DALLAS – After vetoing $120 million in proposed spending, Texas Gov. Greg Abbott has signed a $217 billion state budget into law.

Abbott’s signature on Senate Bill 1 concludes the main business of the 85th regular session of the Texas Legislature, but the Republican governor has called a special session in July that is tasked with a wide array of issues, ranging from school bathroom gender assignment to property tax relief.

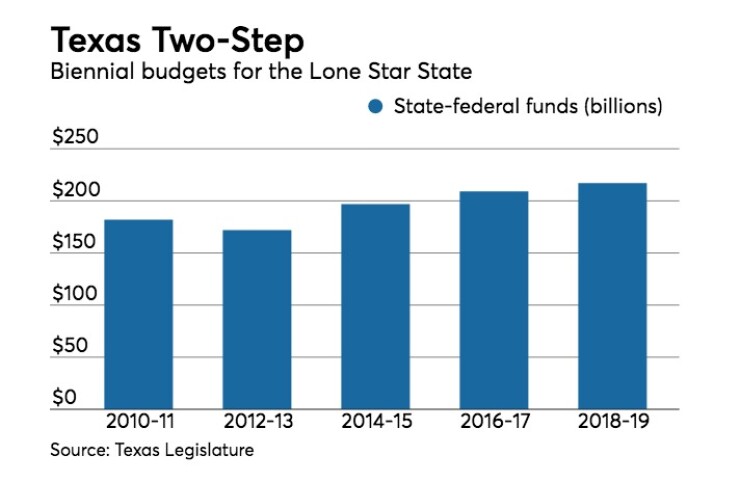

Abbott said the 3.8% increase in state and federal spending over the next two years fulfills his expectations for fiscal restraint while maintaining a spending pace with the state’s growth.

“I am once again signing a budget that addresses the most pressing challenges faced by our state,” Abbott said in a written signing statement. “This budget funds a life-saving overhaul of Child Protection Services, continues to fund the state’s role in securing our border, and ensures that the workforce of today and tomorrow have the resources they need to keep Texas’ economy growing and thriving. Lastly, this budget restrains state-controlled spending below the growth in the state’s estimated population and inflation.”

Among the measures vetoed was a bill designed to improve the quality of life in the state’s border “colonias,” impoverished settlements near the Rio Grande that don’t conform to building codes and often lack water and sewer services.

But Abbott praised the budget bill for continuing to spend $800 million for additional border security beyond that provided by the federal government.

“Even in a tight budget climate, this budget prioritizes the safety and well-being of all Texans,” Abbott said. “It continues to fund our state’s role in securing the border, adding an additional 250 troopers to keep our communities safe.”

The budget for the next two fiscal years beginning Sept. 1 comes as the state continues to rebound from a dip in revenues over the past year.

Texas Comptroller Glenn Hegar reported earlier this month that state sales tax revenue of $2.5 billion in May represented a 4% increase over the same month in 2016.

“State sales tax collections in May indicate a Texas economy expanding at a moderate pace,” Hegar said. “Growth in sales tax revenue occurred across most major industry sectors, including oil- and gas-related sectors. Only the construction sector showed a slight decline.”

Hegar also said state franchise tax revenue for fiscal year 2017 totaled $3.2 billion in May, which is 8.9% less than in May 2016.

Total sales tax revenue for the three months ending in May 2017 is up 3.2% compared to the same period a year ago. Sales tax revenue is the largest source of state funding for the state budget, accounting for 56% of all tax collections. Motor vehicle sales and rental taxes, motor fuel taxes and oil and natural gas production taxes also are large revenue sources for the state.

Motor vehicle sales and rental taxes were down 1.1% while motor fuel taxes rose 6%, Hegar said.

Oil and natural gas production taxes of $267 million were up 79.9% from May 2016, despite a slump in oil prices that began three years ago. The increase is due in part to refunds provided to natural gas severance taxpayers in May 2016, which resulted in artificially low tax collections during that period, Hegar said.