.

Specialty state paper demand has been extremely high, Mackey said, adding he expects that to continue into the fourth quarter.

With the heavy demand and lack of supply in specialty states, deals with strong and aggressive pricing are still getting oversubscribed, he noted.

PNC Capital Markets priced the Allegheny County Sanitary Authority, Pa.’s (Aa3/A+/NR/NR) $155 million of sewer revenue bonds — which Mackey said was an example of the heavy demand for specialty state paper.

The Series 2020A refunding bonds were priced to yield from 0.35% with a 3% coupon in 2023 to 2.38% with a 3% coupon in 2040. The Series 2020B new-money bonds were priced to yield from 0.29% with a 3% coupon in 2022 to 2.08% with a 4% coupon in 2040; a 2045 maturity was priced as 4s to yield 2.24% and a 2050 maturity was priced as 4s to yield 2.30%.

“That gives you an idea how much demand there is for specialty state paper,” Mackey said.

Overall, he said the strong demand is leading to positive flows among high-grade funds, despite some cautiousness over rate volatility.

“Yields are going to be steady in the muni world and you will have buyers come in and my prognosis is that yields will go lower in 10-years” and beyond, Mackey said.

The stock market, he said, represents fairly good value, but in the short term it appears “dicey” for conservative investors.

“If investors have their money managed professionally they will look for diversification,” chiefly into investment-grade fixed-income products, such as municipals, he said.

Primary market

IHS Ipreo estimates supply for the upcoming week at $12.6 billion. The calendar is composed of $10.4 billion of negotiated deals and $2.2 billion of competitive sales.

Leading the week’s slate is Chicago’s (NR/A/A/A+) $1.2 billion deal for O’Hare International Airport. Jefferies is set to price the general airport senior lien bonds on Thursday.

The deal consists of $511.4 million of Series 2020A exempt revenue refunding bonds not subject to the alternative minimum tax, $143.47 million of Series 2020B exempt non-AMT private activity revenue refunding bonds, $60.125 million of Series 2020C exempt non-AMT revenue refunding bonds, $65.62 million of Series 2020E exempt non-AMT revenue bonds and $462.63 million of Series 2020D taxable revenue refunding bonds.

Philadelphia, Pa., (A2//A/) is coming to market with $372 million of airport revenue and refunding bonds.

Barclays Capital is set to price the bonds in a deal that consists of $178.765 million of Series 2020A non-AMT private activity revenue refunding bonds, $37.525 million of Series 2020B non-AMT governmental revenue bonds and $$155.965 million of Series 2020C AMT private activity revenue and refunding bonds.

JPMorgan is set to price the Portland International Airport, Ore.’s (NR/A+/NR/NR) $348.72 million of Series 27A AMT and Series 27B taxable revenue bonds on Wednesday.

Turning now to sports, the New York City Industrial Development Agency (A2/AAA/NR/AA+) is heading into the market with a $924 million deal for Yankee Stadium.

Goldman Sachs is set to price the $807.4 million of Series 2020A tax-exempt and the $116.13 million of Series 2020B taxable PILOT revenue refunding bonds on Tuesday. The deal will be insured by Assured Guaranty Municipal Corp.

The Sports and Exhibition Authority of Pittsburg and Allegheny County, Pa., (A1/A+//) is coming to market with a $112.45 million sale.

PNC Capital Markets is set to price the regional asset district sale tax revenue refunding bonds on Wednesday.

Also on tap is the Texas Water Development Board’s (/AAA/AAA/) $600 million deal. Morgan Stanley is expected to price the Master Trust state water implementation revenue fund for Texas revenue bonds on Tuesday.

In the competitive arena, Florida issuers rule.

The Miami-Dade County School District is selling $475 million of tax anticipation notes on Thursday.

On Tuesday, Miami-Dade County is selling $531.715 million of special obligation bonds in three offerings. The deals consist of $340 million of Series 2020B taxable capital asset acquisition bonds, $114.96 million of Series 2020C exempt non-AMT capital asset acquisition bonds and $76.755 million of taxable capital asset acquisition refunding bonds.

Secondary market

Some notable trades Friday, Washington County, Oregon GOs, 5s of 2024, trading at 0.23% to 0.20%. Ohio waters, 5s of 2024 at 0.23% to 0.20%. Harvard 5s of 2026 at 0.35%. New York City TFA 5s of 2028, trading at 1.00% to 0.99%, originally priced at 1.09%.

