DALLAS — Utah, one of the most fiscally fit states in the mountain West, expects to price the largest issue in its history next week — a $1.25 billion deal that will combine taxable Build America Bonds with tax-exempt debt.

Given the rarity of large Utah issues, investors are expected to jump on the triple-A general obligation bonds through retail orders Sept. 22 followed by institutional pricing the next day.

“I expect to have really good demand for the sale,” said state Treasurer Richard Ellis. “I think we’re coming to market at a good time.”

Rough scenarios call for the state to issue $496 million as tax-exempt Series A and $574 million of BABs as Series B, according to Fitch Ratings. The $200 million refunding portion will be Series C. However, officials said those figures could shift as pricing approaches.

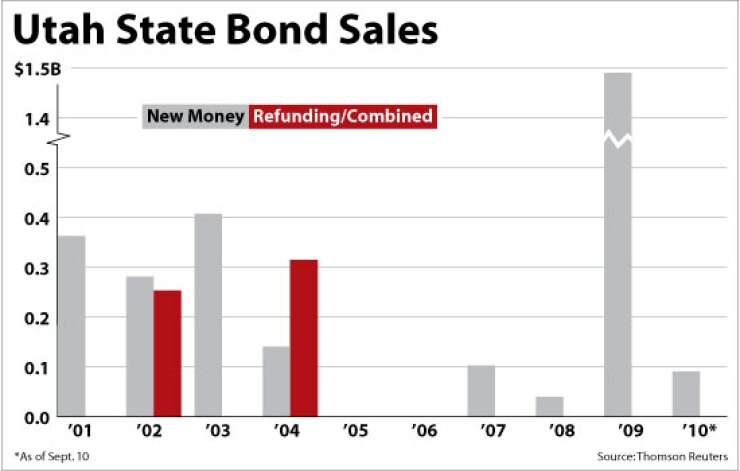

Market conditions are so good that Utah officials might be able to take out a 2009 issue as part of the refunding.

Bonds issued in 2004 are also possible refund targets, Ellis said.

The state expects net present-value savings of at least 3% or somewhere between $3 million and $10 million.

“It seems a little bit odd, but market conditions have changed where we can do a deal like that,” Ellis said. “I think piggybacking with another issue provides the right economy of scale.”

The new-money portion of the issue will provide $800 million for transportation and $100 million for state buildings.

The exact ratio of BABs to tax-exempts will be decided as the deal comes nearer to the pricing date, according to the treasurer.

Ellis is working with Zions Bank Public Finance managing director Jon Bronson as financial adviser and Chapman & Cutler as bond counsel.

Goldman, Sachs & Co. and JPMorgan are joint book runners with a syndicate that includes Morgan Stanley, Wells Fargo Securities, Jefferies & Co., George K. Baum & Co. and Seattle Northwest Securities Corp.

The building bonds will have maturities of seven years, while the road bonds will mature in 15 years. Such short maturities are typical of Utah issues and will likely affect the ratio of BABs versus tax-exempts, according to people working on the deal.

“You want to find crossover point where it’s cheaper to issue BABs than tax-exempts,” said one official.

Standard & Poor’s, Fitch Ratings and Moody’s Investors Service have affirmed their triple-A ratings.

Utah’s previous largest issue was nearly $1 billion of GOs last year.

Utah’s general obligation tax-exempt bonds issued on Sept. 29 last year with 2018 maturities and coupons of 5% are averaging yields of 2.03%, down from the original yield of 2.68%. The bonds are trading at 6 basis points above the Municipal Market Data average. In the most recent trade on Sept. 8, the 2018 bonds yielded 1.85%.

“The rating reflects our view of Utah’s young, well-educated workforce and diverse economy, with an unemployment rate that, although rising, remains lower than the national average,” said Standard & Poor’s credit analyst Misty Newland. “Further supporting the rating is our view of the state’s continued good financial management, including proactive budget adjustments to maintain good financial reserves, and low debt burden with short maturity schedules.”

The transportation bonds will fund a $1.7 billion redevelopment of the Interstate 15 freeway in Salt Lake County, one of the largest projects in Utah history.

The state hired Provo River Constructors, a consortium led by Fluor Enterprises and Ames Construction, for the 24-mile job.

The freeway will grow by two lanes in each direction, and in some places three, according to the plan. Northern sections will have five or six general-purpose lanes each way, with the six-lane segment stretching from Orem to Lehi in the Salt Lake City suburbs.

The project is expected to take three years and employ up to 2,000 people.

While Utah has continued to grow, the pace has slowed in recent years. Between 2000 and 2009, the state’s population grew 24% compared to 8.8% nationally.

The population is also considerably younger than the national average. Median household incomes were 108% of the national average in 2009.

Utah’s comparatively low unemployment rate has tripled since hitting the historic low of 2.7% in 2007. However, the state’s workforce has declined just 5% since reaching peak employment of 1.33 million in February 2008, compared to 1.25 million for July 2010.

According the Bureau of Labor Statistics, Utah had the 14th lowest unemployment rate, at 7.2%, among states nationally for July 2010, compared to the lowest rate of 3.6% in North Dakota. The state also reported two consecutive quarters of personal income growth through the first quarter of 2010.

Meanwhile, the neighboring state of Nevada has notched the nation’s highest unemployment rate of 14.3% compared to the national average of 9.6%.

Another neighbor, Arizona, shares Nevada’s dire housing straits, a fate that Utah has managed to avoid. According to the latest report from the research firm CoreLogic, Nevada had the highest percentage of negative homeowner equity, with 68% of all of its mortgaged properties underwater, followed by Arizona, with 50%.

The percentage of homes worth less than their mortgages in Utah was 20.4%, according to the report for the second quarter of this year.

Eastern neighbor Colorado is in better shape than Arizona or Nevada but faces a potentially wrenching economic shift if voters approve any of three ballot propositions in November.

One of the proposals would prohibit future state-debt issuance of any kind, while others would reduce the state and local tax bases and limit maturities of local bonds to 10 years.

Even in fiscally conservative Utah, where lengthy bond maturities are prohibited and debt loads are light, the Colorado propositions look troublesome to Ellis.

“It seems like it’s very conservative to do that, but it’s very difficult to make that kind of transition when you’ve been mortgaging for 20 years,” the treasurer observed.

“The state does not issue variable-rate debt, employ the use of interest-rate swaps, or issue short-term or cash-flow notes,” Fitch analyst Karen Krop said in her Utah ratings report.

“Amortization is rapid as the state has historically limited its bond maturities to seven years other than for transportation-related bonds for which it permits 15-year amortization,” she added.

With the upcoming issue, Utah’s net tax-supported debt of approximately $3.5 billion will equal 4.1% of 2009 personal income, Krop said.