DALLAS – Cities and states on the U.S. borders are vulnerable to falling tax receipts amid protectionist rhetoric and the possibility that the North American Free Trade Agreement could unravel, according to Fitch Ratings.

The ratings agency’s monthly “Fitch Focus on Munis” found that passenger crossings at several ports-of-entry were down year-over-year, particularly in Alaska, California, Michigan, Texas and Washington.

Lower vehicle, passenger, and rail traffic would have a measurable impact on sales and excise tax revenues collected in border communities, as taxes paid by visitors and workers help support local governments, analysts said.

"Although reduced border crossings themselves are not credit negative, these fluctuations are an indicator of what border traffic declines might look like - on a larger scale - if NAFTA negotiations break down," according to Fitch director Michael D'Arcy. "A re-imposition of tariffs would depress border traffic and sales tax receipts, factors which represent a credit risk to border municipalities, particularly those in Texas and New Mexico given their budgetary reliance on sales and excise taxes."

Vehicle passenger traffic either fell or stagnated at three of the four largest ports of entry - San Ysidro and Otay Mesa, Calif., and Laredo, Texas, Fitch said. Along the northern U.S. border, passenger vehicle traffic at each of Michigan's three major border crossings showed signs of softness in the first half of 2017.

Of California’s two counties bordering Mexico, San Diego County showed strong sales tax growth in the first half of 2017, while Imperial County recorded a 15% decline, the report said. Imperial County’s pattern of declining sales taxes has persisted for several years, so reduced border crossings are unlikely to have played a major role, analysts said.

“Because trade with Mexico plays a modest role in the Southern California region, which includes five counties in addition to Imperial and San Diego, Fitch believes reduced border crossings driven by more intense political rhetoric and/or NAFTA-related trade disruptions are unlikely to have a major impact on regional tax revenue performance.”

Arizona’s ports of entry -- with the exception of Nogales -- saw healthy and consistent increases in both truck and vehicle passenger traffic in the first half of 2017, the report said.

“Political tensions and concerns over NAFTA had no obvious effect on crossings into Arizona,” analysts noted.

In New Mexico, local excise tax revenues grew 3.2% year over year in the first quarter of this year, but but Grant and Otero Counties registered declines in each month, as did the cities of Alamogordo and Las Cruces.

New Mexico’s two ports of entry, Santa Teresa and Columbus, yielded mixed data as healthy upticks in vehicle passenger traffic in January and April were matched with declines in February, March, May and June.

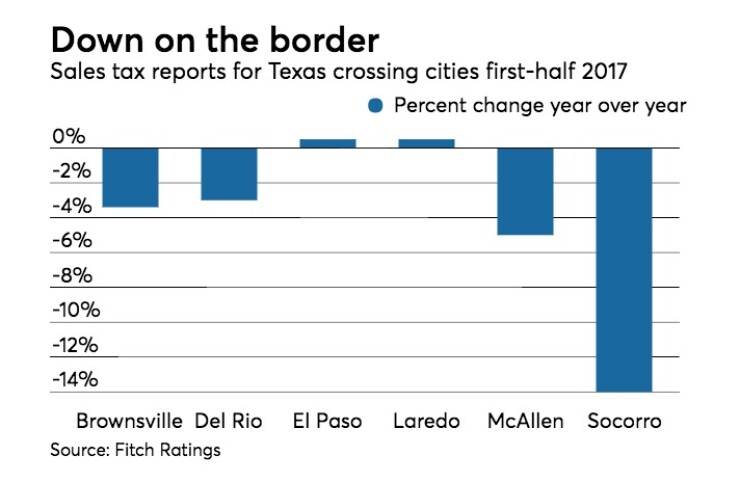

Sales tax collections in most Texas border communities weakened with the exception of Brewster County which, due largely to energy sector and pipeline projects in far West Texas, saw a nearly 14% increase.

Sales tax receipts for the city of Socorro in the El Paso area contracted by 14%. Rio Grande City’s receipts fell 12%. Del Rio’s sales tax receipts dropped 3% and Brownsville’s sales taxes fell 3.4%.

“Brownsville’s and Del Rio’s sales tax declines occurred despite a healthy rise in truck and passenger traffic, hinting that weaker spending by visitors contributed to the decline,” Fitch said.

McAllen, Texas in the Lower Rio Grande Valley recorded a 5% drop in sales taxes with revenues down in January through May.

“McAllen’s revenues are closely linked to cross-border traffic, as sales taxes account for 48% of general fund revenues and an estimated 35% of retail purchases are attributed to shoppers from Mexico,” analysts said. “By contrast, sales taxes make up only 26% of Brownsville’s general fund revenues.”

Sales tax receipts for both the city and county of El Paso flattened, rather than declining outright, the report said.

Sales tax receipts for the city of Laredo -- home to the second-largest southern port of entry -- were also stagnant.

“Laredo’s sales tax numbers held up fairly well despite a sizable drop in inbound vehicle passengers in early 2017,” analysts said. Fitch attributes Laredo’s stable sales tax numbers primarily to continued energy exploration in the nearby Eagle Ford Shale.

Presidio, Kinney and Maverick Counties saw sales tax declines of 5.3%, 8.5% and 7.8%, espectively, Fitch said.

“Because Texas’s border counties are less dependent on the energy sector than the state’s major oil-producing regions, it seems probable that the drop in sales tax collections was caused at least in part by a reduction in passenger traffic from Mexico that reduced the number of commercial transactions,” analysts said. “A weaker Mexican peso likely played a role, as well.”