A bevy of bond issues hit the municipal market on Wednesday, led by a Massachusetts negotiated deal and Washington state competitive sales.

Primary market

Morgan Stanley priced Massachusetts’ $727.065 million of general obligation and GO refunding bonds for institutional investors after holding a one-day retail order period.

The deal is rated Aa1 by Moody’s Investors Service, AA by S&P Global Ratings and AA-plus by Fitch Ratings.

In the competitive arena, Washington state sold $502.13 million of GOs in three offerings.

Citigroup won the $262.915 million of Series 2019A various purpose GOs with a true interest cost of 3.8175%

Citi also won the $145.78 million of Series 2019T taxable GOs with a TIC of 3.3357%

The state also sold $93.435 million of Series 2019B motor vehicle fuel tax GOs. Information was not immediately available.

Montague DeRose & Associates and Piper Jaffray are the financial advisors and Foster Pepper is the bond counsel.

The deals are rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Dallas competitively sold $155.66 million of Series 2018C waterworks and sewer system revenue refunding bonds.

Morgan Stanley won the bonds with a TIC of 3.5685%. Hilltop Securities and Estrada Hinojosa are the financial advisors and McCall Parkhurst and Escamilla & Poneck are the bond counsel.

The deal is rated AAA by S&P and AA-plus by Fitch.

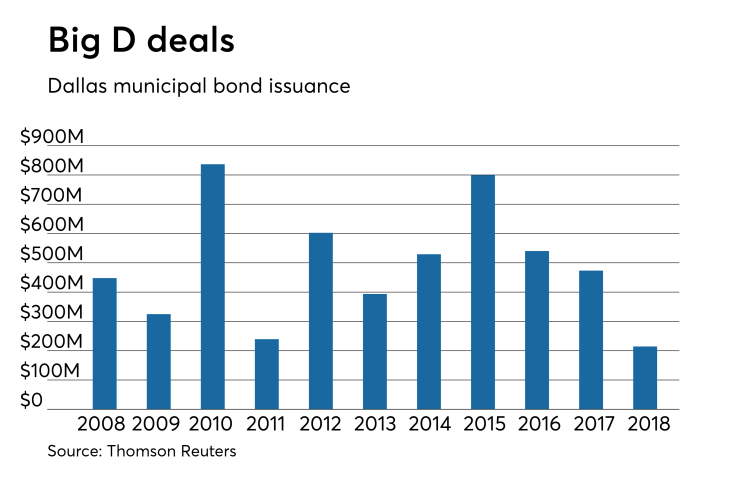

Since 2008, Dallas has sold over $5 billion of debt, with the most issuance occurring in 2010 when it sold $836.7 million of bonds. Prior to this year, it sold the least amount of debt in 2011, when it issued $239.4 million of bonds.

Bank of America Merrill Lynch priced the National Finance Authority, N.H.’s $169.595 million of resource recovery refunding revenue bonds for the Covanta project consisting of Series 2018A bonds subject to the alternative minimum tax, Series 2018B non-AMT bonds and Series 2018C AMT bonds.

The deal is expected to be rated B1 by Moody’s and B by S&P.

JPMorgan Securities received the official award on the West Virginia Hospital Finance Authority’s $271.575 million of Series 2018A tax-exempt and Series 2018B taxable hospital refunding and improvement revenue bonds for the Cabell Huntington Hospital Obligated Group.

The deal is rated Baa1 by Moody’s and BBB-plus by S&P.

Wednesday’s bond sales

Massachusetts

Washington

New Hampshire

West Virginia

Bond Buyer 30-day visible supply at $8.9B

The Bond Buyer's 30-day visible supply calendar decreased $635.2 million to $8.90 billion for Wednesday. The total is comprised of $4.31 billion of competitive sales and $4.59 billion of negotiated deals.

Secondary market

Municipal bonds were mostly stronger on Wednesday, according to a midday read of the MBIS benchmark scale. Benchmark muni yields fell less than one basis point in the one-year and eight- to 30-year maturities and rose less than a basis point in the two- to seven-year maturities.

High-grade munis were also mostly stronger, with yields calculated on MBIS’ AAA scale falling as much as one basis point in eight- to 30-year maturities, rising less than a basis point in the two- to seven-year maturities and remaining unchanged in the one-year maturity.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the both yield on the 10-year muni general obligation and the yield on 30-year muni maturity rising by as much as one basis point.

Treasury bonds were weaker as stock prices traded higher.

On Tuesday, the 10-year muni-to-Treasury ratio was calculated at 84.2% while the 30-year muni-to-Treasury ratio stood at 99.2%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 39,557 trades on Tuesday on volume of $9.87 billion.

California, New York and Texas were the municipalities with the most trades, with Golden State taking 15.119% of the market, Empire State taking 13.665% and the Lone Star State taking 10.65%.

Treasury sells $17B reopened 2-year notes

The Treasury Department Wednesday auctioned $17 billion of one-year 11-month floating rate notes with a high discount margin of 0.047%, at a 0.043% spread, a price of 99.991756.

The bid-to-cover ratio was 2.94. Tenders at the high margin were allotted 66.65%. The median discount margin was 0.040%. The low discount margin was 0.020%.

The index determination date is Aug. 27 and the index determination rate is 2.080%.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.