The arrival of the third quarter brings with it less volatility and more opportunity as municipal managers forecast everything from reduced political and economic uncertainty to more defensive strategies and upside potential if municipals outperform.

Future expectations for lower rates and a steepening yield curve could create a “transitional phase” in the third quarter, according to managers like Reid Smith, director of fixed income strategies at Ziegler Capital Management LLC.

“We are potentially heading into a Fed easing cycle which is going to change the direction of the market,” he said, pointing to the expectations for a 25 to 50 basis-point easing by the Federal Reserve Board before year end.

“We are in a difficult economic conundrum,” he explained just before the close of the first half. “We are not seeing inflation or wage growth consistent with a lower unemployment market as we head into this third quarter.”

Smith, whose firm manages just under $2 billion in separately managed municipal assets for high net worth retail investors, expects much of the current political tension to ease in the next three months.

“We think a lot of the [previous] volatility was due to hesitation because of the political environment,” including trade talks with China, the hype over the 2020 presidential election and expectations for potential infrastructure legislation, he said.

That means there is less chance for an economic recession and more opportunity for the inflation rate to creep up to above the Federal Reserve Board’s target of 2% due to the strong employment market, Smith said.

“Wage growth will continue to push forward because of the expected reduction in the noise around the trade issues with China,” he added.

Moderate inflation could increase the pressure on the Federal Reserve to cut interest rates this year. Consumer prices barely rose in May, according to the Labor Department, which reported some evidence of inflation in rising rent and healthcare costs, which could give the central bank more time before easing monetary policy.

‘Boring,’ but promising

Others believe the municipal market will be largely unchanged from the first half — with strong market technicals and a solid economic foundation continuing in the third quarter.

“It’s kind of a boring repeat to the second quarter,” Jim Colby, senior municipal strategist and portfolio manager at Van Eck Securities, said on June 28.

He noted that municipal performance and flows were equally strong in the first half as evidenced by over 24 consecutive weeks of fund flows.

“I’m hard-pressed to say there are going to be any great changes that occur based on the last six months’ activity and the lack of any significant legislation or initiatives coming out of Washington,” he said.

Investors should take advantage of potential windows of opportunity based on Fed action and changing market technicals — both of which could create upside potential in the third quarter, managers said.

“We do believe that yields could move lower, and if munis begin to resume their outperformance over Treasuries, investors should pay attention to compelling entry points,” Jeffrey Lipton, head of municipal research and strategy and municipal capital markets at Oppenheimer & Co. wrote in a June 25 report.

Due to the consistently strong fund flows in the first half, Lipton believes demand will remain strong — even if municipals underperform.

“As we think about the second half of the year, we do so with great anticipation of higher returns compared to last year and favorable odds that ratios trend lower — although we are less certain that they breach the lows attained earlier,” Lipton wrote.

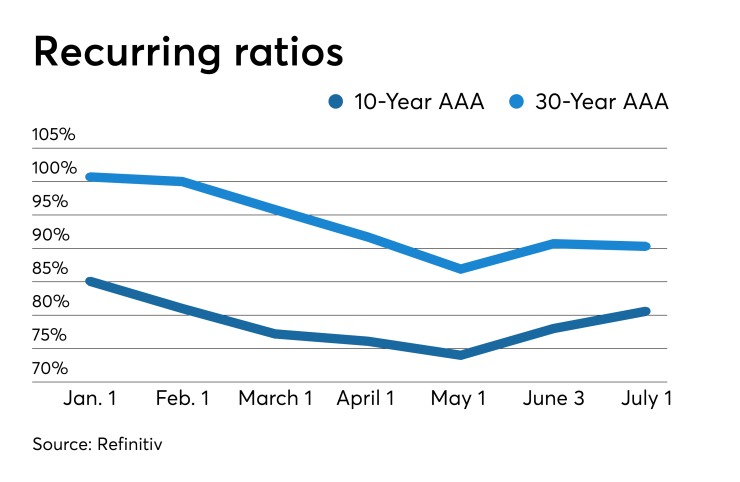

The municipal to Treasury ratio in 10 years was at 80.6% as of July 1, down from a maximum of 81.9% earlier this year, while the 30-year was at 90.3%, down from a maximum 92.4%, according to Refinitiv Municipal Market Data.

The Fed will rely on fresh rounds of economic data ahead of both the July and September policy meetings, he said.

“Although munis have lagged much of the June bond market rally, anticipated technicals could catalyze a reversal and investors should focus on nominal returns,” Lipton added. “Year-to-date, the Bloomberg/Barclays muni index shows just over a 5% return, which is already better than our initial target of 3% to 5%, and we think there is upside potential from here.”

Summer Strategy

Managers say given the economic and rate forecast, the best strategy for the third quarter includes focusing on quality, maintaining the proper structure and duration, and avoiding risk on the long end of the yield curve.

Smith recommends investors maintain a barbell strategy — focused on the two to three-year slope of the yield curve out to as long as 12 to 15 years — with callable paper to provide the best combination of income as well as principal stability.

“The yield curve is very flat and investors are not being paid a lot of additional income to extend,” he explained.

The triple-A general obligation benchmark scale has declined by over 60 basis points since the start of the year. On Tuesday, the 30-year triple-A GO yielded 2.31%, down from 2.99% on Jan. 2, according to Refinitiv.

The spread between the one and five-year triple-A GO scale is just six basis points, while on the long-end investors only earn 19 basis points of additional yield for extending from 20 to 30 years, according to Refinitiv.

Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management, advised investors to take the opportunity to upgrade in credit quality and search for some relative value on the longer end of the curve — but he is advocating the 12- to 14-year range as the sweet spot.

“It’s always better to sell into strength than weakness,” he said, adding that higher coupons with shorter calls can provide a yield advantage if they are held to maturity.

The intermediate range of the curve is recommended for those investors that depend on income, want the potential for roll down and capital appreciation — and want to avoid being crowded out on the short end, according to Heckman.

He said investors should also diversify their portfolios by issuer and maturity to gain the proper yield curve and duration management. “I frankly don’t hear enough of that in our industry,” he said.

Turning up the Volume?

The supply-demand imbalance in the first half was unparalleled compared to recent years, but at least one municipal manager said the third quarter could see some supply improvement with the passing of market and political interference.

“With no infrastructure finance legislation coming out of Congress for the remainder of this year that will bring more supply in the summer months than usual,” Smith said.

Lipton said the low-rate environment could prompt a burst of issuance at a time when supply is tapering off from early June levels and cyclical reinvestment needs coincide with “typically lighter” summer issuance.

“Increasingly compelling tax-exempt borrowing terms could bring the fringe issuer seeking to address pressing capital needs and lock in low fixed interest rates into the market,” Lipton wrote.

At the same time, political events and data announcements could impact the Fed’s decision-making and contribute to volume deceleration in the third quarter, Peter Block, managing director of credit strategy at Ramirez & Co., said in a June 24 weekly report.

Year-to-date gross supply is up by 6% year over year at $159 billion, however, down 8% versus the five-year average, Block noted.

As of Tuesday, 30-day visible supply of municipal bonds totaled $4.563 billion, which is up $780.8 million from the previous session, according to Bond Buyer data.

Block predicts if the arrival of $30 billion in gross supply a month pans out, “actual net supply should remain price-supportive at negative $11 billion in June, negative $14 billion in July, and negative $19 billion in August when reinvestment peaks.”

Demand Steady But Tapered

The additional marginal demand seen earlier this year as investors impacted by the removal of state and local tax deductions flooded the municipal market will begin to taper off in the next three months, Smith said.

Besides the lack of yield compensation, the expectation for less attractive ratios of municipals to Treasuries — especially in 15 years and longer — should moderate municipal flows, he predicted. “I think unless there’s a spook about rates not dropping and the economy accelerating to the point where the Fed considers raising rates, I don’t see that [demand] pace being maintained — but there will still be money flowing in,” Heckman agreed. “Demand is not going to wane.”

Other managers believe the imbalance will continue in the third quarter — even if supply faces continued challenges and the insatiable demand abates.

Colby of Van Eck doubts the calendar will build with any significant consequential issues in the third quarter, and said the market can easily handle issuance if it remains at an average of $5 billion a week as it did in the second quarter.

Like Colby, Heckman expects continued strong municipal performance in the third quarter, but little acceleration in supply.

“The market is not generating enough issuance to meet demand and rolloff of maturities and calls,” he said.

He noted that mutual funds are holding a record high of $740 billion of municipal debt and households are holding individual bonds near record levels.

“I think it’s still an environment where municipalities are fiscally conservative because they are hit with other headwinds, like pension liabilities and costs,” Heckman said of the continued scarce supply.

In addition, voters “are not too engaged with higher taxes so getting bonds approved is challenged in some areas,” while fiscal austerity is also playing a role in keeping issuance down, he pointed out.

With strong property and sales tax revenues, municipalities “might not feel the need to issue,” Heckman added. However, with the low rates and tight ratios, he believes it is a perfect environment for issuers to sell tax-exempt bonds.

Defensiveness and Decision-Making

With the potential for lower rates and the political and economic uncertainty, other managers said investors will likely remain skittish and defensive in the third quarter as they adjust to the changing market environment.

"With the expectation for Fed rate cuts of 50-plus basis points, the money market funds will most likely lose assets as rates tumble and investors seek more yield," Peter Delahunt, managing director of municipals at Raymond James & Associates said as June came to a close.

"That said, many investors aren’t comfortable locking into longer rates, so this gives them another year to cogitate their options."

Despite the supply challenges, Colby said municipals are still worthy of participation from traditional and non-traditional investors.

“We have some investors outside the domain of the 50 states looking at the muni asset class as an attractive alternative to places that have negative interest rates,” he explained.

Denmark, Japan, and Switzerland are among the countries that currently have negative interest rates.

Lipton said the appeal of taxable municipals has extended to foreign buyers who are not seeking tax-efficiency, but strategizing to boost investment performance by investing in U.S. infrastructure.

“Current patterns of declining — and cheaper — hedging costs may produce more compelling interest in munis from these non-traditional, foreign buyers and this becomes more evident as the Fed reduces interest rates,” Lipton wrote.

Taxable munis offer yield and duration as well as portfolio diversification, while being able to offset long-dated risk, he added.

“It’s still a good time for investors to strongly consider the muni asset class” and stay the course in the second half since municipals continue to offer liquidity, credit quality, and low default rates, Colby said.

Smith of Ziegler said with a changing market comes volatility — but that volatility means opportunity.

He advised individuals facing investment decisions in the next three months to be nimble, own insured securities, and keep some powder dry for unforeseen events.

“Investors should do this in order to be able to invest and length duration or risk as the market changes and we get more visibility into the long term future,” Smith added.