The first of the week’s new-issue slate sold on Tuesday as millions of dollars of bonds hit the market in a wave led by issuers from Michigan, California and Ohio.

Primary market

JPMorgan Securities priced the Michigan Finance Authority’s (A1/NR/AA-) $599.805 million of Series 2019A hospital revenue bonds for McLaren Healthcare.

Goldman Sachs priced and repriced the Los Angeles Department of Airport’s (Aa3/AA-/AA-) $427.305 million of subordinate revenue bonds consisting of Series 2019D bonds subject to the alternative minimum tax and Series 2019E non-AMT bonds.

JPMorgan priced for retail the New York City Housing Development Corp.’s (Aa2/AA+/NR) $490.595 million of Series 2019 E-1 and E-2 multifamily housing revenue sustainable neighborhood bonds.

Morgan Stanley priced the Cerritos Community College District of Los Angeles County, California’s (Aa2/AA/NR) $100 million of Series 2019C Election of 2012 general obligation bonds.

BofA Securities priced Riverside County, Calif.’s (NR/SP1+/F1+) $340 million of Series 2019 tax and revenue anticipation notes.

Ohio (Aa1/AA+/AA+) competitively sold $300 million of Series 2019A higher education unlimited tax GOs. BofA Securities won the bonds with a true interest cost of 2.9026%.

Proceeds will be used to pay for higher education. Acacia Financial Group was the financial advisor; Frost Brown was the bond counsel.

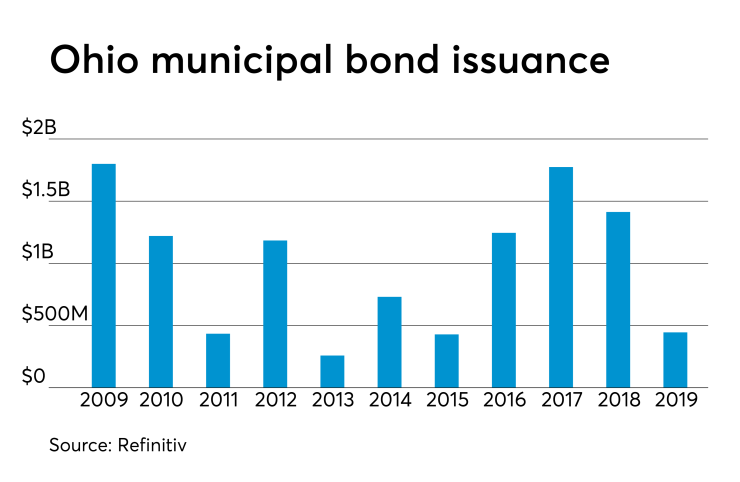

Since 2009, the state has sold about $11 billion of bonds, with the most issuance occurring in 2009 when it sold $1.8 billion. It sold the least amount in 2013 when it issued $258.6 million.

The Santa Clara County Financing Authority (NR/AA+/AA) sold $249.24 million of Series 2019A county facilities lease revenue bonds. Citigroup won the bonds with a TIC of 2.9749%.

Proceeds will be used for costs related to the purchase of Acquired Health Facilities. KNN Public Finance was the financial advisor; Orrick Herrington was the bond counsel.

Pennsylvania State University (Aa1/AA/NR) came to market with two competitive issues totaling $226 million.

Citigroup won the $119 million of Series 2019B taxable revenue bonds with a TIC of 3.2843%. UBS Financial won the $107 million of Series 2019A tax-exempt revenue bonds with a TIC of 3.3143%.

Proceeds will be used for university projects. PFM Financial Advisors was the financial advisor; Greenberg Traurig was the bond counsel.

Tuesday’s bond sales

Secondary market

Munis were weaker on the

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year GO rose two basis points to 1.65% and the yield on the 30-year muni increased two basis points to 2.35%.

The 10-year muni-to-Treasury ratio was calculated at 76.9% while the 30-year muni-to-Treasury ratio stood at 89.7%, according to MMD.

Treasuries were stronger as stocks traded higher. The Treasury three-month was yielding 2.279%, the two-year was yielding 1.930%, the five-year was yielding 1.912%, the 10-year was yielding 2.139% and the 30-year was yielding 2.615%.

