Favorable interest rates and demand for municipal bonds mixed with concern over international trade conflicts, making for a typically slow Monday in the muni market, traders said. In the primary, retail buyers got first shot at New York City’s big general obligation bond sale.

“This week's calendar is relatively light and technicals should favor the muni market,” said Peter Delahunt, managing director of municipals at Raymond James & Associates. “Municipal-to-Treasury ratios have traded in a fairly tight range over the past three months and should continue without any sign of change on the technical front in the near future,” he said on Monday afternoon.

“Secondary activity continues to be somewhat lethargic as investors are guarded from decision making while trade talk remains uncertain and anxieties run high,” Delahunt added.

Muni market participants will also see about $4.8 billion of new issues come to market this week in a calendar consisting of $3.99 billion of negotiated deals and $813 million of competitive sales.

Citigroup priced the city’s $850 million of Fiscal 2018 Series F Subseries F-1 tax-exempt general obligation bonds for retail investors on Monday. Underwriters will hold a second retail order period on Tuesday ahead of the institutional pricing on Wednesday. NYC is also competitively selling $133.49 million of Fiscal 2018 Series F Subseries F-2 taxable) GOs and $116.51 million of Fiscal 2018 Series F Subseries F-3 taxable GOs on Wednesday.

Proceeds from the sale will be used to fund capital projects, with the exception of about $64 million, which will be used to convert some outstanding floating-rate bonds into fixed-rate bonds. The deals are rated Aa2 by Moody’s Investors Service and AA by S&P Global Ratings and Fitch Ratings.

On Tuesday, Barclays Capital is set to price the California Statewide Communities Development Authority’s $100 million of Series 2018 revenue bonds for the Huntington Memorial Hospital. The deal is rated A-minus by S&P.

Monday’s bond offering

New York:

Prior week's actively traded issues

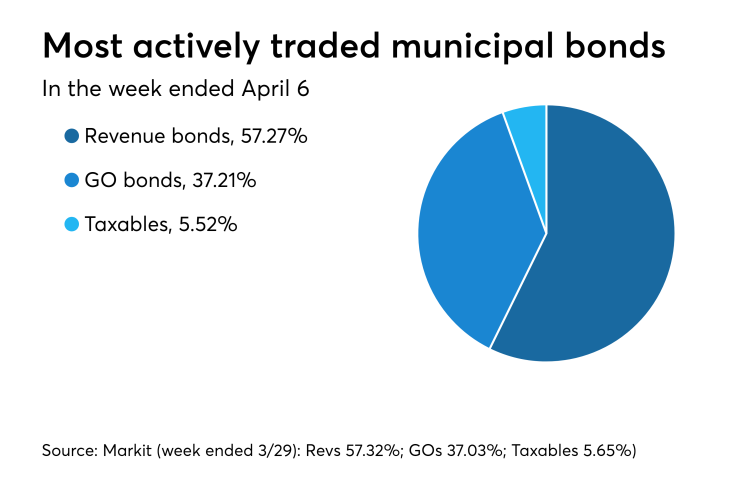

Revenue bonds comprised 57.27% of new issuance in the week ended April 6, down from 57.32% in the previous week, according to

Some of the most actively traded bonds by type were from Kansas, New Jersey and Idaho issuers.

In the GO bond sector, Wichita, Kan., 1.75s of 2019 traded 36 times. In the revenue bond sector, the N.J. Tobacco Settlement Financing Corp. 5s of 2046 traded 154 times. And in the taxable bond sector, the Idaho Building Authority 4.124s of 2039 traded 13 times.

Previous session's activity

The Municipal Securities Rulemaking Board reported 36,014 trades on Friday on volume of $10.05 billion.

California, Texas and New York were the states with the most trades, with the Golden State taking 15.167% of the market, Lone Star State taking 12.595%, and the Empire State taking 9.348%.

Prior week's top underwriters

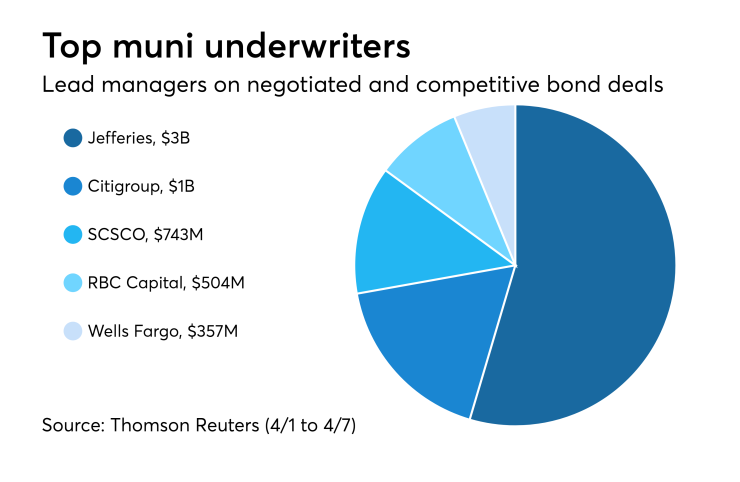

The top municipal bond underwriters of last week included Jefferies, Citigroup, Siebert Cisneros Shank & Co., RBC Capital Markets and Wells Fargo Securities, according to Thomson Reuters data.

In the week of April 1 to April 7, Jefferies underwrote $3.15 billion, Citi $1.0 billion, SCSCO $742.5 million, RBC $504.0 million and Wells Fargo $357.4 million.

Treasury to sell $45B of 4-week bills

The Treasury Department said Monday it will sell $45 billion of four-week discount bills Tuesday. There are currently $84 billion of four-week bills outstanding.

Treasury sells discount bills

Tender rates for the Treasury Department's latest $48 billion of 91-day and $42 billion of 182-day discount bills were lower.

The three-months incurred a 1.715% high rate, down from 1.740% the prior week and the six-months incurred a 1.880% high rate, off from 1.905% the week before. Coupon equivalents were 1.746% and 1.924%, respectively. The price for the 91s was 99.560167 and that for the 182s was 99.036917.

The median bid on the 91s was 1.680%. The low bid was 1.650%. Tenders at the high rate were allotted 5.27%. The bid-to-cover ratio was 2.92.

The median bid for the 182s was 1.850%. The low bid was 1.830%. Tenders at the high rate were allotted 45.47%. The bid-to-cover ratio was 3.04.

Gary Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.