Top-shelf muni yields are unchanged around lunchtime according to traders, as the market is seeing a multitude of pricings coming in non-stop.

Secondary market

The yield on the 10-year benchmark muni general obligation was steady at 1.92% from Monday, while the 30-year GO yield was unchanged from 2.78%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker Tuesday around midday. The yield on the two-year Treasury was up to 1.44% from 1.42%, the 10-year Treasury yield increased to 2.23% from 2.21% and the yield on the 30-year Treasury bond rose to 2.78% from 2.76%.

On Monday, the 10-year muni-to-Treasury ratio was calculated at 86.6% compared with 85.0% on Friday, while the 30-year muni-to-Treasury ratio stood at 100.7% versus 99.5%, according to MMD.

Primary market

Issuance started pouring in on Tuesday, on what will end up being the busiest day of the week.

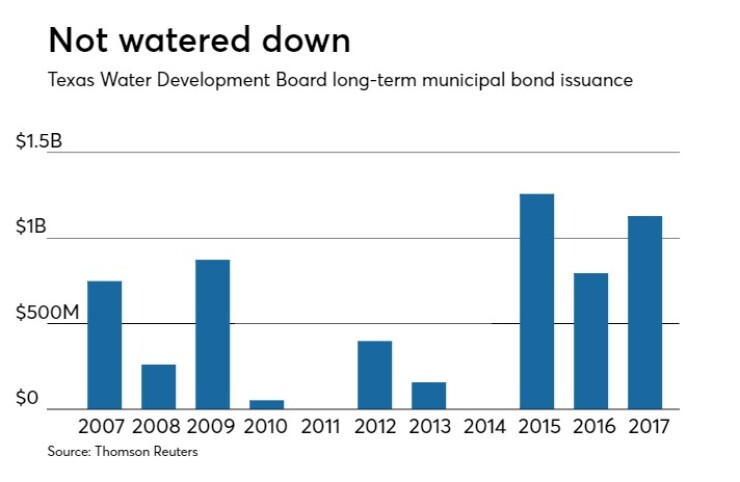

Morgan Stanley priced the Texas Water Development Board’s $1.05 billion of State Water Implementation Revenue Fund for Texas bonds on Tuesday. The bonds are priced to yield from 0.94% with a 5% coupon in 2019 to 3.14% with a 4% coupon in 2038. A term bond in 2042 was priced to yield 3.24% and 2.91% with 4% and 5% coupons in a split maturity. A term bond in 2047 was priced to yield 3.31% and 2.98% with 4% and 5% coupons in a split maturity. A term bond in 2052 was priced to yield 3.41% with a 4% coupon. The 2018 maturity was offered as a sealed bid. The deal is the largest in the board’s history and carries ratings of triple-A from S&P Global Ratings and Fitch Ratings.

Since 2007, the TWDB has sold about $5.76 billion of securities, with the most issuance in 2015 when it sold $1.26 billion. The board did not come to market in 2011 or 2014.

Raymond James priced the New York City Municipal Water Finance Authority’s $384.14 million of water and sewer system second general resolution revenue bonds for institutional investors after a retail order period on Monday. The $219.245 million of fiscal 2018 series BB, subseries BB-1 bonds were priced to yield from 3.45% and 3.01% with 3.375% and 5% coupons in a split 2045 maturity to 3.02% with a 5% coupon in 2046.

The $164.895 million of subseries BB-2 bonds were priced to yield from 2.17% with a 5% coupon in 2028 to 2.54% with a 5% coupon in a split 2032. The deal is rated Aa1 by Moody’s Investors Service and AA-plus by S&P and Fitch.

Bank of America Merrill Lynch priced New Jersey Turnpike Authority’s $579 million of revenue SIFMA LIBOR indexed bonds. The $31.05 million of Series 2017C-1 bonds were priced to about 40 basis points above the 1-month LIBOR in a bullet 2021 maturity.

The $32.775 million of Series 2017C-2 bonds were priced about 50 basis points above the 1-month LIBOR in a bullet 2022 maturity.

The $34.575 million of Series 2017C-3 bonds were priced about 60 basis points above the 1-month LIBOR in a bullet 2023 maturity.

The $36.475 million of Series 2017C-4 bonds were priced about 70 basis points above the 1-month LIBOR in a bullet 2024 maturity.

The $150 million of Series 2017C-5 bonds were priced about 50 basis points above the 1-month LIBOR in a bullet 2028 maturity, with a soft PUT and a tender date of Jan. 1, 2021.

The $115.125 million of Series 2017C-6 bonds were priced about 80 basis points above the 1-month LIBOR in a bullet 2030 maturity, with a soft PUT and a tender date of Jan. 1, 2023.

The $129.375 million of Series 2017D-1 bonds were priced about 70 basis points above the 1-month LIBOR in a bullet 2024 maturity.

The $16.075 million of Series 2017D-2 bonds were priced about 50 basis points above the 1-month LIBOR in a bullet 2022 maturity.

The $16.675 million of Series 2017D-3 bonds were priced about 60 basis points above the 1-month LIBOR in a bullet 2023 maturity.

The $17.25 million of Series 2017D-4 bonds were priced about 70 basis points above the 1-month LIBOR in a bullet 2024 maturity. The deals are rated A2 by Moody’s, A-plus by S&P and A by Fitch.

Bank of America Merrill Lynch priced Oregon’s $577.795 million tax anticipation notes for institutions. The notes were priced to yield 0.97% with a 5% coupon. The TANs are rated MIG 1 by Moody’s, SP-1-plus by S&P and F1-plus by Fitch.

Citi priced the City and County of Denver, Colo.’s $250.575 million special facilities airport revenue refunding bonds for the United Airlines project. The bonds were priced to yield 3.40% with a 5% coupon in a bullet 2032 maturity. The deal is rated BB-minus by S&P.

On the competitive side, Washington sold a total of $528.81 million in three separate sales.

Citi won the largest of the three, $435.025 million of general obligation various purpose motor vehicle fuel tax bonds with a true interest cost of 3.36%. The bonds were priced to yield from 1.31% with a 5% coupon in 2022 to 2.94% with a 5% coupon in 2042.

Wells Fargo won the Evergreen State’s $36.725 million of taxable GO refunding various purpose motor vehicle fuel tax bonds with a TIC of 1.75%. No pricing information was immediately available.

Morgan Stanley won the third sale of $57.06 million with a TIC of 1.22%. No pricing information was immediately available. All three deals are rated rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Elsewhere, the Massachusetts Bay Transportation Authority sold a total of $512.775 million in three separate sales.

JP Morgan won the $281.7 million of subordinate sales tax sustainability bonds with a TIC of 1.37%. No pricing information was immediately available.

Wells won the $130.92 million with a TIC of 3.61%. The bonds were priced to yield from 1.81% with a 5% coupon in 2025 to 2.97% with a 5% coupon in 2046.

Citi won the $100.145 million with a TIC of 3.61%. The bonds were priced to yield from 1.78% with a 5% coupon in 2025 to 2.88% with a 5% coupon in 2042. A term bond in 2044 was priced to yield 2.93% with a 5% coupon. A term bond in 2046 was priced to yield 2.95% with a 5% coupon. The deals are rated Aa3 by Moody’s and AA by S&P.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 33,574 trades on Monday on volume of $5.778 billion.

Bond Buyer reports 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $3.032 billion to $16.24 billion on Tuesday. The total is comprised of $5.95 billion of competitive sales and $10.29 billion of negotiated deals.