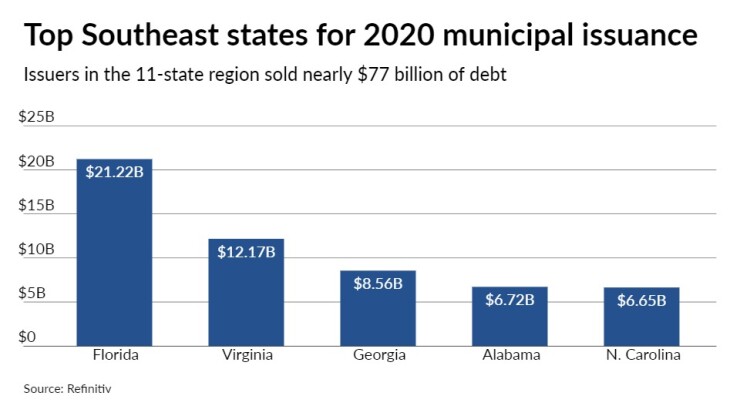

Municipal bond issuers in the Southeast sold $76.91 billion of bonds in 1,152 issues in 2020, putting volume slightly ahead of 2019, according to Refinitiv data.

The 1.6% volume boost in the 11-state region trailed the national increase of 14.3%, which set an all-time record of $483.64 billion in 13,273 deals in a year indelibly marked by the coronavirus pandemic.

Expect fundamental shifts in the region to drive issuance higher in the long run, according to John Mousseau, president, CEO and director of fixed income at Cumberland Advisors.

“The Southeast — Florida, Georgia, the Carolinas, they will continue to see migration of Northeast citizens — [because of] retirement and taxes,” Mousseau said. “On top of that, the red states are turning more blue, which probably means more spending down the road and hence more issuance.”

North Carolina, for example, in November re-elected a Democratic governor, while Georgia voted for Joe Biden in November and sent two Democrats to the Senate in January.

In 2020, issuers from Florida made it the fourth largest source of municipal bonds nationally and the largest in the Southeast.

In September, it recorded the region's

Proceeds went to bolster the state’s Hurricane Catastrophe Fund.

"It is quite clear that issuers in the region have taken advantage of the low-rate environment," said John Hallacy, founder of John Hallacy Consulting LLC. "The Cat Fund is in the market on a regular basis and is very careful about trying to tap the market when the best rate is available."

Ben Watkins, a member of the corporation's board and director of Florida's Division of Bond Finance, told The Bond Buyer Tuesday that a variety of factors drove the deal's success.

“Our strategy on this deal was a little bit different. Some of the previous transactions we had executed for Cat Fund had been tax-exempt in the 2005-06 era when we blew out the fund from six hurricanes in two years and we have done pre-event deals which we do on a taxable basis, which was what this was, for liquidity purposes.”

Prior to this deal, Watkins said the reception from the investor community had been mixed.

He attributed this to “a misunderstanding regarding what a Cat Fund is and what it is not. This is fundamentally a muni credit secured by taxes on insurance policies."

Watkins said the underwriter did a good job in lining up nearly 40 one-on-one calls with investors ahead of the sale and that they had over 100 accounts participate in the transaction.

“So we really were looking to broaden the investor base, so that in the future when there may come a time when we need access to credit, we want everyone to understand this credit and what better way to understand this credit than to own it,” he said.

“As a consequence the Cat Fund is going to be very well-positioned on a go-forward basis with an educated investor and analyst community for any future borrowings,” Watkins added.

The issuer coming in second place was also from the Sunshine State: Miami-Dade County. The county sold $2.97 billion of debt in 15 issues in 2020.

The single biggest deal from Miami-Dade was a $513 million competitive sale of taxable transit system sales surtax revenue refunding bonds which was won by Morgan Stanley in August.

According to Michael Rinaldi, Fitch senior director and head of U.S. local governments, the Florida economy and its employment picture has been improving.

He told The Bond Buyer that the state was doing favorably when compared to the U.S. average in recovering jobs lost to the pandemic, increasing job gains at a slightly better pace through December. He said a lot of that had to do with policy at the state and local level.

“Florida has opened up its economy at a more rapid pace than may other states, particularly those in the Northeast,” Rinaldi said. “And so there’s a decent amount of economic activity taking place.”

In his State of the State Address on Tuesday, Florida Gov. Ron DeSantis also stressed that because Florida’s economy is open, revenue is coming in at levels higher than the most recent revised estimates.

“For the last three months — December to February — preliminary estimates peg the increase in revenue at more than $800 million over and above the December revenue estimation,” he said. “Florida is below the national average in unemployment and much lower than our peer states of Texas, New York and California. We also anticipate downward revisions of December’s unemployment numbers to reflect even stronger jobs numbers.”

Rounding out the five largest issuers in the region for the year were the Virginia Housing Development Authority ($1.59 billion in 14 issues), the Alabama Public School and College Authority ($1.48 billion in two issues), and the state of Louisiana ($1.43 billion in four issues).

"One item that was missing in the region was deficit financing," Hallacy said. "I do not think issuers in this region perceived the need. Instead they trimmed their budgets within reason."

Eric Kim, a Fitch director, said that for the most part the agency hadn't seen credit trends bifurcated among the states. He said that most state revenues were performing better than was anticipated.

“Relative to pre-pandemic expectations, most states are still trailing, but not all," Kim said. “So things are better than had been expected at the start of the pandemic.”