Municipal bond buyers saw the last of the week’s new issues come to market on Thursday as the Bond Buyer’s 30-day visible supply dropped to a 2019-low of $2.2 billion ahead of the upcoming July 4 holiday week.

Primary market

Citigroup priced and repriced the Board of Regents of the University of Texas System’s (Aaa/AAA/AAA) $319.11 million of Series 2019B revenue financing system bonds.

The deal was repriced as 5s to yield 1.79% in 2029 and 2.80% in 2049.

"The demand for the UT BOE deal was solid, as it was oversubscribed by two to two and a half times," said one Texas trader. "The loan was non-call, very unique as we have not seen much duration paper away from the discounts."

He added that the 2049s, with the non-call, were bumped plus 49 basis points to the MMD scale.

"At plus 49, I would have thought the demand would have been more robust."

Thursday’s muni sales

Muni money market funds see inflows

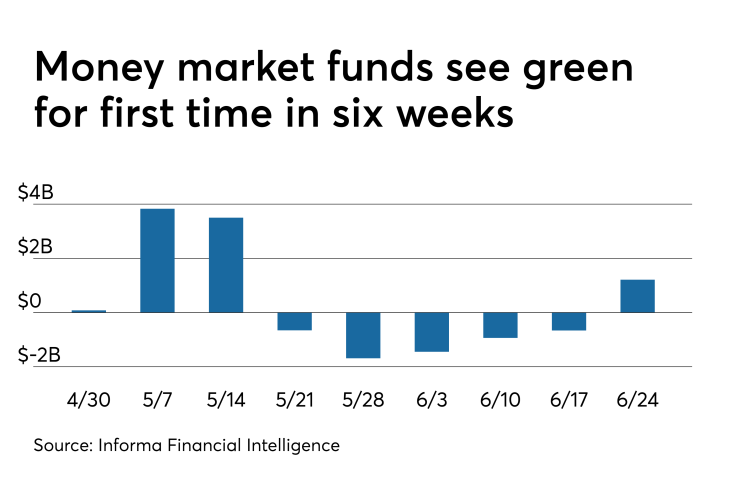

Tax-exempt municipal money market fund assets grew by $1.21 billion, with total net assets settling at $135.74 billion in the week ended June 24 according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds ballooned to 1.41% from 1.25% in the previous week.

Taxable money-fund assets increased $17.92 billion in the week ended June 25, bringing total net assets to $3.020 trillion, the second consecutive week that the taxable total has reached or exceeded $3 trillion in nearly a decade.

The average, seven-day simple yield for the 807 taxable reporting funds remained at 1.99% from the prior week.

Overall, the combined total net assets of the 994 reporting money funds rose $19.13 billion to $3.56 trillion in the week ended June 25.

Secondary market

Munis were little changed in late trade on the

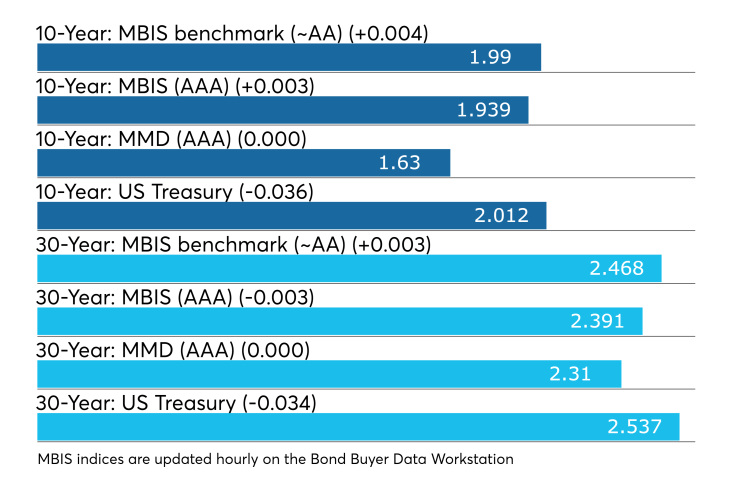

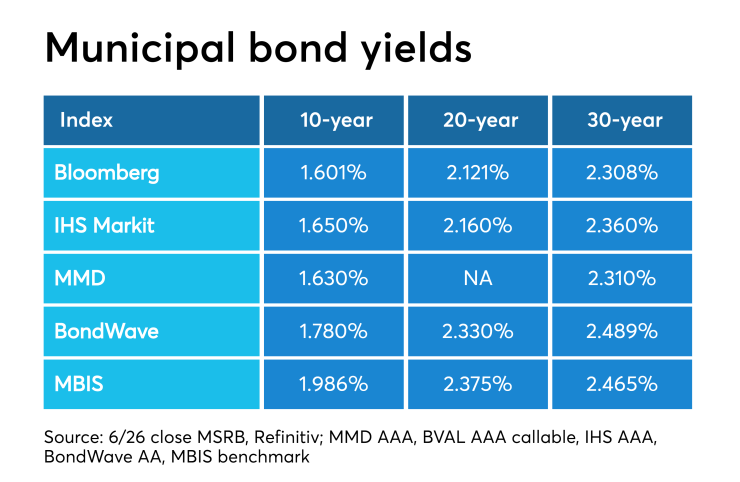

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on both the 10-year and 30-year GO remained unchanged at 1.63% and 2.31%, respectively.

“The muni market remains directionless with the ICE Muni Yield Curve unchanged from yesterday’s levels,” ICE Data Services said in a market comment. “High-yield and tobaccos are also quiet and unchanged. Taxables are down 2.5 basis points in the five-year maturities.”

The 10-year muni-to-Treasury ratio was calculated at 81.5% while the 30-year muni-to-Treasury ratio stood at 91.7%, according to MMD.

Treasuries were stronger as stocks were little changed. The Treasury three-month was yielding 2.141%, the two-year was yielding 1.737%, the five-year was yielding 1.765%, the 10-year was yielding 2.012% and the 30-year was yielding 2.537%.

Previous session's activity

The MSRB reported 39,888 trades Wednesday on volume of $14.55 billion. The 30-day average trade summary showed on a par amount basis of $12.82 million that customers bought $6.53 million, customers sold $4.19 million and interdealer trades totaled $2.11 million.

California, Texas and New York were most traded, with the Golden State taking 14.341% of the market, the Empire State taking 13.109% and the Lone Star State taking 10.428%.

The most actively traded security was the New York City Municipal water Finance Authority Series 2020AA revenue 4s of 2020, which traded 40 times on volume of $37.63 million.

All BB index yields drop

In the week ended June 27, the weekly average yield to maturity of the Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, fell to 3.70% from 3.72% the previous week.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields dipped one basis point to 3.50% from 3.51% the week before. It is at its lowest level since June 6, when it was at 3.48%.

The 11-bond GO Index of higher-grade 11-year GOs slipped one basis point to 3.04% from 3.05% the previous week. It is at its lowest level since June 6, when it was at 3.02%.

The Bond Buyer's Revenue Bond Index was one basis point lower to 3.99% from 4.00% the week before. It is at its lowest level in two weeks, when it was at 3.97%.

The yield on both the U.S. Treasury's 10-year note and 30-year Treasury were unchanged at 2.01% and 2.53%, respectively.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.