"The high-grade market is slightly weaker today as yields follow U.S. Treasuries yields higher. The curve is flattening by approximately two basis points," ICE Data Services said in a market comment. "One to three-year yields are three to four basis points higher while five-years and out are up one to three basis points. High-yield munis are having a quiet day with yields about one basis point higher across the curve."

Previous session's activity

The MSRB reported 33,928 trades Monday on volume of $8.74 billion. The 30-day average trade summary showed on a par amount basis of $12.52 million that customers bought $6.18 million, customers sold $4.22 million and interdealer trades totaled $2.13 million.

California, Texas and New York were most traded, with the Golden State taking 14.217% of the market, the Lone Star State taking 12.236% of the market, and the Empire State taking 9.409%.

The most actively traded security was the Maryland Series 2018A GO 5s of 2030, which traded six times on volume of $30 million.

No cure in sight

The forces of supply and demand continue to collide in the municipal market as consistent fund flows remain robust and visible volume is nothing to write home about, municipal experts said Tuesday.

“The chronic supply-demand imbalance should maintain tight absolute levels through at least year-end,” Peter Block, managing director of credit and market strategy at Ramirez & Co., said in a Monday report.

He also noted that the imbalance continues to be exacerbated by heavy and unrelenting inflows. Tax-exempt mutual funds reported inflows for the 22nd consecutive week with inflows of $793 million for the week ended June 5, compared to the 12-week moving average of a $1.17 billion inflow, he said.

“We expect reinvestment — maturities, calls, and some coupons — to add to the supply deficit as reinvestment peaks during this period,” he explained.

He also estimated significant positive “net” reinvestment flows — or surplus demand — totaling $67 billion in June through August. That consists of the addition of $17 billion in June, $21 billion in July, and $28 billion in August, Block said.

“Over the next 30 days, we see net muni market supply at negative $34.32 billion,” Block wrote. The supply consists of $12.29 billion in new issues, $34.12 billion in maturing bonds, and $12.48 billion in announced calls, Block added that the states that stand to experience the largest change in outstanding debt include California with $7.79 billion; New York with $5.85 billion; New Jersey, $3.98 billion; Florida, $2.48 billion; and Arizona, $2.12 billion.

Gross supply for this week ramps up significantly to $10.3 billion or an additional 62% versus the 12-week average, including $6.7 billion of negotiated and $3.6 billion competitive volume. Year-to-date gross supply is $139 billion, or an additional 2% year over year — and down 12% versus the five-year average.

“Yearto-date gross supply remains relatively in-line with our full-year 2019 projection of plus-8% year over year,” which is a projected total of $341.8 billion, Block said.

The 30-day visible net supply is down $34.3 billion, composed of $12.3 billion new-issue, compared with the loss of $46.6 billion of maturing bonds that amount to $34.1 billion and called bonds resulting in the loss of $12.5 billion.

The firm remains active in the market and recommends an intermediate-long strategy between 11 and 30 years that consists of selling short calls and buying long calls to capture between 70% and 90% of the yield curve and incremental spread.

“We like high-quality AAA and AA tax-exempts with long calls 6-10 years versus short calls 1-2 years, which are trading virtually on top of the MMD scale mostly due to the relentless flattening of 2s and 10s by 21 basis points since Jan. 1 to only 29 basis points,” Block said in the report. “Longer calls generate meaningful yield pickup given MMD 10s and 20s has been largely range-bound since Jan. 1 at 50 basis points,” he added.

Treasury to sell $40B 4-week bills

The Treasury Department said it will sell $40 billion of four-week discount bills Thursday. There are currently $35.000 billion of four-week bills outstanding.

Treasury also said it will sell $35 billion of eight-week bills Thursday.

Treasury auctions 3-year notes

The Treasury Department auctioned $38 billion of three-year notes with a 1 3/4% coupon at a 1.861% high yield, a price of 99.678063. The bid-to-cover ratio was 2.62.

Tenders at the high yield were allotted 94.89%. All competitive tenders at lower yields were accepted in full. The median yield was 1.838%. The low yield was 1.388%.

Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.