DALLAS — A combination of falling tax revenue, increased demand for state services, and the lack of federal stimulus funds could result in Texas lawmakers having up to $18 billion less to appropriate for the next two-year budget cycle.

Wayne Pulver, assistant director of the Legislative Budget Board, told members of the House Appropriations Committee on Tuesday that the gap between expected expenditures and available funds would be $15 billion to $18 billion in fiscal 2012 and fiscal 2013.

Texas operates on a two-year budget. Lawmakers will convene early next year to develop the budget for fiscal 2012 and 2013.

Pulver said revenue over the next two years would be $3.5 billion less than is expected in the current budget cycle, which ends Aug. 31, 2011. In addition, he said, lawmakers in 2009 allocated $5.6 billion in one-time revenue that will not be available next year.

Pulver said the state benefited from $6.4 billion in federal stimulus funds in the current budget, which will not be available in fiscal 2012. The stimulus total included $3.2 billion for local public education.

Increased health care costs and more demand for state social services due to the weak economy could result in a two-year shortfall that exceeds the rainy-day fund by several billion dollars, according to Pulver. The next state revenue forecast will not be developed until January 2011.

“You cannot increase appropriations if the revenues are not there,” he told the committee. “You can transfer some expenditures and transfers from the end of fiscal 2011 into fiscal 2012, but the budget must be in balance by the end of the cycle.”

Rep. Jim Pitts, R-Waxahachie, chairman of the Appropriations Committee, said the solution to the revenue problem will likely include “revenue enhancement” as well as cuts in state agency budgets.

Asked to define what he meant by revenue enhancements, Pitts said another House committee is looking at a number of tax exemptions that cost the state approximately $1 billion a year.

House Speaker Joe Straus, R-San Antonio, told the committee that lawmakers would have to make tough decisions in developing a two-year budget that is balanced without new tax revenues.

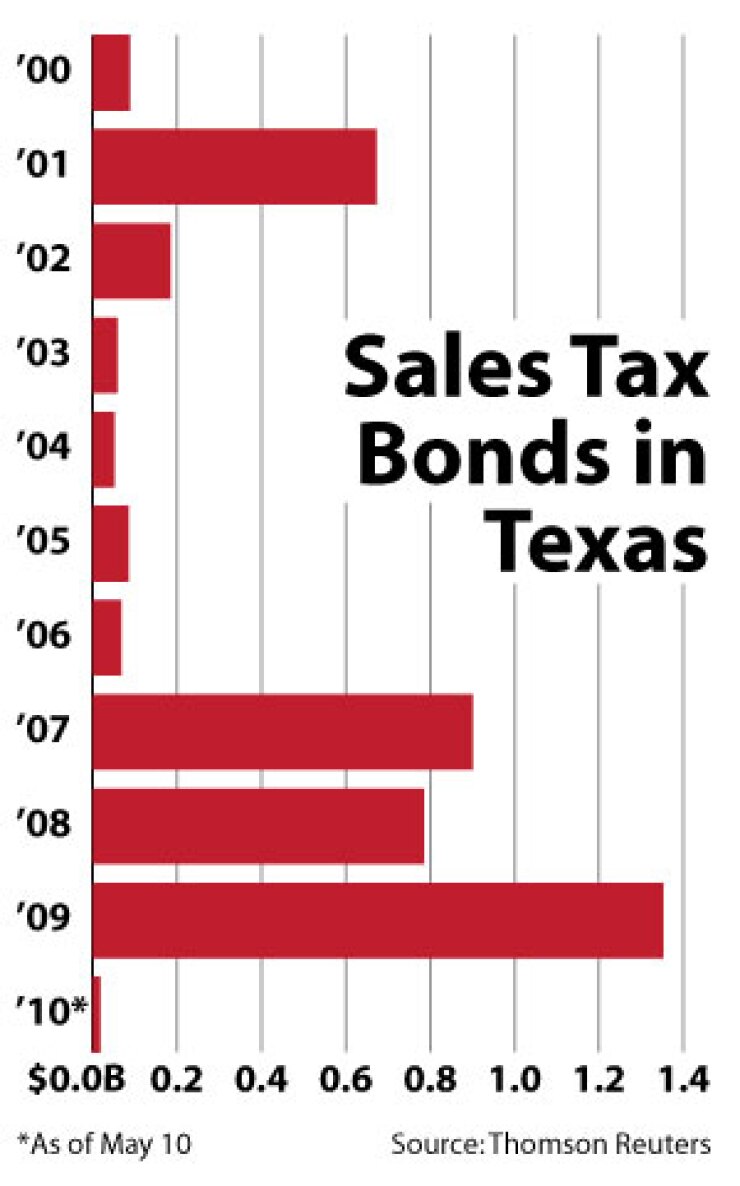

“You will have to consider a blanket moratorium on new state services,” Straus said. “We may have to stop issuing bonds because of the increasing costs associated with new debt.”

John Hellerman, chief revenue estimator in the state comptroller’s office, said the rainy-day fund is expected to total $8.2 billion by the beginning of fiscal 2012. He said that is based on the current fund balance of $7.6 billion, an expected $400 million transfer due to higher-than-expected revenues from the severance tax on oil, and interest earned by the fund.

Sales tax collections, which provide 60% of the general fund, are $1 billion less than expected, Hellerman said. Attaining the expected revenue level by the end of fiscal 2010 would require an increase in monthly collections of 20%, he said.