"The demand is still there. What other paper can you have faith in, save for munis and UST?" a New York trader said. "You can go back to New York TFAs — [subordinates] by the way — 4s of 2045, trading at 2.28%, trading up from the original pricing at 2.35%. The NYC TFA subs, 3s of 2048 trading at 2.53% to 2.52 while originally pricing at 2.57%. Lower couponing is attracting investors."

"If I were really trying to predict the future, I clearly wouldn't be trading municipal bonds," he said.

Gilt-edged Maryland GOs, 5s of 2032, landed at 1.05% after pricing in July at 0.91%. Another high-grade name, Loudoun County, Virginia 3s of 2032% at 1.06% to 1.12%. Charlotte, North Carolina waters, 4s of 2036 traded at 1.34%, originally at 1.39%.

Out longer with a 5% coupon in 2045, a Washington State GO (AAA/AA+/AA+) traded at 1.63%, a mere plus-five basis points higher than MMD, four basis points up from ICE and five up from IHS.

Puerto Rico bonds were getting a huge boost on Friday after the Federal government announced an additional $13 billion in aid to the Commonwealth to repair damage from Hurricane Maria three years ago, ICE Data Services said. About $9.6 billion will go to the island beleaguered electric utility PREPA to rebuild the power infrastructure.

Selected issues include:

PREPA (Electric Power) revenue bonds (74526QVX) up 2 ¼ points to $66 7/8;

PREPA (Electric Power) revenue bonds (74526QV6) up 2 7/8 points to $71 ¾;

PREPA (Electric Power) RSA revenue bonds - (74526QD9) up 2 ¼ points to $74-net;

PREPA (Electric Power) RSA revenue bonds - (74526QG3) up 2 7/8 points to $79-net;

Commonwealth 8% due 7/1/35 (74514LE8) up 1 point to $64-net.

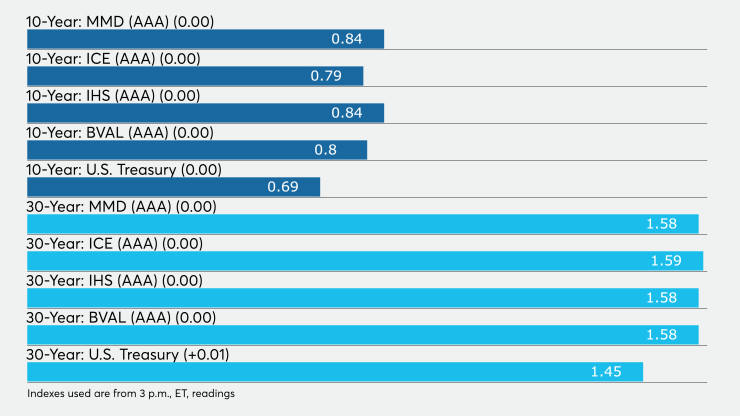

High-grade municipals were little changed on Friday, according to final readings on Refinitiv MMD’s AAA benchmark scale. Yields were flat in 2021 and 2022 at 0.12% and 0.13%, respectively. The yield on the 10-year muni was steady at 0.84% while the 30-year yield remained at 1.58%.

The 10-year muni-to-Treasury ratio was calculated at 121.0% while the 30-year muni-to-Treasury ratio stood at 108.7%, according to MMD.

The ICE AAA municipal yield curve showed the 2021 maturity steady at 0.12% and the 2022 maturity flat at 0.12%. The 10-year maturity was unchanged at 0.79% and the 30-year was flat at 1.59%.

The 10-year muni-to-Treasury ratio was calculated at 120% while the 30-year muni-to-Treasury ratio stood at 108%, according to ICE.

The IHS Markit municipal analytics AAA curve showed prices unchanged with the 2021 maturity yielding 0.13%, the 2022 maturity at 0.14%, the 10-year muni at 0.84% and the 30-year at 1.58%.

The BVAL AAA curve showed the yield on the 2021 maturity unchanged at 0.11%, the 2022 maturity down one basis point to 0.13%, the 10-year down one basis point to 0.80% and the 30-year unchanged at 1.58%.

Treasuries were mixed as stock prices traded lower.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 0.69% and the 30-year Treasury was yielding 1.45%.

The Dow fell 0.89%, the S&P 500 decreased 1.18% and the Nasdaq lost 1.31%.

Lynne Funk contributed to this report.