With claims against a giant wealth manager related to Puerto Rican bonds tapering off as the U.S. territory inches closer to a settlement lifting it out of bankruptcy, clients won a major award from the firm in FINRA arbitration.

UBS and UBS Puerto Rico must pay claimants Eugenia Fidalgo Gutierrez, Mercedes Fidalgo Gutierrez and Fidalgo Gutierrez Holding $4.8 million in damages and fees,

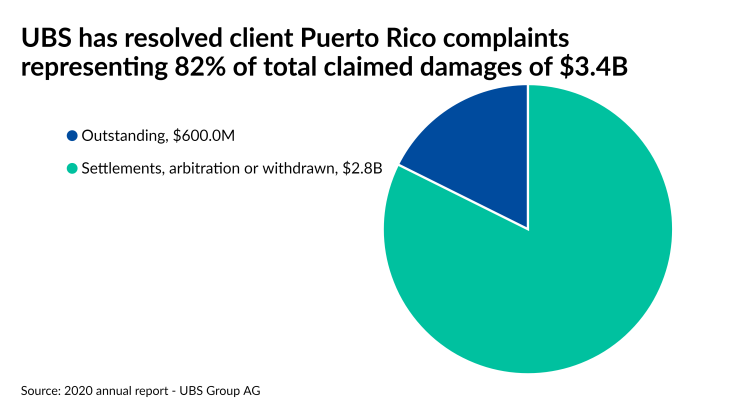

The wealth manager has resolved claims relating to the bonds and the closed-end funds representing more than 80% of the $3.4 billion in damages asserted by clients since 2015,

“Any time you have a risky security leveraged, it's a recipe for disaster,” O’Neal says, noting that some closed-end funds investors were levered at a 2-to-1 ratio and had an additional layer from non-purpose loans made with the bonds as collateral.

“It's a situation where, if anything went wrong in the Puerto Rico market, it would have dire consequences for clients who were concentrated in those investments and leveraged in those investments,” he added. “And that's exactly what happened.”

Even though the panel awarded a lower amount than the clients had requested, the wealth manager is “disappointed with the decision to award any damages, with which we respectfully disagree,” UBS spokesman Huw Williams said in a statement.

“The decision in this case was based on the facts and circumstances particular to these individual claimants, and is not indicative of how other panels may rule with regard to other customers who invested in similar products,” Williams said.

The clients had initially sought $15 million, the award shows. As is customary, the arbitrators didn’t explain how they came to their decision.

The clients’ lawyer, Francisco A. Feliu Nigaglioni, declined a request for comment on the case.

A week before the decision, the panel of three public arbitrators unanimously denied a UBS motion to dismiss the case based on the statute of limitations in the Securities Act of Puerto Rico. In the decision, one arbitrator dissented with respect to the panel’s award of damages for rescission. They also declined the firm’s request for expungement of two brokers’ records.

In a bitter irony for clients with big losses, the bonds have been

Bonds and closed-end funds linked to them had exceeded the returns of comparable products before Puerto Rico’s fiscal crisis, bringing income that’s exempt from estate and gift taxes. So, while Fitch Ratings’ last action on the U.S. territory after it defaulted on a debt service payment for its general obligation bonds in 2016 gave Puerto Rico a “D” rating, the agency last week

For its part, UBS settled cases in 2014 and 2015 with the SEC, FINRA and securities regulators in Puerto Rico, its annual report states. It also faces underwriter litigation, with four insurers seeking a combined $955 million.

Several thousand clients who owned Puerto Rican bonds and closed-end funds filed arbitration claims against UBS, Merrill Lynch of Puerto Rico, Santander Bank, Oriental Bank and Banco Popular. As the fund manager, UBS has garnered “by far” the most retail client claims of all those financial institutions, according to O’Neal, whose firm provides expert analysis and witness testimony in complex litigation. The situation reminds O’Neal of the hundreds of cases against Morgan Keegan after the financial crisis — claims that involved closed-end funds, too.

“What happens frequently is that brokers become enamored of a particular product and they begin to sell it to a large portion of their clients,” O’Neal says. “If it does blow up, you see an awful lot of cases that have similar facts behind them that are brought by former clients of the brokerage firms.”