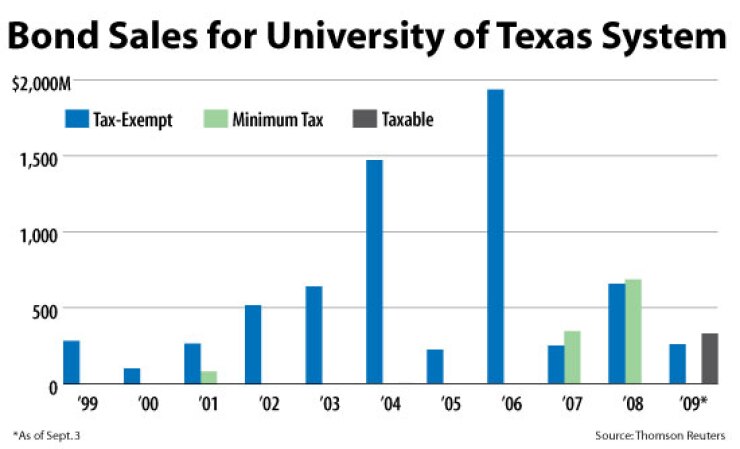

DALLAS - The University of Texas System will offer risk-averse investors $250 million of triple-A rated Build America Bonds backed by the state's Permanent University Fund this week.

The deal is the second BAB issue for UT. In June, the system included about $330 million of the taxable, federally subsidized debt in a $625 million revenue bond issue.

The new bonds, which will be issued in traditional fixed-rate mode, are expected to price via negotiated sale today or later this week with Barclays Capital as senior manager. The system serves as its own financial adviser, with McCall Parkhurst and Horton as bond counsel.

Proceeds of the issue will refund all $250 million of outstanding taxable commercial paper notes.

As expected, the bonds have earned triple-A ratings from Standard & Poor's, Fitch Ratings and Moody's Investors Service.

"The AAA rating continues to reflect the PUF's vast, highly diversified investment holdings, which had a market value of $9.5 billion on July 31, 2009, and the expertise of the University of Texas Investment Management Company (UTIMCO), which manages the financial assets comprising the PUF investment portfolio," Fitch analysts wrote.

Like other large endowment funds, the PUF's market value reached its lowest point of $8.3 billion in February. Since then, the value has grown by about 14%, with its July 31 market value representing about 81% of its peak year-end value of $11.7 billion on Aug. 31, 2007.

With this issue, the UT System, anchored by the flagship University of Texas at Austin, will have about $7.6 billion of debt outstanding. As of the system's last debt issue, the ratio was 56% fixed rate to 44% in variable rate, according to Moody's.

Under the Texas constitution, the system's total PUF debt may not exceed 20% of the cost value of the fund, not counting state lands that are part of the fund.

As of July 31, outstanding bonds and notes represented about 13.5% of the unaudited PUF cost value, well below the maximum threshold, Fitch analysts noted.

While the system is authorized under a current resolution to issue up to $400 million more in PUF debt by Aug. 31, 2010, it has no plans to do so, officials indicated.

The UT System and the Texas A&M University System are both allowed to issue bonds backed by annual distributions from the PUF. The UT System gets to use a two-thirds share of the funds, while Texas A&M is limited to a one-third portion. Distributions grow or shrink based on returns on PUF investments.

For fiscal 2008, the most recently audited period, the distribution to the so-called Available University Fund from the PUF came to $448.9 million.

The UT system's share was about $320.6 million and $11.3 million of investment earnings. That translated to a coverage ratio on PUF bonds of 3.2 times revenue to debt service requirements.

In the wake of a controversy over bonuses to UTIMCO executives and the abrupt resignation of its top executive, the UT Board of Regents last month drew up a new compensation plan that limits incentive payments in declining markets.

UTIMCO became the first external investment corporation formed by a public university when it was created in March 1996.

Under the new pay plan, the company's senior staff will have more of their pay at stake when investments fall. While executives previously had 30% of their incentive pay at risk due to market conditions, they will now have 50% in play.

If investment losses are 5% or more at the end of the year, investment experts could lose 14% or more of their compensation, possibly cutting incentive pay completely.

The carrot is a potential doubling of incentive pay if investments bring strong returns of 20% or more.

The changes followed a review of compensation practices, the university said.

"These changes came about after a very thoughtful and deliberate review process," said Regents' vice chairman Paul Foster, who also is a member of the UTIMCO board of directors.

Robert Rowling, former chairman of UTIMCO, dramatically quit his job in the middle of a legislative hearing last February after sharp criticism from Gov. Rick Perry and Lieut. Gov. David Dewhurst over the payment of $3.38 million in bonuses for fund managers.

The Republican leaders called the bonuses "irresponsible" in light of losses of 21% for the period between September and November of 2008.

Rowling explained that the bonuses were based on results before the decline and based on contracts.

The controversy paralleled national outrage over investment bankers' bonuses as the markets were collapsing, resulting in the demise of Lehman Brothers and the absorption of others by commercial banks.

Other universities with large endowments, particularly Harvard University, have also seen fund managers under attack for declining results.

Harvard alumni and faculty complained about executive compensation under Jack Meyer, who ran the endowment for 15 years, when assets soared to $25.9 billion from $4.7 billion. Meyer left in 2005 to start an investment firm.

The UT System is one of the nation's largest higher education systems, with nine academic campuses, six medical schools and more than 84,000 employees. It has an annual operating budget of $11.9 billion, including $2.5 billion in sponsored programs funded by federal, state, local and private sources.

Student enrollment exceeded 195,000 in the 2008 academic year. More than a third of Texas' undergraduate degrees come from UT campuses, and the medical schools supply about three-fourths of the state's health care professionals annually.

Under the new budget approved last month, the UT System's spending will rise 3.9%, or $446 million, over the previous fiscal year. But system chancellor Francisco G. Cigarroa characterized the plan as fiscally conservative amid the continuing recession.

"In developing this budget, the chancellor's office articulated to system administration executive staff and institution presidents the importance of fiscal conservatism and cost savings in the setting of an uncertain economic horizon," Cigarroa said in a prepared statement.

"Salaries for the chancellor, executive vice chancellors, vice chancellors, and presidents were frozen for this upcoming fiscal year, in addition to a flexible hiring freeze at the system administration."